Highlands REIT’s Common Stock Generating Interest in Auction Market

March 5, 2019 | James Sprow | Blue Vault

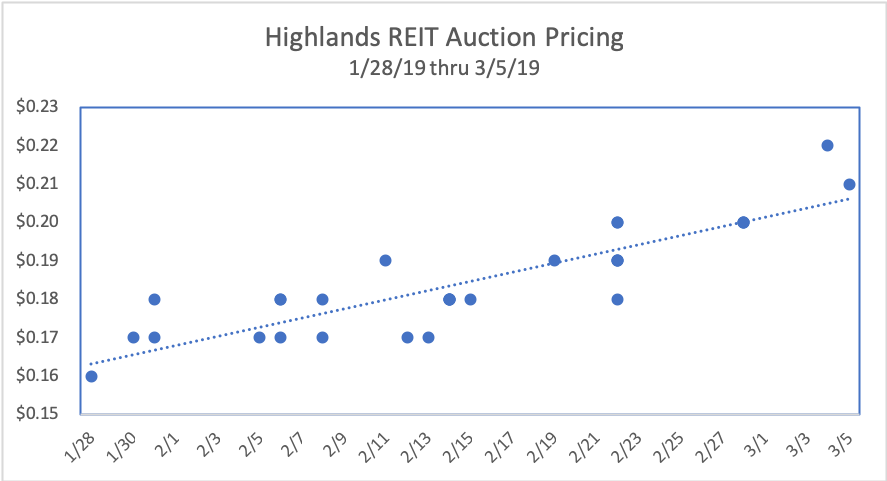

In terms of economic value, the recent auction history for the common shares of the nontraded Highlands REIT, a diversified self-managed portfolio that was spun off from InvenTrust, is not very significant. The history of this REIT’s transactions on the third-party auction site Central Trade & Transfer since the end of January shows 138,662 shares sold for a grand total of $25,995. What’s interesting is the uptick in auction pricing. For years, the common shares were selling at auction for less than $0.18 per share. Recently, however, the closing prices on these auctions have jumped, averaging $0.21 per share over the last five auctions, as of March 5, 2019.

Related: The Interesting Case of Highlands REIT – Part II in a Series on InvesTrust Properties Corporation

Highlands REIT’s most recent estimated NAV per share was $0.33, announced in January 2019.

The REIT has not announced any major changes recently to give a hint at why the auction pricing may be trending upward, but a price move from $0.16 on January 28 to $0.22 per share on March 4 is significant, even if this penny stock is not.