June retail market: US sales drop below expectations; 4 new bankruptcies

June 15, 2021 | Tayyeba Irum and Chris Hudgens | S&P Global Market Intelligence

U.S. retail sales fell in May as stores in several categories reported less business than the prior month, though industry watchers remain optimistic about consumer spending as the economy continues to reopen.

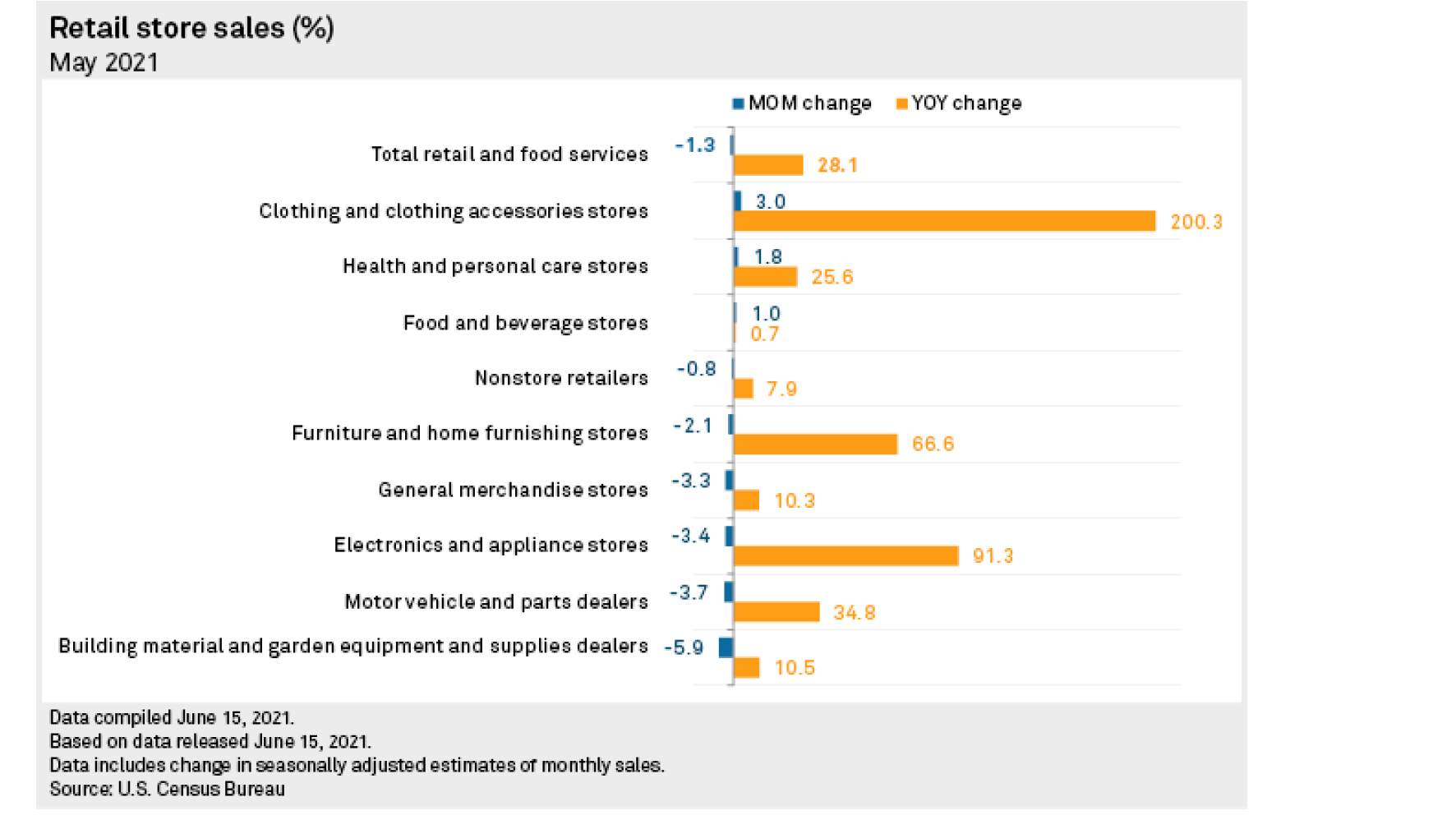

Retail and food services sales dropped 1.3% in May compared to April, which registered a revised gain of 0.9%. Economists polled by Econoday had forecast a decline of 0.5% in May.

