Liberty Street Advisors Private Shares Fund Clears $1 Billion Milestone

August 9, 2022 | Liberty Street Advisors Inc.

Liberty Street Advisors Inc. (“Liberty Street”), an experienced investment advisor committed to providing advisors and investors access to differentiated strategies through its selective multi-manager family of funds, today announced that The Private Shares Fund (the “Fund”) has increased assets under management to more than $1 billion.

“I am truly humbled to reach this milestone, as it’s a testament to the fact that our value proposition has resonated across an ultra-competitive investment landscape,” said Kevin Moss, Liberty Street managing director and the Private Shares Fund president. “Since the Fund’s inception, our chief goal has been to democratize access to the private market, and late-stage, venture-backed, private companies specifically. This achievement wouldn’t be possible without the combined efforts of our dedicated investment team, our trustees and our shareholders. I’m grateful for the trust our investors continue to place in us.”

Liberty Street CEO Tim Reick added: “Our investment team has done yeoman’s work implementing the institutional framework that has allowed us to scale the strategy. As the democratization of the private market continues to accelerate, investors are still searching for opportunities that offer them liquidity options. This environment, coupled with the investment team’s eight-year track record managing the Fund, gives me confidence that we can move forward with the momentum built over the past two years.”

Launched in 2014, the Private Shares Fund investment team is composed of eight professionals, whose backgrounds include venture capital, private equity, investment banking and portfolio management experience. The Fund seeks capital appreciation by investing in the equity securities of private, operating, late-stage, growth companies.

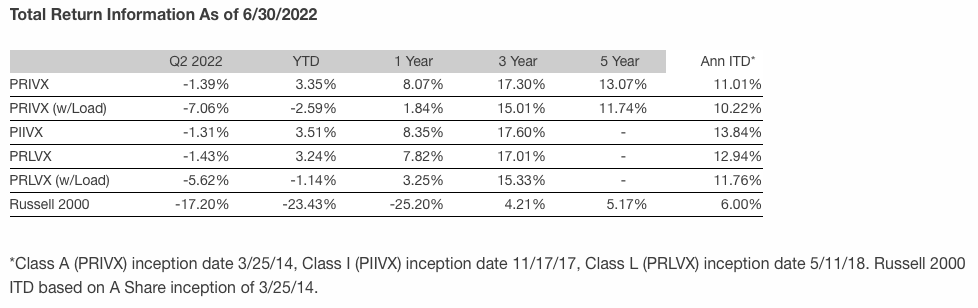

Liberty Street has facilitated the Fund increasing its assets under management by approximately $723 million since it assumed management responsibilities for the Fund on Dec. 9, 2020. The Private Shares Fund’s Class A shares (without load) have delivered annualized returns of 11.01% since inception, and 17.30% over the last three years as of June 30, 2022.

“I’m thrilled that we have achieved such a significant milestone and am enthusiastic about the next phase of the Fund’s growth,” said Christian Munafo, Liberty Street CIO and Private Shares Fund portfolio manager. “As the types of high growth innovation companies that we target continue to stay private longer and grow into larger market capitalizations within the private market, we think it’s increasingly important for all investors to have access to this potential alpha generation before they get acquired or go public.”

Continued Munafo: “We’re well-positioned to continue working with various participants across the venture capital and growth ecosystem, while capitalizing on technology and innovation-driven opportunities across sectors including aerospace, finance, cybersecurity, healthcare, agriculture, transportation and e-commerce, among others, and I believe we’ll continue to drive meaningful returns for our investors and shareholders.”

ABOUT THE PRIVATE SHARES FUND

The Private Shares Fund is a 1940 Act, closed-end interval fund that seeks to invest in a portfolio of private, late-stage, growth companies. While traditionally, such access to private companies has only been available to institutional and high net worth investors through high minimum, complex and paperwork laden private placement vehicles, the Fund provides all investors access to such companies, with a daily NAV, a quarterly repurchase program, no performance fees and simple 1099 tax reporting. Formerly named the Sharespost 100 Fund, the Fund changed its name to The Private Shares Fund on April 30, 2021.

ABOUT LIBERTY STREET ADVISORS

Liberty Street Advisors, Inc. (“Liberty Street”) is an SEC registered investment advisor. The firm is located in New York City and launched its first fund in 2007. Liberty Street provides access to valuable and timely investment strategies designed to help investors and financial advisors meet the challenges of today’s market environment. As of June 30, 2022, Liberty Street manages seven mutual funds and an interval fund with collective assets under management of over $1.4 billion.

Private Shares Fund Top 10 Holdings As of 07/27/2022*

GrubMarket, Tradeshift, SpaceX, Motive, Axiom Space, NextRoll, , NextRoll, Kraken, Betterment, Relativity, Lime

*Represents 28.9% of Fund holdings as of July 27, 2022. Holdings are subject to change. Not a recommendation to buy, sell, or hold any particular security. To view the Fund’s complete holdings, visit privatesharesfund.com/portfolio.

Returns vary per share class. Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Current performance may be lower or higher than the performance data quoted. For performance as of the most recent month-end, please call 1-855-551-5510. Some of the Fund’s fees were waived or expenses paid by the Advisor; otherwise, returns would have been lower. The Fund’s total gross expenses are 2.37%, 2.32%, and 2.60%, and for the Class A, I, and L shares respectively. The Fund’s total net expenses are 2.53%, 2.28%, and 2.78% for the Class A, I, and L Shares respectively. The Fund’s advisor has contractually agreed to waive fees and/or pay operating expenses, excluding taxes, interest, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, such that total expenses do not exceed 2.50%, 2.25%, and 2.75% for the Class A, I, and L shares respectively. The agreement with the Advisor is in place until at least May 2, 2023. Net expenses are applicable to investors. Performance results with load reflect the deduction of the 5.75% maximum front end sales charge for Class A Shares and 4.25% for the Class L Shares.

