Johnathan Rickman | Blue Vault

While a return to glory days may seem elusive for private real estate right now, the sector is showing clear signs of a market rebound, and committed investors who work with diligent stewards of real assets are helping to maintain that market momentum.

Real estate has historically performed well for investors, and the asset class continues to hold promise for many, as recent Blue Vault data1 reveal. Quarterly fundraising for the nontraded REIT industry reported a second consecutive increase in inflows in the first quarter of 2025, eclipsing $2.0 billion for the first time since the second quarter of 2023.

Interest in private real estate is rising even though many sector investments may remain illiquid for years after the initial investment. So, how are fund sponsors winning the trust of wealth advisors and investors in a tough market for real estate and providing for the perennial investor demand for income flows?

The answer: active fund management. That’s according to Warren Thomas, ExchangeRight Co-Founder and Managing Partner, who we spoke with to gain more insight into how the team that manages The Essential Income REIT delivers long-term results for shareholders. The REIT is managed by an experienced, cross-functional team that includes acquisition analysts, underwriters, asset managers, legal professionals, and senior executives.

A nontraded REIT investor may commit years to such an investment. What are fund managers doing in the meantime to maximize the fund’s prospects and future results?

“As Managers and Trustees of the Essential Income REIT, we know that success requires continuous diligence and a steadfast commitment to investor-centric decisions. Since founding the REIT in 2019, we have met or exceeded investor cash flow expectations and have expanded the asset base by applying rigorous underwriting standards during acquisition and proactively managing the properties thereafter. While we focus on net-leased properties, occupied by primarily investment-grade corporate tenants in essential industries, our management of the physical properties and tenant relationships have yielded strong results, with 100% rent collections and significant releasing success across our portfolio,” Thomas said.

To maximize operational performance, his team:

• Actively manages the physical real estate and the tenant’s adherence to their leases

• Proactively negotiates lease extensions

• Builds relationships with the corporate tenants while also monitoring their corporate credit and operating performance

• Strategically manages cash flows and adjusted funds from operations (AFFO) to support consistent distributions

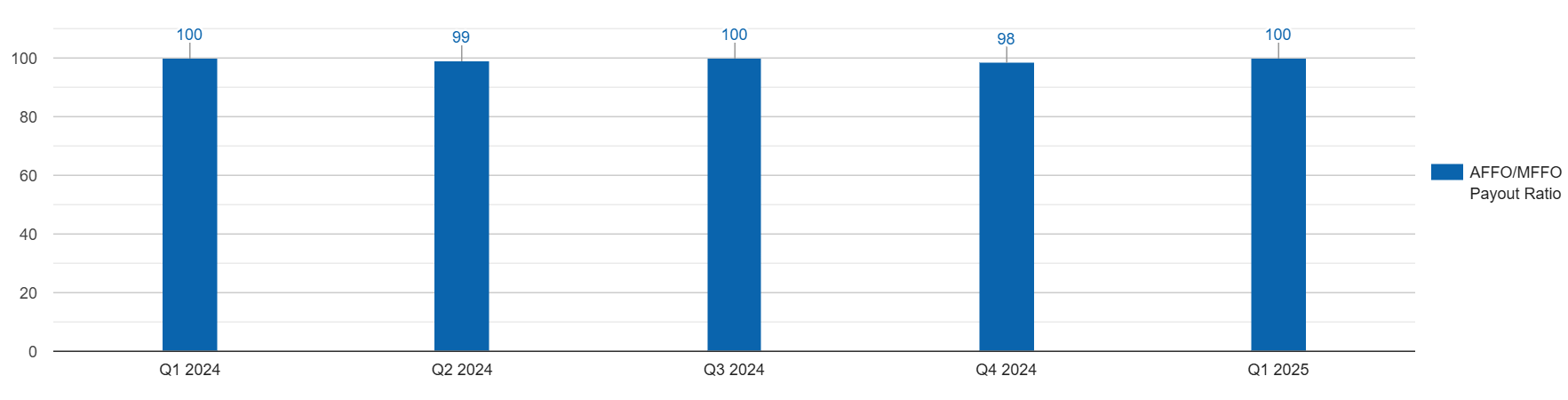

Those distributions have been “fully covered,” Thomas noted. Blue Vault data bears this out. The fund fully covered its distributions with AFFO or modified funds from operations (MFFO) in 2024 and in the first quarter of this year:

The Essential Income REIT: Historical AFFO/MFFO Payout Ratio

For the quarter ending March 31, 2025, ExchangeRight declared distributions totaling $11.0 million, funded entirely from cash flow from operating activities.

Does fund management involve monitoring the market’s daily movements? Does this play into the valuation process?

“Our team continuously monitors market fundamentals in target markets, assesses acquisition opportunities, and positions the portfolio for long-term stability and growth in alignment with our conservative investment strategy,” Thomas said. “In contrast to public equity investors, whose returns are highly sensitive to quarterly earnings, headlines, and shifting market expectations, our focus is on the long-term operational strength, credit quality, and fiscal responsibility of our tenants,” he added.