Despite the drop, trillions in excess consumer savings and pent-up demand for goods and services will likely provide plenty of support to the economy during the remainder of the year, experts say.

“As a result, the sky is the limit for consumer spending for the rest of this year (and possibly 2022 as well),” Stephen Stanley, chief economist at Amherst Pierpont, said in a note.

Meanwhile, bankruptcies across the retail sector picked up pace during late May and early June, with four new filings by retail companies during the period.

Retail sales

U.S. retail and food services sales declined to $620.21 billion in May, according to data released June 15 by the U.S. Census Bureau.

While that represents a slowdown from April and the massive spending jump in March, “the consumer pulse remains vibrant,” Lydia Boussour, senior U.S. economist at Oxford Economics, said in a note.

“Strong fundamentals continue to underpin consumer spending including over $1 trillion in personal transfers, rising employment and wages, increased optimism and reduced virus fear, and $2.5 trillion in excess savings,” Boussour said.

Among retailers, sales at dealers of building material and garden supplies fell 5.9% in May, while sales at general merchandise stores declined 3.3% month on month. Motor vehicle and parts dealers also registered a decline of 3.7% in sales to $135.98 billion during the month.

However, sales at clothing and clothing accessories retailers jumped 3%, while food services and drinking places posted a month-over-month sales increase of 1.8%.

Sales declines were caused in large part by supply chain constraints, according to the National Retail Federation. Consumer demand remains strong despite the fading effects of government stimulus payments, NRF Chief Economist Jack Kleinhenz said in a statement from the trade group.

“There is still pent-up demand for retail goods and consumers are likely to remain on a growth path into the summer,” Kleinhenz said.

Marwan Forzley, CEO of global payments firm Veem, said in an email that there are many reasons to be optimistic about retail sales in the coming months.

“As travel picks up, COVID restrictions continue to be lifted, and a growing number of Americans become vaccinated, I anticipate an increase in people going out and shopping again as we try and return to pre-pandemic levels,” Forzley said.