The Russell 2000 is an index measuring the performance of approximately 2,000 smallest-cap American companies in the Russell 3000 Index, which is made up of 3,000 of the largest U.S. stocks. It is a market-cap weighted index. It is not possible to invest in an index.

IMPORTANT DISCLOSURES

This press release is not intended to, and does not, constitute an offer to purchase or sell shares of the Fund. Shares of the Fund are sold only through their respective share class prospectus.

As of December 9, 2020, Liberty Street Advisors, Inc. became the adviser to the Fund. The Fund’s portfolio managers did not change. Effective April 30, 2021, the Fund changed its name from the “SharesPost 100 Fund” to “The Private Shares Fund.” Effective July 7, 2021, the Fund made changes to its investment strategy. In addition to directly investing in private companies, the Fund may also invest in private investments in public equity (“PIPEs”) where the issuer is a special purpose acquisition company (“SPAC”), and profit sharing agreements. The Fund’s investment thesis has not changed.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus with this and other information about The Private Shares Fund (the “Fund”), please download here, or call 1-855-551-5510. Read the prospectus carefully before investing.

The investment minimums are $2,500 for the Class A Share and Class L Share, and $1,000,000 for the Institutional Share.

Investment in the Fund involves substantial risk. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. The Fund has no history of public trading and investors should not expect to sell shares other than through the Fund’s repurchase policy regardless of how the Fund performs. The Fund does not intend to list its shares on any exchange and does not expect a secondary market to develop.

All investing involves risk including the possible loss of principal. Shares in the Fund are highly illiquid, and can be sold by shareholders only in the quarterly repurchase program of the Fund which allows for up to 5% of the Fund’s outstanding shares at NAV to be redeemed each quarter. Due to transfer restrictions and the illiquid nature of the Fund’s investments, you may not be able to sell your shares when, or in the amount that, you desire. The Fund intends to primarily invest in securities of private, late-stage, venture-backed growth companies. There are significant potential risks relating to investing in such securities. Because most of the securities in which the Fund invests are not publicly traded, the Fund’s investments will be valued by Liberty Street Advisors, Inc. (the “Investment Adviser”) pursuant to fair valuation procedures and methodologies adopted by the Board of Trustees. While the Fund and the Investment Adviser will use good faith efforts to determine the fair value of the Fund’s securities, value will be based on the parameters set forth by the prospectus. As a consequence, the value of the securities, and therefore the Fund’s Net Asset Value (NAV), may vary. There are significant potential risks associated with investing in venture capital and private equity-backed companies with complex capital structures. The Fund focuses its investments in a limited number of securities, which could subject it to greater risk than that of a larger, more varied portfolio. There is a greater focus in technology securities that could adversely affect the Fund’s performance. The Fund’s quarterly repurchase policy may require the Fund to liquidate portfolio holdings earlier than the Investment Adviser would otherwise do so and may also result in an increase in the Fund’s expense ratio. Portfolio holdings of private companies that become publicly traded likely will be subject to more volatile market fluctuations than when private, and the Fund may not be able to sell shares at favorable prices. Such companies frequently impose lock-ups that would prohibit the Fund from selling shares for a period of time after an initial public offering (IPO). Market prices of public securities held by the Fund may decline substantially before the Investment Adviser is able to sell the securities. The Fund may invest in private securities utilizing special purpose vehicles (“SPV”s), private investments in public equity (“PIPE”) transactions where the issuer is a special purpose acquisition company (“SPAC”), and profit sharing agreements. The Fund will bear its pro rata portion of expenses on investments in SPVs or similar investment structures and will have no direct claim against underlying portfolio companies. PIPE transactions involve price risk, market risk, expense risk, and the Fund may not be able to sell the securities due to lock-ups or restrictions. Profit sharing agreements may expose the Fund to certain risks, including that the agreements could reduce the gain the Fund otherwise would have achieved on its investment, may be difficult to value and may result in contractual disputes. Certain conflicts of interest involving the Fund and its affiliates could impact the Fund’s investment returns and limit the flexibility of its investment policies. This is not a complete enumeration of the Fund’s risks. Please read the Fund prospectus for other risk factors related to the Fund.

Alpha: the excess return on an investment after adjusting for market-related volatility and random fluctuations.

The Fund may not be suitable for all investors. Investors are encouraged to consult with appropriate financial professionals before considering an investment in the Fund.

Companies that may be referenced in this press release are privately-held companies. Shares of these privately-held companies do not trade on any national securities exchange, and there is no guarantee that the shares of these companies will ever be traded on any national securities exchange. Fund holdings are subject to change. Not a recommendation to buy, sell, or hold any specific security.

FORWARD-LOOKING STATEMENTS

This release contains forward-looking statements that subject to risks, uncertainties and other factors that may cause actual results to differ materially. Statements in this press release that are not historical facts are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. When used in this press release, words or phrases generally written in the future tense and/or preceded by words such as “will,” “may,” “could,” “expect,” “believe,” “anticipate,” “intend,” “plan,” “seek,” “estimate,” “preliminary” or other similar words are forward-looking statements.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other important factors that could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward-looking statements. Any forward-looking statement made in this press release speaks only as of the date on which it is made. Factors or events that could cause actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We do not undertake any obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

The Private Shares Fund is distributed by Foreside Fund Services, LLC.

Contacts

Kevin Santo

Water & Wall

516-506-8560

kevin@waterandwall.com