Johnathan Rickman | Blue Vault

With interest rates having stalled REITs’ record run of capital raising, credit-focused nontraded BDCs and interval funds are experiencing a flurry of fundraising and advisor interest due to their diversified makeup and ability to fill much-needed gaps in commercial lending.

REITs, nontraded and otherwise, clearly had a rough year this year. Through mid-October, the year-to-date total returns of the FTSE EPRA Nareit Developed Extended Index were -7.6%.¹ That’s according to Nareit, the U.S.-based trade group representing real estate investment trusts and real estate companies.

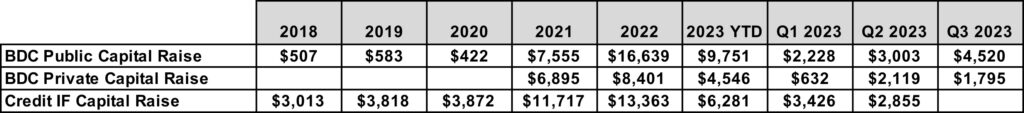

Meanwhile, the changing economic environment has allowed other types of funds to flourish. The following chart shows how different types of funds have fared with raising capital since 2018.

Funding has flowed into the nontraded BDC and interval fund sectors as more commercial banks have withdrawn lending in response to both federal monetary policy and regulation. The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, and its Volcker Rule restraints on commercial and investment banking services, require banks to maintain higher levels of equity versus lending. As banks have become more cautious in the current rate environment, certain credit-focused nontraded BDCs and interval funds are filling the gap, raising capital from shareholders and through variable rate borrowing.

More recently, in June 2023, the Secured Overnight Financing Rate, or SOFR, replaced the London Interbank Offered Rate (LIBOR) as the benchmark interest rate for dollar-denominated derivatives and loans. As SOFR is based on data from evident transactions rather than on estimated (or falsified) borrowing rates, as was most often the case with LIBOR, the move aims to curb market manipulation.²

Nontraded BDCs

Nontraded BDCs and interval funds are relatively new investment vehicles that allow advisors to diversify portfolios for income-seeking investors.

A BDC is an SEC-registered investment company that primarily invests in private U.S.-based businesses. In fact, as a creation of amendments to the Investment Company Act of 1940, BDCs are required to invest 70% or more of their assets in U.S.-based private companies. These vehicles are typically taxed as regulated investment companies and are similar to REITs in that they are required to distribute at least 90% of taxable income as dividends to investors. BDCs themselves pay little or no corporate income tax. BDCs are also required to offer operational or management assistance to the companies they invest in.

The nontraded structure allows BDCs to raise capital continuously, granting them access to capital across economic cycles rather than only when the capital markets are up. As of September 30, 2023,³ the nontraded BDC industry:

· Had 16 open funds currently raising capital

· Had $100.6 billion in assets under management

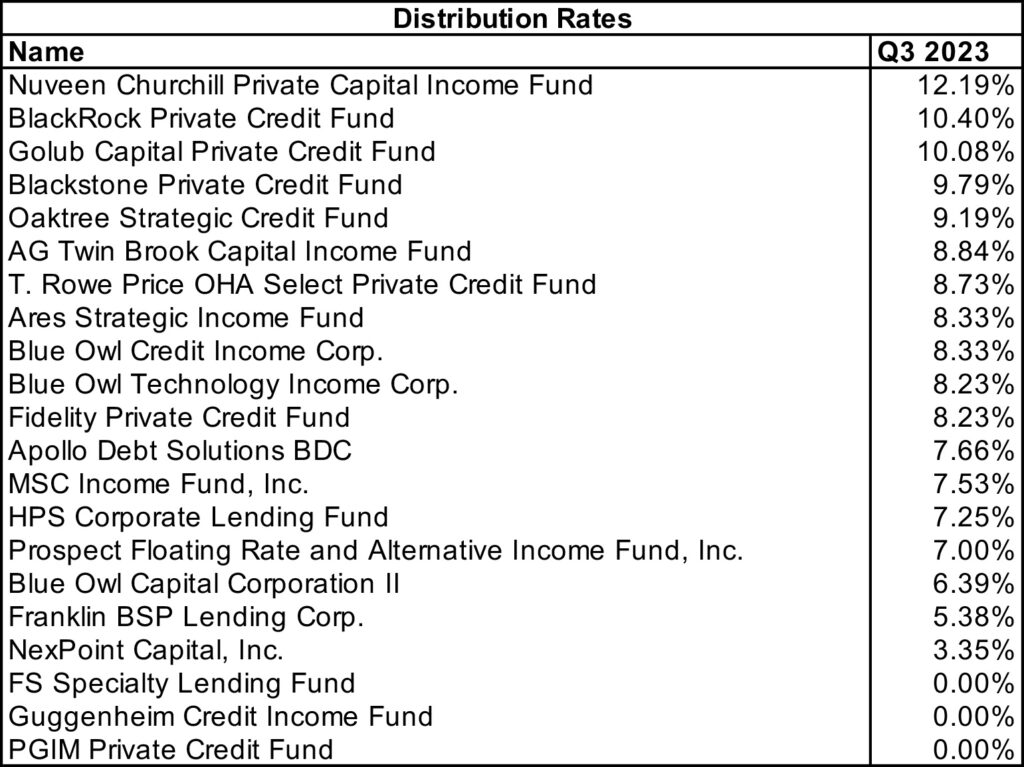

· Generated an average distribution yield of 8.16%

· Publicly raised approximately $4.5 billion in Q3 2023 compared to $3.7 billion in Q3 2022

