July 2021 Nontraded REIT Capital Raise Decreases 9.2% for Reporting Offerings

August 16, 2021 | James Sprow | Blue Vault

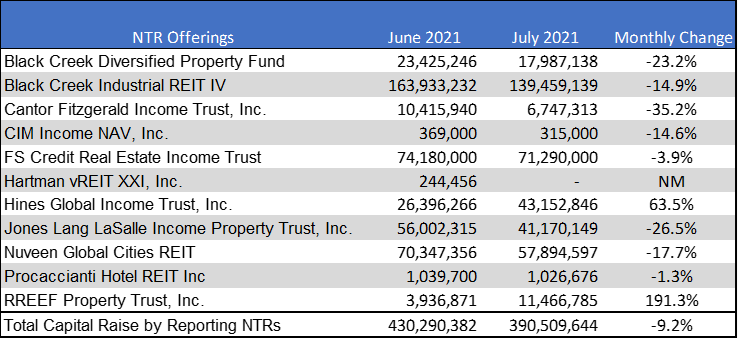

Blue Vault received July sales totals for 10 effective nontraded REIT program offerings as of August 10, 2021. Sales reported by those 10 NTRs totaled $390.51 million compared to $430.29 million for the 11 reporting REITs in June, a decrease of $39.78 million, or 9.2%. Five additional nontraded REITs have previously suspended their offerings or did not report sales for July (Cottonwood Communities, Griffin Capital Essential Asset REIT, InPoint Commercial Real Estate Income, Moody National REIT II, and Strategic Storage Trust IV).

Blue Vault received July sales totals for 10 effective nontraded REIT program offerings as of August 10, 2021. Sales reported by those 10 NTRs totaled $390.51 million compared to $430.29 million for the 11 reporting REITs in June, a decrease of $39.78 million, or 9.2%. Five additional nontraded REITs have previously suspended their offerings or did not report sales for July (Cottonwood Communities, Griffin Capital Essential Asset REIT, InPoint Commercial Real Estate Income, Moody National REIT II, and Strategic Storage Trust IV).

Black Creek Industrial REIT IV’s offering again led the 10 reporting NTRs with sales of $139.46 million, down 14.9% from $163.93 million in June. FS Credit Real Estate Income Trust raised $71.29 million, down 3.9% from June’s $74.18 million. Nuveen Global Cities REIT raised $57.89 million in July, down 17.7% from $70.35 million in June. Hines Global Income Trust raised $43.15 million, up 63.5% from $26.40 million in June. Jones Lang LaSalle Income Property Trust raised $41.17 million, down 26.5% from June when it raised $56.00 million. All sales reported include distributions reinvested in shares of the REIT (DRIP).

Table I shows month-to-month comparisons for those REITs reporting sales for June and July 2021.

Table I

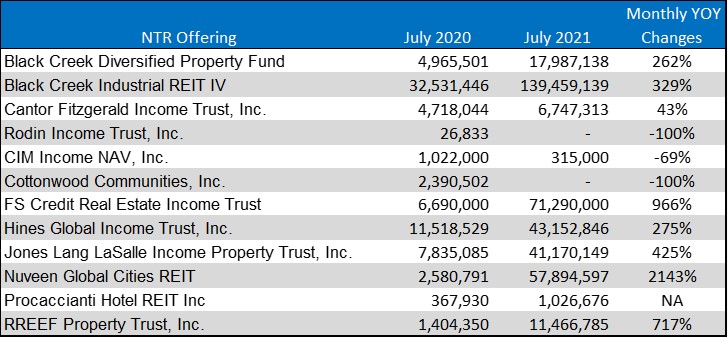

Table II shows June Y-O-Y comparisons for 12 nontraded REITs that have reported sales either in July 2020 or July 2021, or both. The most significant Y-O-Y increases were for Nuveen Global Cities REIT (+931%), FS Credit Real Estate Income Trust (+876%), Hines Global Income Trust (486%), Black Creek Industrial REIT IV (+419%) and Cantor Fitzgerald Income Trust (+417%). Other REITs with significant Y-O-Y increases were Black Creek Diversified Property Fund (+272%), Jones Lang LaSalle Income Property Trust (+167%), and RREEF Property Trust (+26%).

