Highlighting NexPoint Diversified Real Estate Trust

August 16, 2022 | James Sprow | Blue Vault

NexPoint Diversified Real Estate Trust (NXDT) is an externally advised, publicly traded, diversified real estate investment trust (REIT) focused on the acquisition, development, and management of opportunistic and value-add investments throughout the United States across multiple sectors where NexPoint and its affiliates have operational expertise. NXDT is externally advised by NexPoint Real Estate Advisors X, L.P.

As of August 9, 2022, the REIT was selling at a 42.1% discount to NAV per share. The most recent calculation of NAV per share was $27.72. With the $16.06 market price as of August 9, 2022, that is a very steep discount.

Insiders own 22.24% of the REIT’s shares1 as of August 11, 2022, a very significant investment, especially compared to most listed REITs. For example, W.P. Carey, Inc., a very successful listed REIT, reported 1.01% of shares held by insiders. Over 63% of the shares of NXDT are held by institutional investors.

Regarding the discount, the REIT’s management pointed out in an investor presentation on August 10, 2022, that the discount should be reducing as the listed REIT is added to market indices. Whenever a listed company’s stock is added to a market index, mutual funds that base their investment portfolios upon a mirror of a particular index composition, must purchase shares in a company that is added to the index. According to the recent presentation, the REIT expects these index inclusions to result in a total of $72 million incremental investments in NXDT common stock.

“Due to the timing of the conversion, the largest inflow (Russell 2000 of an expected $41 million) will not happen until June 2023 since it only rebalances once a year. The Real Estate indices rebalance quarterly, so those inflows (an expected $31 million) could happen as early as August or November 2022.”2

NexPoint Diversified Real Estate Trust’s Portfolio Data

NXDT’s portfolio is very diversified across a wide variety of asset types. This diversification by asset type is attained via majority and minority interests in other investment vehicles. For example, the REIT has a 10.8% interest in VineBrook Homes Trust, a company that owns 21,144 homes. NexPoint Storage Partners has 47 investments with 34,000 units in the self-storage sector and is 53.1% owned by NXDT. NexPoint Real Estate Finance is a publicly traded mortgage REIT that is 23.0% owned by NXDT and has a 8.9% dividend yield.

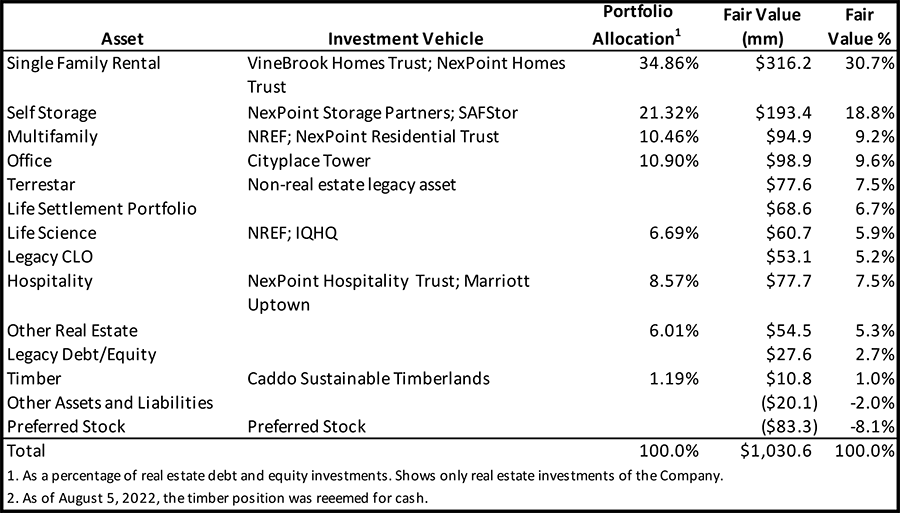

The following table shows the contribution of every investment by asset type in the NXDT portfolio to the total NAV as of June 30, 2022. It is not a simple exercise to identify which investments contain which asset types so the “Investment Vehicle” column is not a perfect representation but merely an observation from the REIT’s presentation.