· Privately raised approximately $1.8 billion in Q3 2023 compared to $1.1 billion in Q3 2022

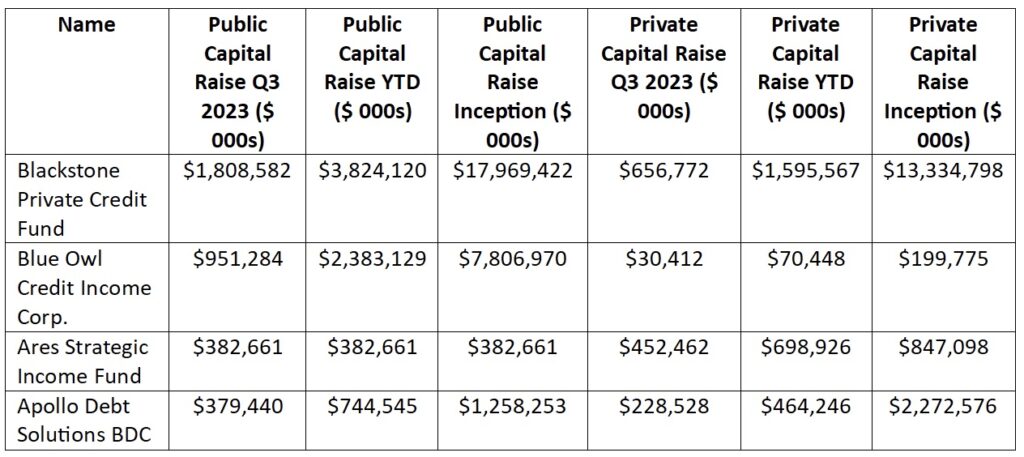

The median return of the industry through the first nine months of 2023 was 7.60% compared to 3.19% for all of 2022. The introduction of new, credit-focused products has helped boost the sector’s strength. Blackstone and Blue Owl (formerly Owl Rock) contributed to the resurgence of the sector in early 2021 when they launched the Blackstone Private Credit Fund and Blue Owl Credit Income Corp., respectively.

Since its inception in January 2021, Blackstone’s market-leading corporate credit fund (and largest BDC), Blackstone Private Credit Fund, has raised over $13.33 billion in private capital and over $17.96 billion in public capital. The BDC’s portfolio as of October 31, 2023, consists of 97% senior secured debt and 98% floating rate debt. This strategy of lending to creditworthy companies and applying a variable interest rate pegged to SOFR helps BDCs borrow at a lower interest rate than what they’re earning on their investments, which helps them reduce federal monetary policy risks and potentially boosts distributions when interest rates rise.

Other credit-focused BDCs with similar strategies are also raising considerable amounts of capital:

The distribution rates for those and other credit-focused BDCs have also been impressive:

Interval Funds

Credit-focused interval funds are also experiencing an uptick in fundraising and investor interest. Interval funds are a type of SEC-registered, closed-end fund that expands investor access to illiquid alternative investment strategies through low investment minimums, frequent valuations, and 1099 tax forms. Governed by the Investment Company Act of 1940, interval funds are perpetual, continuously offered, and sold by financial advisors such as RIAs, independent broker-dealers, and wirehouse advisors.

Interval funds are a fast-growing market, reporting approximately $87.8 billion in total assets as of June 30, 2023, up from $81.3 billion as of December 31, 2022, and $78.8 billion as of June 30, 2022.⁴

Most interval funds have quarterly tenders at NAV (i.e., up to 5% per quarter) to provide limited liquidity. Legally, repurchases must range from 5% – 25% of the total shares outstanding within the fund per repurchase period. If a repurchase offer is oversubscribed, the fund may repurchase only a pro-rata portion of the shares tendered by each shareholder.

Market leaders are demonstrating they can pass critical fund milestones quickly. For instance, the credit-focused Cliffwater Corporate Lending Fund reported sales of $2.343 billion in the first half of its fiscal year 2023. This was 23.2% of the total capital raise for the 85 interval funds in Blue Vault’s reports. Interval funds report semi-annually and have different fiscal years, making comparisons problematic.

Interval funds are also proving their worth to investors. The Invesco Dynamic Credit Opportunity Fund, for example, which invests primarily in floating or fixed-rate senior loans to corporations, partnerships, and other entities, had a NAV-per-share price of $11.13 across its four share classes as of August 31, 2023. This generated distribution yields of between 9.52% and 9.88% across its suite of share classes. As of September 30, 2023, over 92% of the fund’s senior loans bore interest at floating rates to help hedge against rising interest rate risk.5 Learn more about nontraded BDCs, interval funds, and other alts covered in Blue Vault’s research. Along with access to individual fund performance data and industry studies, Blue Vault subscribers also get exclusive access to our webinars, including the Exploring Private Credit and Private Equity Opportunities in the Interval Fund Market webinar from October 2023 moderated by Kimberly Flynn of XA Investments.

References

1 https://www.reit.com/news/blog/market-commentary/2024-reit-performance-outlook

2 https://www.investopedia.com/secured-overnight-financing-rate-sofr-4683954

3 Blue Vault, BDC Industry Review, Q3 2023

4 XA Investments, June 2023 5 https://www.invesco.com/us-rest/contentdetail?contentId=91d8ff4b-ab76-4b57-a070-692ba035c62f&dnsName=us