Consumer prices

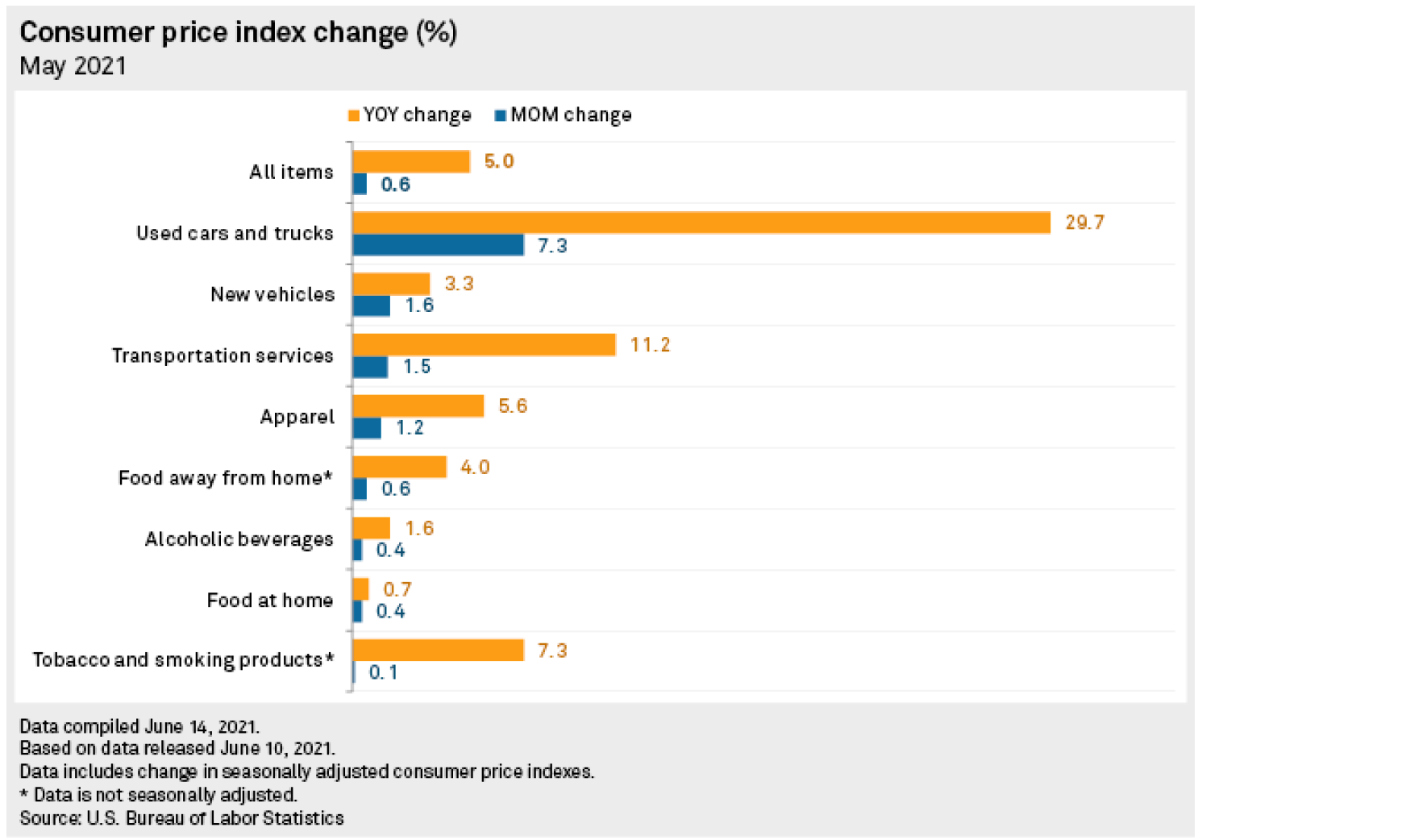

Consumer prices jumped 0.6% in May after increasing 0.8% in April, according to data from the U.S. Bureau of Labor Statistics. On a year-on-year basis, prices jumped 5.0% before seasonal adjustment.

Prices for used cars and trucks rose 7.3% month over month in May. Apparel prices rose 1.2% as prices for women’s and girls’ apparel rose 2.2% from a month earlier.

