Interval Funds in the Blue Vault Database

December 13, 2021 | James Sprow | Blue Vault

The Blue Vault Database gives subscribers over 350 different potential data points for each of the 56 interval funds listed in the data. Why so many? For example, the 56 interval funds taken altogether have 28 different share classes and the database has recent pricing for each share class that the interval fund offers. For example, Blackstone / GSO Floating Rate Enhanced Income Fund offers five different share classes (D, I, T, T-1 and U) and each share class will have a recent offering price in the database. And for each share class, the database contains the front load, the recent NAV, and the semi-annual distribution rate.

The data for each interval fund also contains financial metrics from the balance sheet, income statement and statement of cash flows for the six-month period of each semi-annual report. Unlike the nontraded REITs in the Blue Vault Database, interval funds file financial reports with the SEC only every six months. To further complicate comparisons, the interval funds report according to their fiscal years rather than calendar quarters, and the 56 funds have fiscal years ending in 10 of the 12 months.

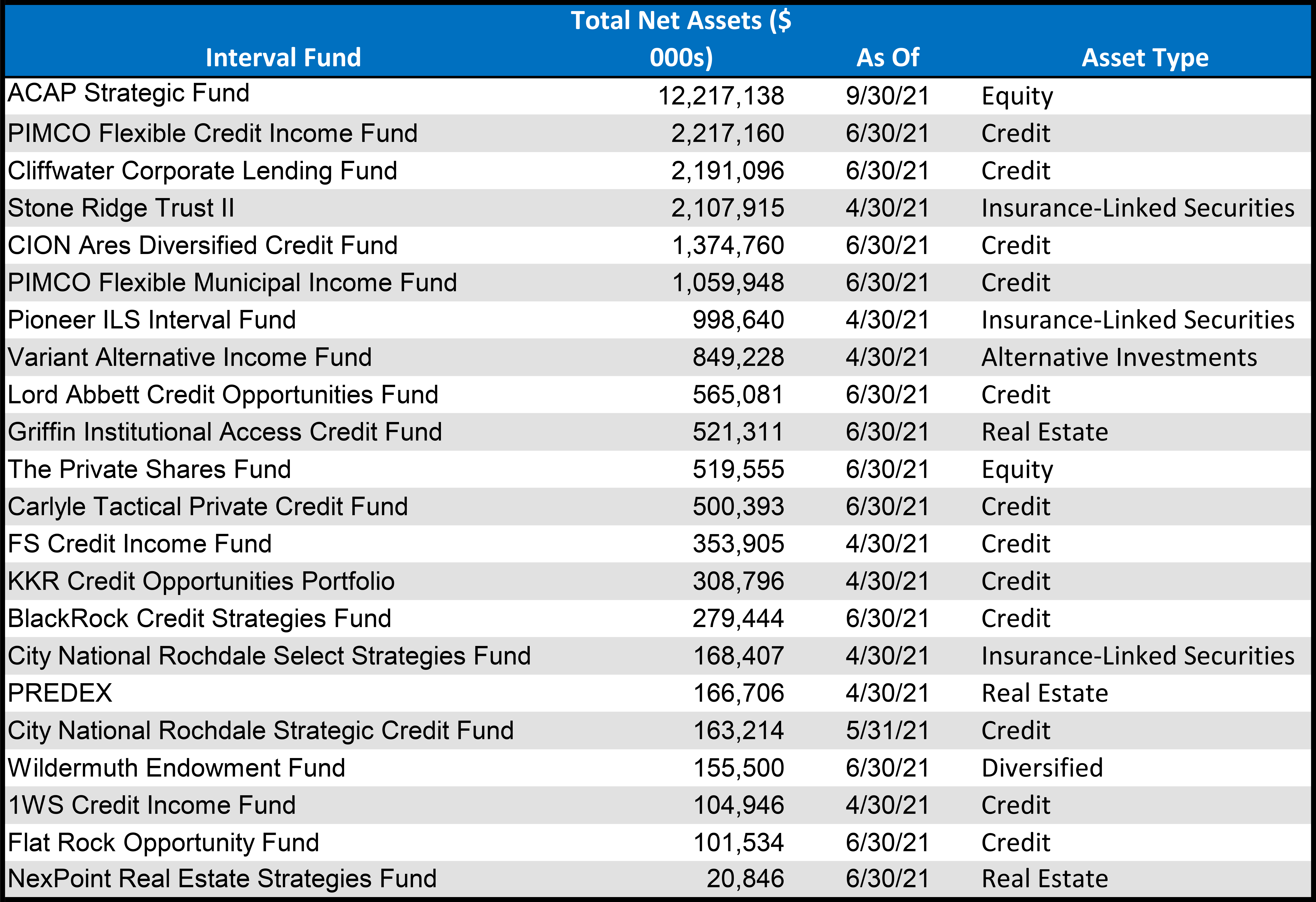

Below is a table that shows the 22 largest interval funds by Total Net Assets ($ 000s) and the types of assets they invest in. Note that the six largest had Total Net Assets combined of over $26.9 billion, while the next 16 by size combined had just $14.6 billion.

ACAP Strategic Fund, the largest fund by Net Assets in the Database, has 80% of its holdings in U.S.-based large-cap firms, with the remaining assets spread across global developed markets.

Source: Blue Vault