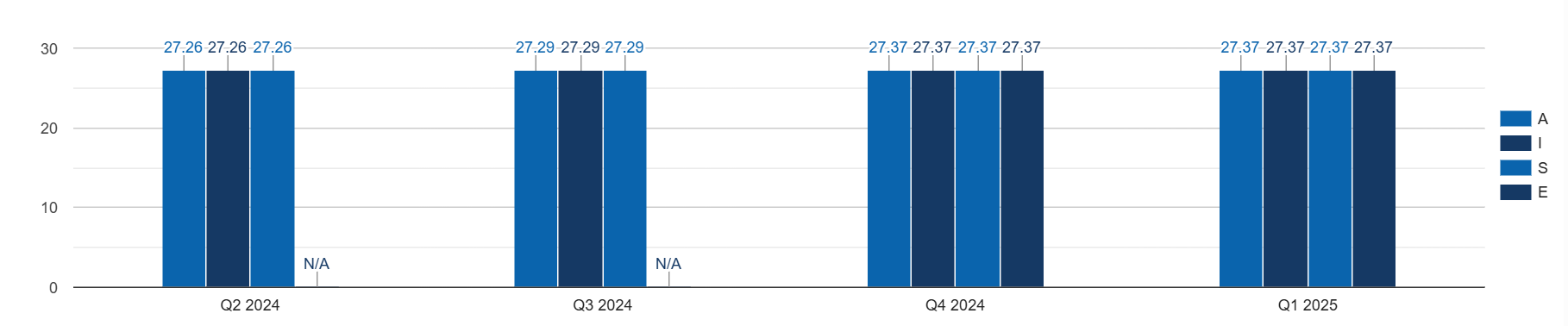

To the degree that NAV helps measure REIT performance, The Essential Income REIT has shown consistency in this area as well, generating steady share prices at just under $30 per share:

The Essential Income REIT: Historical NAV

On July 22, 2025, ExchangeRight affirmed its NAV per share at $27.17, calculated as of June 30, 20252.

Is there a strict boundary between property management and fund management?

“Yes, there is a defined boundary, but coordination between the two is essential,” Thomas said. “We maintain strong integration through regular reporting, oversight protocols, and strategic alignment to ensure that operational decisions support the REIT’s overall performance and investor objectives,” he added.

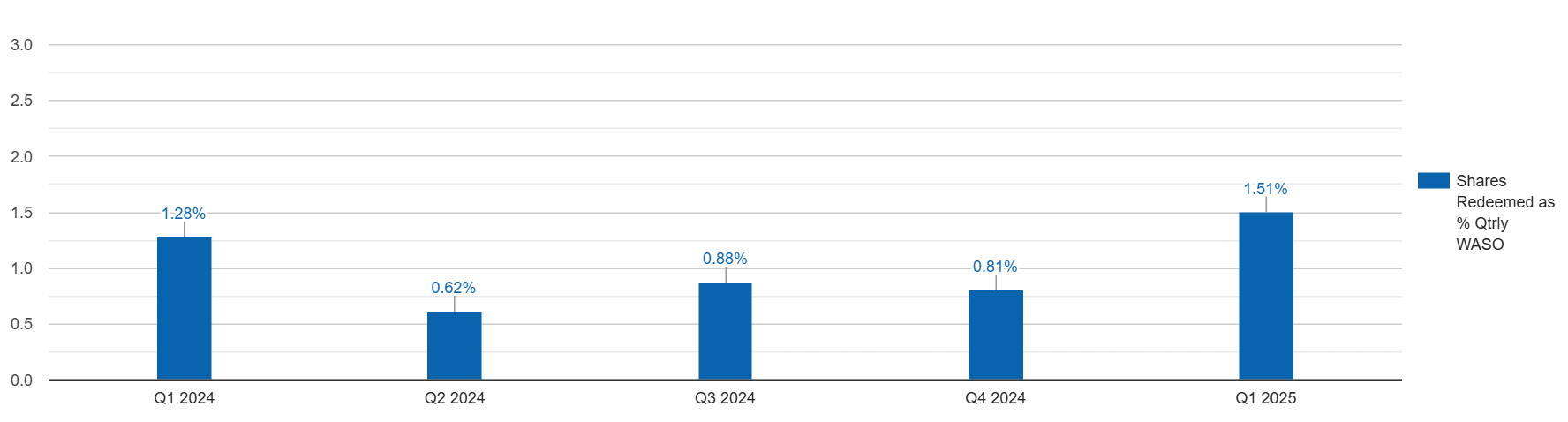

The REIT’s investors appear committed to its continued growth. According to Blue Vault data, the REIT in Q1 2025 experienced a redemption rate lower than most of its peers, with redemptions totaling 1.51% of weighted average shares outstanding:

The Essential Income REIT: Redemptions

Most private nontraded REITs aren’t required to file publicly but you choose to. Why?

“We voluntarily elected to become an SEC-reporting company to provide investors with greater transparency, accountability, and access to institutional-quality reporting,” Thomas said. “We believe this enhanced level of disclosure reinforces our commitment to best-in-class governance and builds investor trust,” he added.

Learn more about Warren Thomas, ExchangeRight, and The Essential Income REIT. Become a Blue Vault member today and gain access to current and historical data on nontraded REITs, nontraded BDCs, interval and tender offer funds, private placements, and other alts offerings.

References

1 Blue Vault Nontraded REIT Industry Review: First Quarter 2025

2 ExchangeRight