Bankruptcy

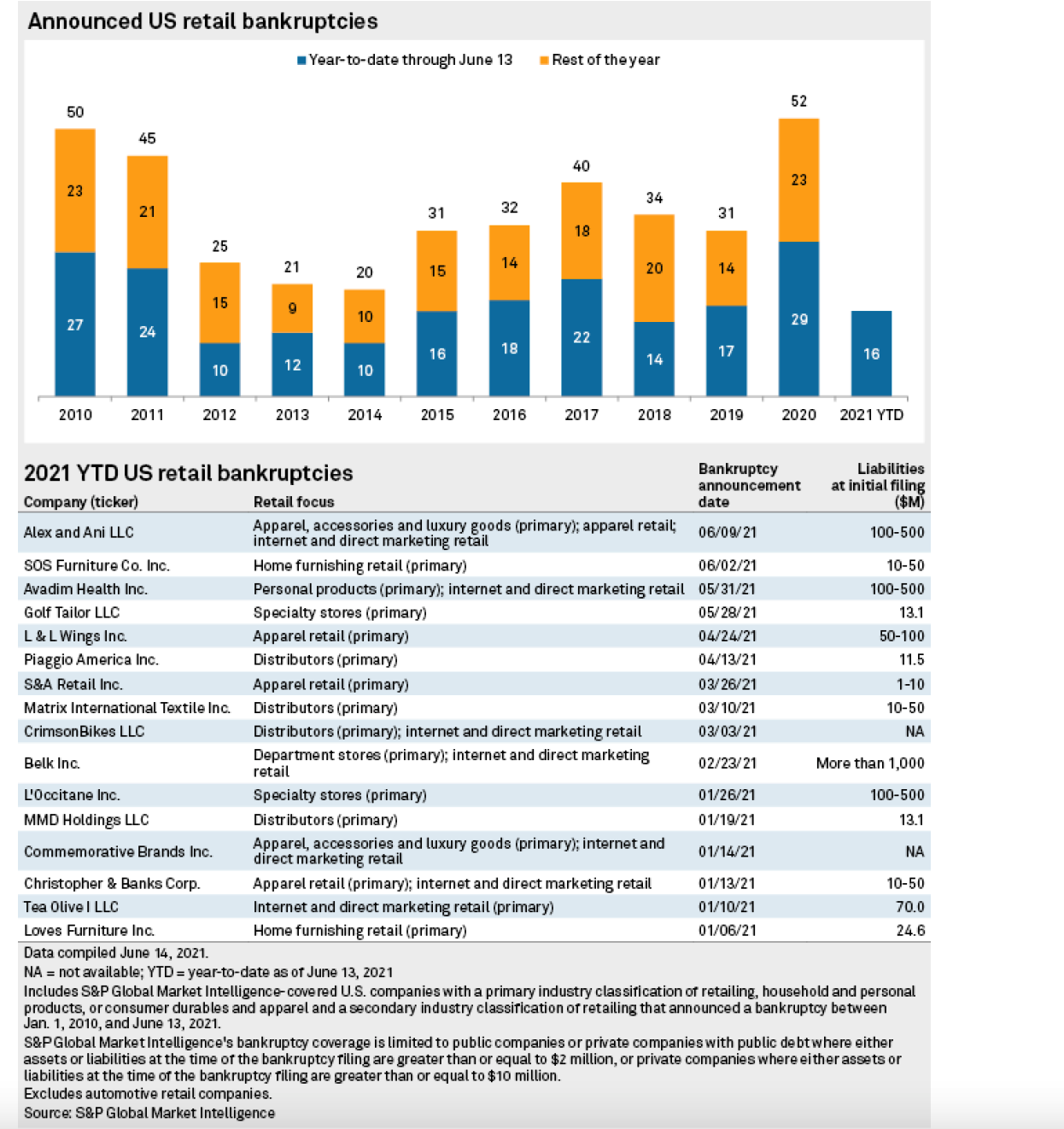

Four S&P Global Market Intelligence-covered U.S. retail companies went bankrupt between late May and early June, pushing the year-to-date count to 16.

The recent filings include a voluntary Chapter 11 petition by jewelry maker Alex and Ani LLC, which listed liabilities of $100 million to $500 million.

Brick-and-mortar retailers outside of big-box stores like Walmart Inc. and Target Corp. struggled during the pandemic, as the structural shift toward online purchases was accelerated, Stanley of Amherst Pierpont said.

“Thus, retailers are facing a rapidly evolving landscape and it would not be surprising to see shifting consumer patterns that lead to additional retail bankruptcies going forward, even as the overall consumer spending outlook is unusually robust,” Stanley said.

