How Co-working, Labor Costs, and M&A May Impact Real Estate Investing

Ethereal drivers like the government and politics seem to have a stranglehold on the media optics of real estate investing: the polarization of D.C., while creating volatility and opportunity, continue to drive eyes and form sentiment. Yet, we believe three less obvious factors may help investors extract value.

- Labor costs: retail will feel the biggest burden

- Co-working: replacing white collar with tech vibes will lead to re-pricing of risk

- Real estate M&A: investors are looking for public market to correct first

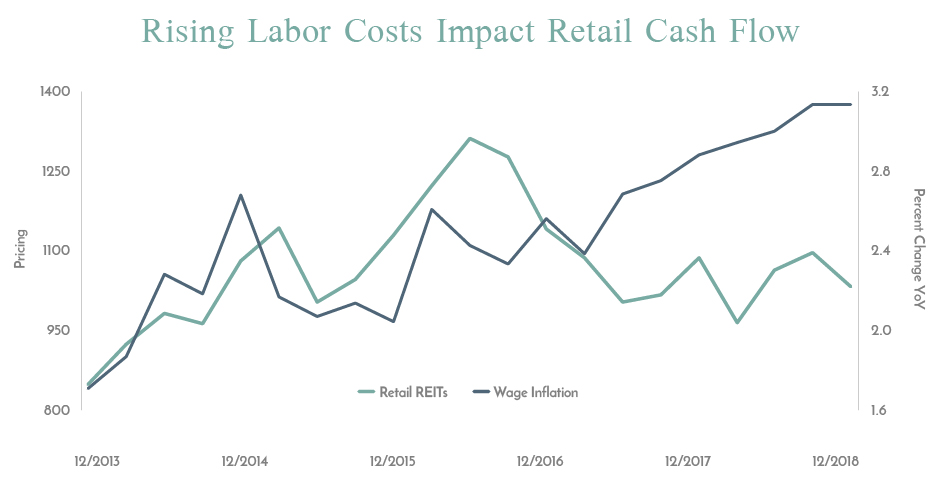

Rising labor costs will have the biggest impact on retail

As if the retail market needs more bad news, rising labor costs will likely cut into an already low-margin business. Traditional brick-and-mortar retail is labor-dependent – you need to pay employees to work the floor and drive sales. Increasing wage inflation stemming from a tight labor market may cut into retail REIT stocks’ cash flows, hurting values. While one could argue that rising wages puts more money into consumers’ pockets for retail purchases, the “share of wallet” continues to shift to experiential retail.

Bloomberg. FTSE NAREIT Retail Property Sector Total Return Index (Retail REITs); Employment Cost Index: Wages and Salaries – Private Industry Workers, Percent Change From Year Ago, Quarterly. SA. 12/31/13-12/31/18. Past performance is not indicative of future results. You cannot invest directly in an index.

With wages going up, investors should look at sectors with minimal manpower costs. It only takes a few people to work concession and run a projector at movie theaters, while apartments require just a small staff and maintenance crew. And we don’t add labor costs to the risks facing office investments. Once a building is up, a doorman and a few maintenance workers may be all a landlord needs.

Click here to read about the impact of co-working and M&A.

Resource Securities LLC, Member FINRA/SIPC.

The information contained herein is intended to be used for educational purposes only and does not constitute an offer to sell or a solicitation to purchase securities. Such offers or solicitations can only be made by means of a prospectus. Prior to making any investment decision, you should read the applicable prospectus carefully and consider the risks, charges, expenses and other important information described therein. The value of your investments may decline, and you could lose some or all of your investment. The prospectus can be obtained by contacting your financial advisor or by visiting our website at www.ResourceAlts.com.

Resource has two interval funds that are distributed by ALPS Distributors, Inc. (ALPS Distributors, Inc. 1290 Broadway, Suite 1100, Denver, CO 80203). Resource Real Estate, LLC, Resource Alternative Advisor, LLC, their affiliates, and ALPS Distributors, Inc. are not affiliated.