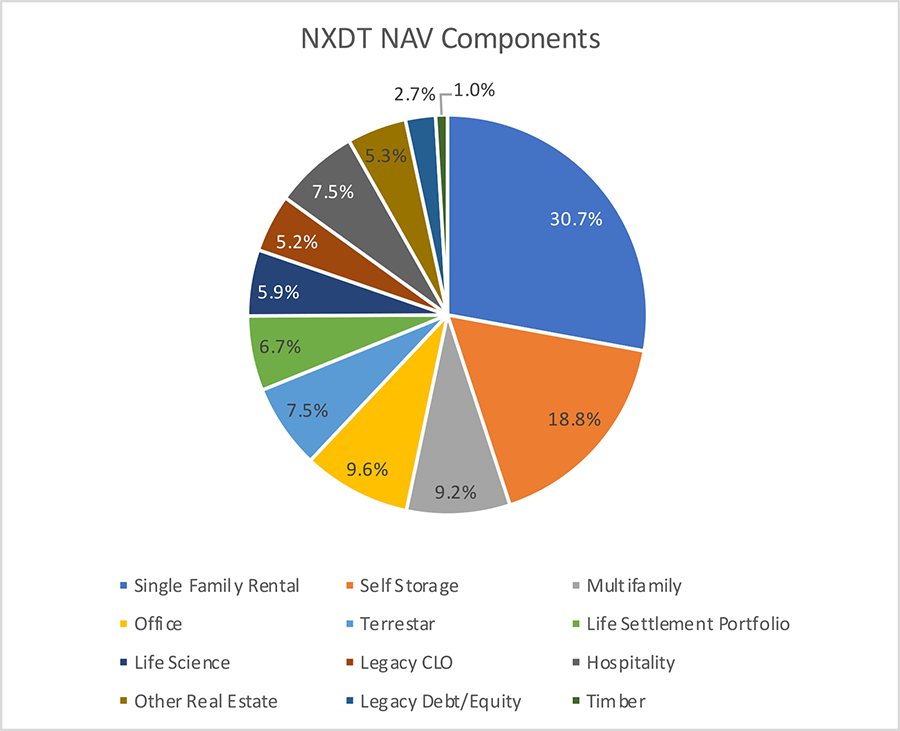

The pie chart below illustrates the broad diversity by asset type of the REIT’s investments. Notable by their absence in the chart are retail and net lease properties. Terrestar is a digital communications asset that is a nonoperating company that primarily derives its value from licenses for use of two spectrum frequencies which have reported values that have significant uncertainty as to a true market value.

NexPoint’s Investment Vehicles

NexPoint Diversified Real Estate Trust uses investments and partial ownership of other NexPoint-managed funds to diversify its portfolio.

The chart below from the NXDT PowerPoint presentation shows the means by which the REIT utilizes investments in other NexPoint-managed funds to achieve its diversification.

Following are brief descriptions of two of those funds.

SAFStor

24.8% owned within NXDT, SAFStor, Inc. owns, develops, and redevelops single – and multistory self -storage properties in undersupplied markets with high barriers to entry. The company looks for markets that offer low delinquency, high traffic count, and high population growth, with above -average household income. Property management is performed by reputable operators such as Extra Space Storage, CubeSmart, and Life Storage. As of June 30, 2022, it has completed 28 individual storage facilities that are currently in lease-up. An additional project is in the construction phase with the completion expected by the end of 2022.

NexPoint Hospitality Trust

46.2% owned within NXDT, NexPoint Hospitality Trust is a publicly traded REIT, with its units listed on the TSX Venture Exchange under the symbol “NHT-U”, and is primarily focused on acquiring, owning, renovating, and operating select-service, extended-stay and efficient full-service hotels located in attractive U.S. markets. NHT is externally advised by an affiliate of NexPoint Real Estate Advisors. NHT partners with well-known hospitality brands with strong loyalty programs, such as Marriott and Hilton. In Q1 2022, NHT purchased two assets – the Hyatt Place in Park City, Utah and the Hampton Inn & Suites in Bradenton, Florida.

Conclusions

In its Q2 2022 Investor Call on August 10, 2022, NexPoint Diversified Real Estate made the case for the value of its well-diversified real estate portfolio. The steep discount to the estimated net asset value per share is striking. In a Blue Vault article on July 7, 2022, we noted that listed REITs were trading at a median 19.4% discount to consensus NAVs as of July 1. Among the most heavily discounted listed REITs by asset types were regional malls, office, hotels and shopping centers. Self storage, industrial and multifamily-focused listed REITs were discounted from their NAVs, but much less than the median for all listed REITs. Looking at the concentration of investments by NXDT, the REIT should be less-heavily discounted than the median discount for all listed REITs, but that has not been the case recently. On the three days since the investor presentation, NXDT’s stock rose from $16.00 per share on August 9 to $17.853 per share as of this writing on August 12, an increase of 11.5%. It appears that the arguments made in the investor presentation have struck a chord with some investors.

Footnotes

1. Per Yahoo!Finance 8/11/22; the REIT reports a »16% insider investment

2. Q2 2022 Investor Call

3. Per Yahoo!Finance 8/12/22 at 11:30 AM