Employment

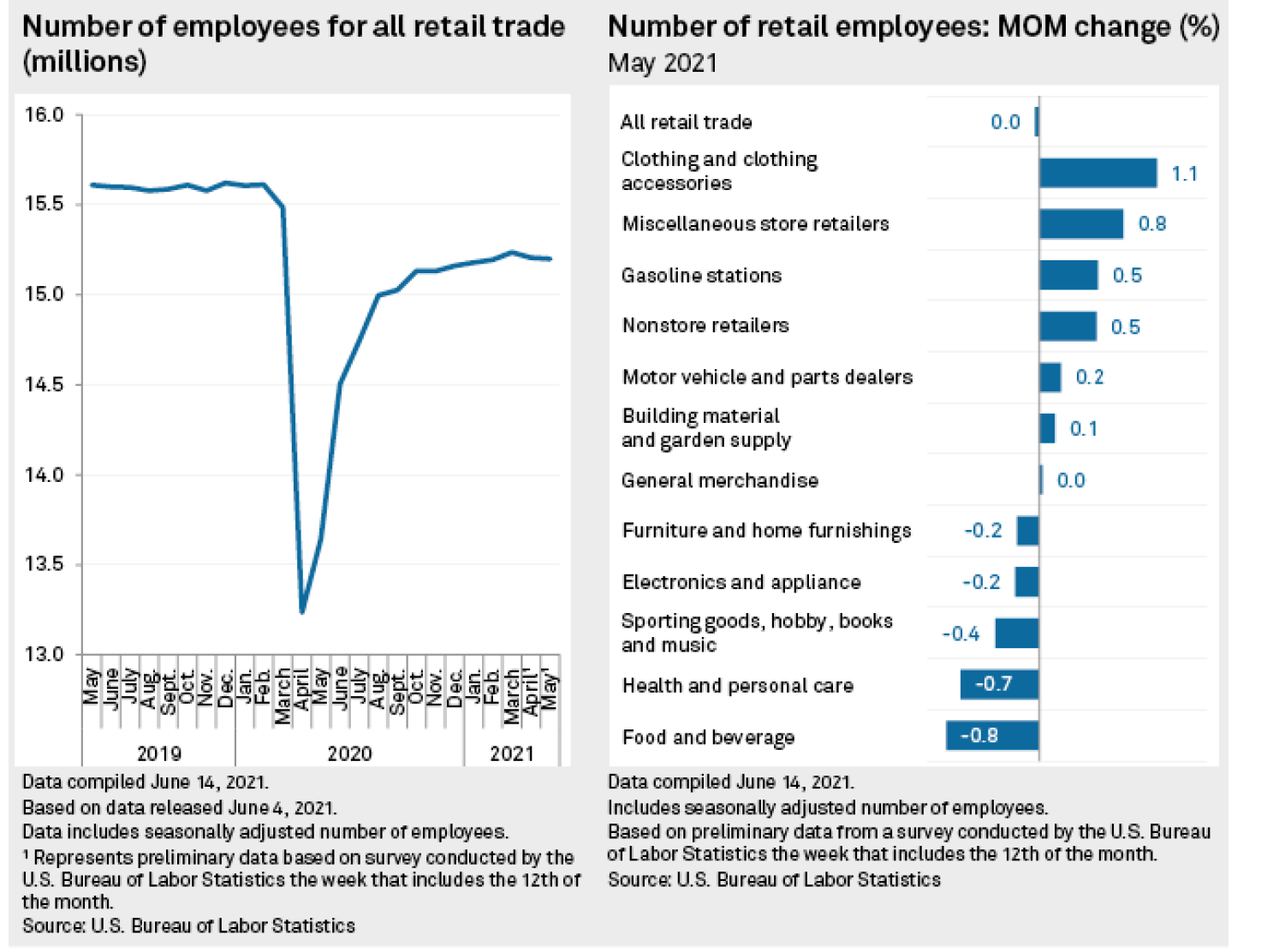

The retail sector lost 5,800 jobs in May to 15.2 million jobs. That represents a decline of 0.04% from April, according to Bureau of Labor Statistics data.

Food and beverage stores lost 26,000 jobs in May, a month-on-month decline of 0.84%. Clothing and clothing accessories retailers, meanwhile, saw an increase of 1.05% in jobs to 1 million jobs.