Table II

Nontraded BDC Sales

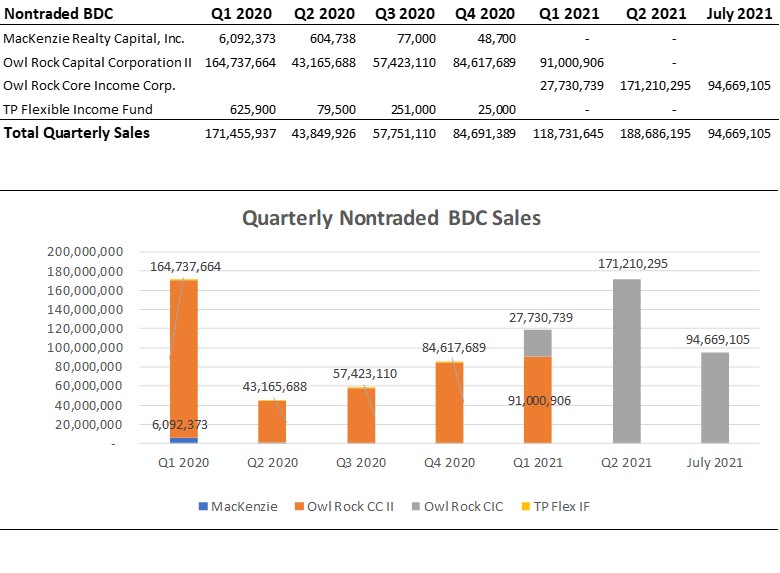

Just one nontraded BDC was raising funds in July 2021 and reported sales to Blue Vault. Owl Rock Core Income Fund raised $94.67 million in July, up 33.4% from $70.95 million in June and 50% in one month of the total raised by the same fund in the three months of Q2 2021. Owl Rock Capital Corporation II closed its offering in April 2021 after sales of $17.46 that month. MacKenzie Realty Capital last reported nontraded BDC sales in October 2020 of $48,700 and closed its offering in December 2020. MacKenzie recently changed its legal structure to a nontraded REIT. Prospect Flexible Income Fund last reported sales for October 2020 of $25,000 and closed its offering in February 2021.

On a quarterly basis, Owl Rock BDCs raised a four-quarter total of $331.37 million from Q3 2020 through Q2 2021. Table III and the accompanying chart show quarterly totals for all reporting nontraded BDCs and July 2021 sales for Owl Rock Core Income Fund.

Table III

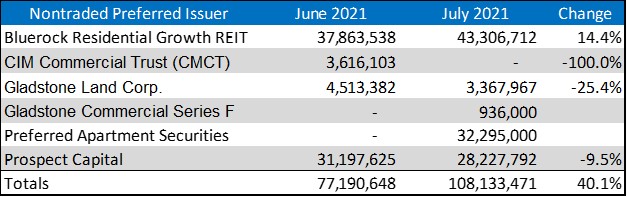

Nontraded Preferred Stock Issued by Reporting Sponsors

Four listed REITs reported their nontraded preferred stock issuances in July 2021 to Blue Vault. The four listed REITs reported total sales of nontraded preferred in July of $108.13 million, up 40.1% from $71.19 million in June. Bluerock Residential Growth REIT issued $43.31 million of its preferred stock in July, up 14.4% from $37.86 million in June. Preferred Apartment Communities did not report their preferred issuances in June but reported $32.30 in sales for July. Prospect Capital issued $28.23 million of nontraded preferred in July, down 9.5%. Gladstone LAND issued $3.37 million in nontraded preferred in July down 25.4% from June’s $4.51 million, after not reporting in April or May. For July 2020 four listed REITs reported sales of $42.29 million in nontraded preferred stock, for a same-month Y-O-Y increase of 121% to the July 2021 total of $108.13 million.

Table IV shows June and July sales of nontraded preferred stock by reporting listed REITs.

Table IV

Private Placement Sales

Blue Vault received sales reports for a total of 49 private placement investment programs for July. The total sales for those programs were $559.3 million in July, down from $657.4 million in June, reported by 47 programs.

Source: Blue Vault