Energy prices push inflation higher, dashing hopes for near-term peak

March 9, 2022 | Brian Scheid | S&P Market Intelligence

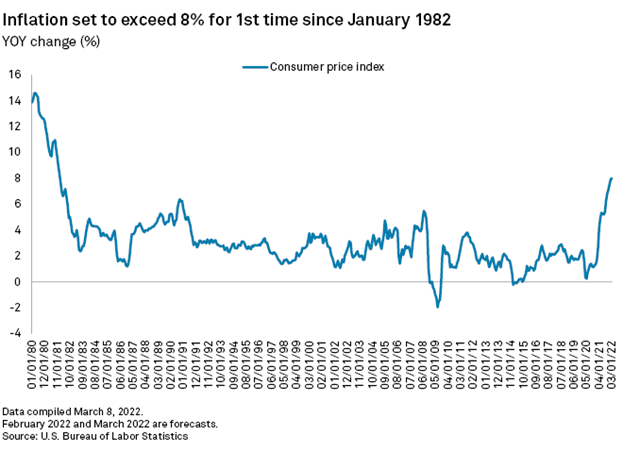

With U.S. inflation data released this week likely to show a new 40-year high, and with energy markets in turmoil, prices promise to climb even higher.

On March 10, the U.S. Bureau of Labor Statistics will release its February data for its consumer price index, the market’s preferred measure of inflation. Economists forecast the index climbed 7.9% from February 2021 to February 2022, according to Econoday.

“Inflationary pressures in the U.S. economy are already intense and in the near term are likely to get even stronger,” said James Knightley, chief international economist with ING, in an interview.

That reading, which would be the biggest one-year jump since February 1982, will likely be a preview of higher inflation to come. Economists expect inflation will rise more than 8% year over year in the coming months as Russia’s invasion of Ukraine and the corresponding increase in crude oil and other energy prices begin to translate into higher consumer prices.

“The CPI number for March is likely to be much stronger than February’s given that the current surge in energy prices is likely to be reflected rather quickly in the gasoline market,” said Oscar Munoz, a macro strategist at TD Securities. Munoz had expected inflation to peak in the first quarter of 2022 before the Russia-Ukraine conflict began.

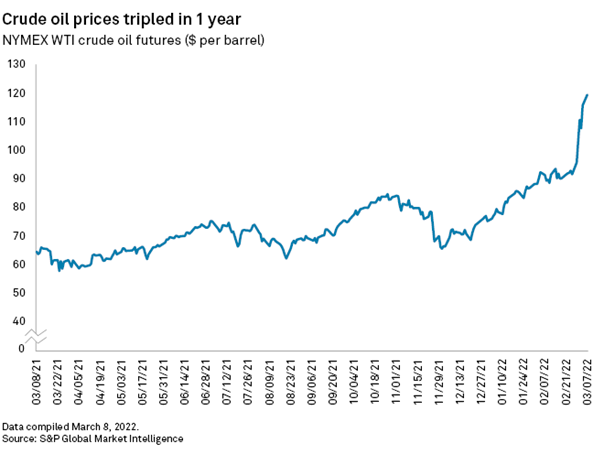

Soaring Energy Prices

NYMEX West Texas Intermediate crude oil futures settled at $123.70 per barrel on March 8 after President Joe Biden announced a ban on Russian oil imports. The settlement is the highest since 2008.

“I think we should view higher energy prices as another supply shock to the economy,” said Michael Crook, chief investment officer at Mill Creek Capital Advisors. “If aggregate demand remains constant, it’ll feed into inflation.”

The impact of soaring oil prices on inflation will depend on how long the rally in crude lasts, Federal Reserve Chairman Jerome Powell told the Senate Banking Committee on March 3.

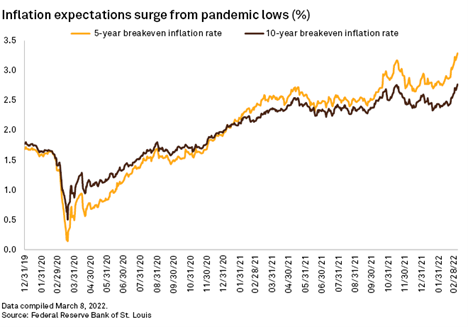

“You can have an oil spike and if it just comes and goes, prices will go up, but it won’t actually affect ongoing inflation,” Powell said. “The concern, though, is there’s already a lot of upward inflation pressure, and additional inflation pressure does probably raise at the margin the risk that inflation expectations will start to react in a way that is negative for controlling inflation.”

Every $10 increase in the price of a barrel of oil generally results in an increase in inflation of 20 basis points, Powell said.

Higher oil prices will add at least 30 bps to the CPI in February and 60 bps in March, Aneta Markowska, chief economist with Jefferies, wrote in a March 4 note.

These higher oil prices, along with increases in commodities more broadly, will make a more than 8% year-over-year increase in CPI in March inevitable, said Knightley with ING.

Inflation expectations rise

On March 7, the five-year breakeven inflation rate, a rough measure of the bond market’s view of inflation over the next five years, closed at 3.29%, while the 10-year breakeven inflation rate closed at 2.77%.

Nearly 70% of business owners raised their average selling prices in February, the highest rate in 48 years, according to the National Federation of Independent Business survey results released March 8. In that survey, 26% of business owners said inflation was their biggest operational problem.

With geopolitical tensions ratcheting up and a high potential for more sanctions, year-over-year CPI growth could reach 9% in March and April, Knightley said.

Combined with continued uncertainty over COVID-19 and ongoing impairments in the global supply chain, higher inflation readings are expected throughout 2022.

“It may not be until 2023 that we see inflation readings declining back toward the 2% target,” Knightley said.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.