Vulnerability

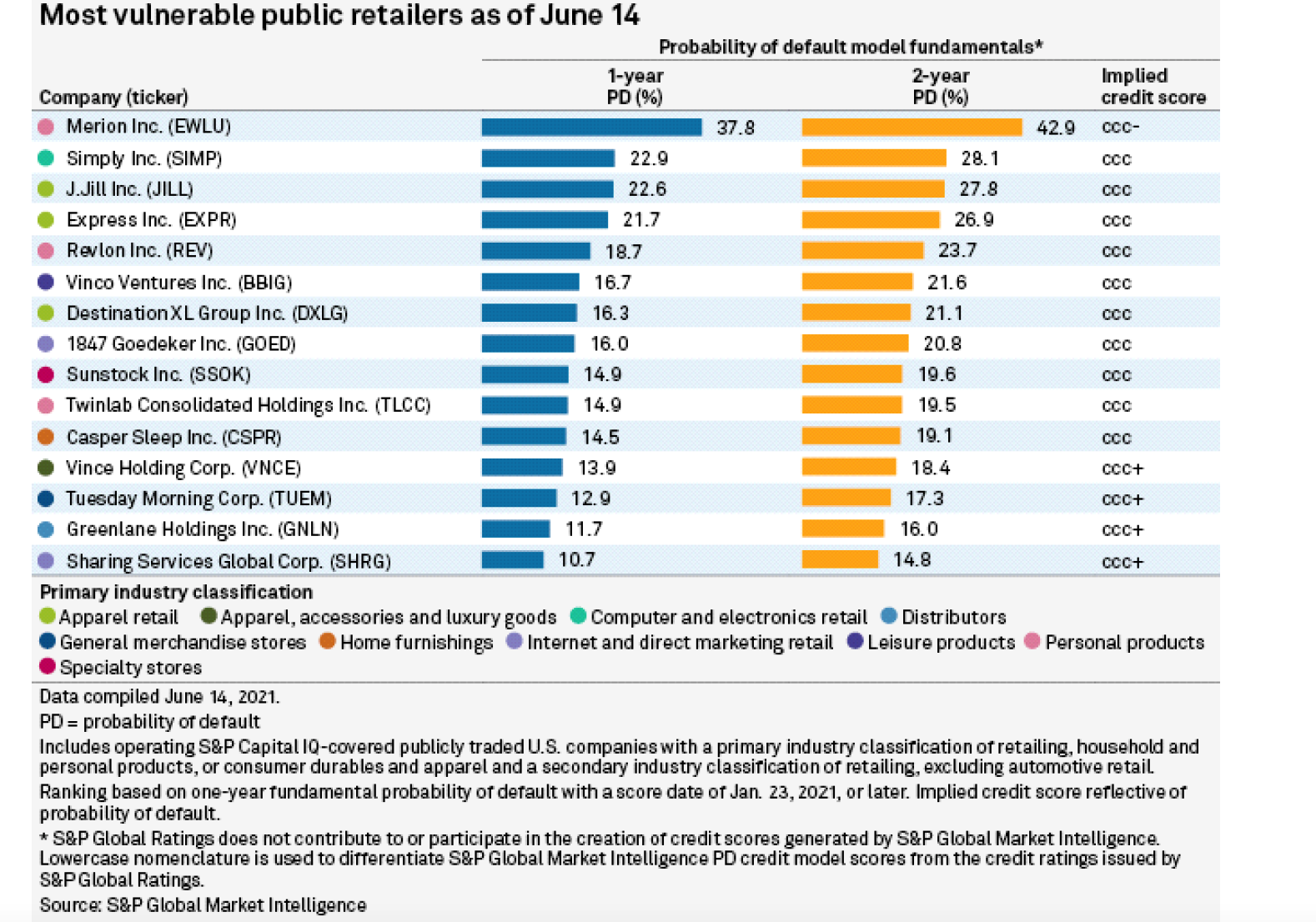

A June analysis of the one-year probability of default scores identified 15 public retailers with scores ranging from 37.8% to 16.0% and corresponding implied credit scores of “ccc-” to “ccc.” The probability of default scores represent the odds that each company will default on its debt in a year, based on financial reports and accounting for different macroeconomic factors.

Health supplements retailer Merion Inc. topped the list with a probability of default score of 37.8%. The company did not respond to a request for comment.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.