Gladstone Commercial Corporation (Nasdaq:GOOD) (the “Company”) announced today that its board of directors declared cash distributions for the months of October, November and December 2022 and also announced its plan to report earnings for the third quarter ended September 30, 2022.

Cash Distributions:

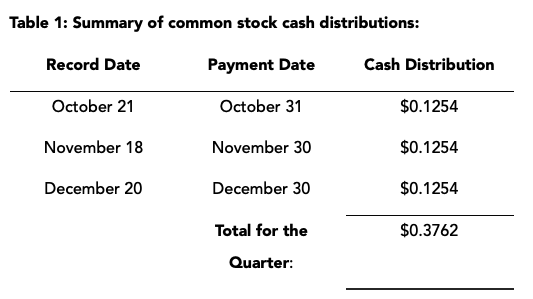

Common Stock: $0.1254 cash distribution per common share for each of October, November and December 2022, payable per Table 1 below. The Company has paid 213 consecutive monthly cash distributions on its common stock. Prior to paying distributions on a monthly basis, the Company paid five consecutive quarterly cash distributions. The Company has never skipped, reduced or deferred a monthly or quarterly common stock distribution since its inception in 2003.

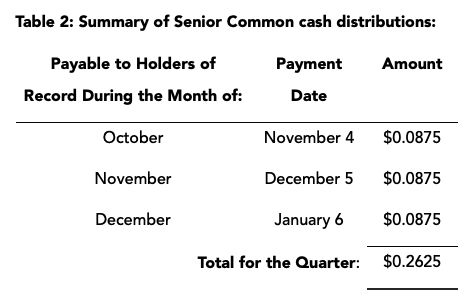

Senior Common Stock: $0.0875 cash distribution per share of the Company’s senior common stock (“Senior Common”) for each of October, November and December 2022, payable per Table 2 below. The Company has paid 150 consecutive monthly cash distributions on its Senior Common. The Company has never skipped, reduced or deferred a monthly Senior Common distribution.

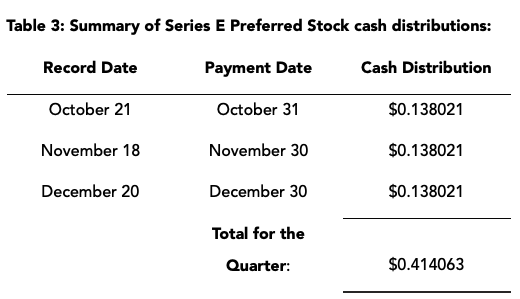

Series E Preferred Stock: $0.138021 cash distribution per share of the Company’s 6.625% Series E Preferred Stock (“Series E Preferred Stock”) for each of October, November and December 2022, payable per Table 3 below. The Series E Preferred Stock trades on Nasdaq under the symbol “GOODN.” The Company has paid 27 consecutive monthly cash distributions on its Series E Preferred Stock. The Company has never skipped, reduced or deferred a monthly Series E Preferred Stock distribution.

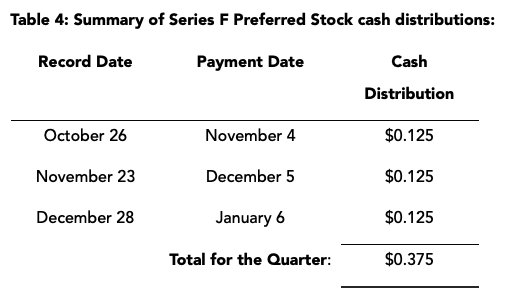

Series F Preferred Stock: $0.125 cash distribution per share of the Company’s 6.0% Series F Preferred Stock (“Series F Preferred Stock”) for each of October, November and December 2022, payable per Table 4 below. The Series F Preferred Stock is not listed on a national securities exchange. The Company has never skipped, reduced or deferred a monthly Series F Preferred Stock distribution.

The Company offers a dividend reinvestment plan (the “DRIP”) to its common stockholders and Series F Preferred stockholders. For more information regarding the DRIP, please visit www.gladstonecommercial.com.

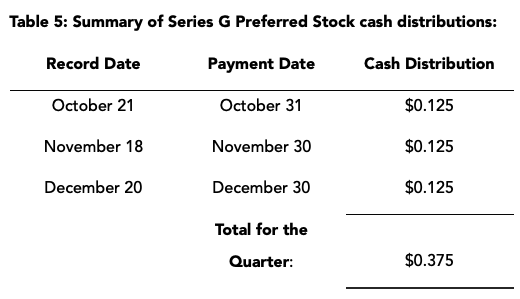

Series G Preferred Stock: $0.125 cash distribution per share of the Company’s 6.00% Series G Preferred Stock (“Series G Preferred Stock”) for each of October, November and December 2022, payable per Table 5 below. The Series G Preferred Stock trades on Nasdaq under the symbol “GOODO.” The Company has never skipped, reduced or deferred a monthly Series G Preferred Stock distribution.

Earnings Announcement:

The Company also announced today that it plans to report earnings for the third quarter ended September 30, 2022, after the stock market closes on Monday, November 7, 2022. The Company will hold a conference call Tuesday, November 8, 2022 at 8:30 a.m. ET to discuss its earnings results. Please call (877) 407-9045 to enter the conference call. An operator will monitor the call and set a queue for questions.

A conference call replay will be available after the call and will be accessible through November 15, 2022. To hear the replay, please dial (877) 660-6853 and use playback conference number 13732342.

The live audio broadcast of the Company’s conference call will be available online at www.gladstonecommercial.com.

If you have questions prior to or following the earnings release you may e-mail them to info@gladstonecompanies.com.

Gladstone Commercial Corporation is a real estate investment trust (“REIT”) focused on acquiring, owning and operating net leased industrial and office properties across the United States. As of June 30, 2022, Gladstone Commercial’s real estate portfolio consisted of 136 properties located in 27 states, totaling approximately 17.0 million square feet. Additional information can be found at www.gladstonecommercial.com.

Investor Relations Inquiries: Please visit www.gladstonecommercial.com or +1-703-287-5893.