American Healthcare REIT Reduces NAV and Suspends DRIP

March 20, 2023 | James Sprow | Blue Vault

On March 15, 2023, American Healthcare REIT’s board of directors unanimously approved and established an updated net asset value per share (NAV) of the Company’s Class T and Class I common stock of $31.40. The previous NAV per share of the Company’s common stock, as of December 31, 2021, was $37.16. The reduction in NAV was 15.5%. In November 2021 the REIT executed a reverse 1:4 stock split which resulted in an equivalent valuation of $9.29 per previous common share at the then $37.16 NAV.

As is the case with other nontraded REIT valuations, the Company cites the effects of higher capitalization rates resulting from higher inflation and interest rates. Robert A. Stanger & Co., an independent third-party valuation firm, provided an Appraisal Report which estimates the per share NAV as of December 31, 2022. The NAV report includes the valuation of the Company’s interest in Trilogy REIT Holdings, LLC, the valuation of the Company’s debt security investment, the Company’s mortgage loans, term loan, line of credit, and the management company. Recent acquisitions of seven properties acquired within three months of the valuation date as well as the pending sale of two properties were valued using contract terms.

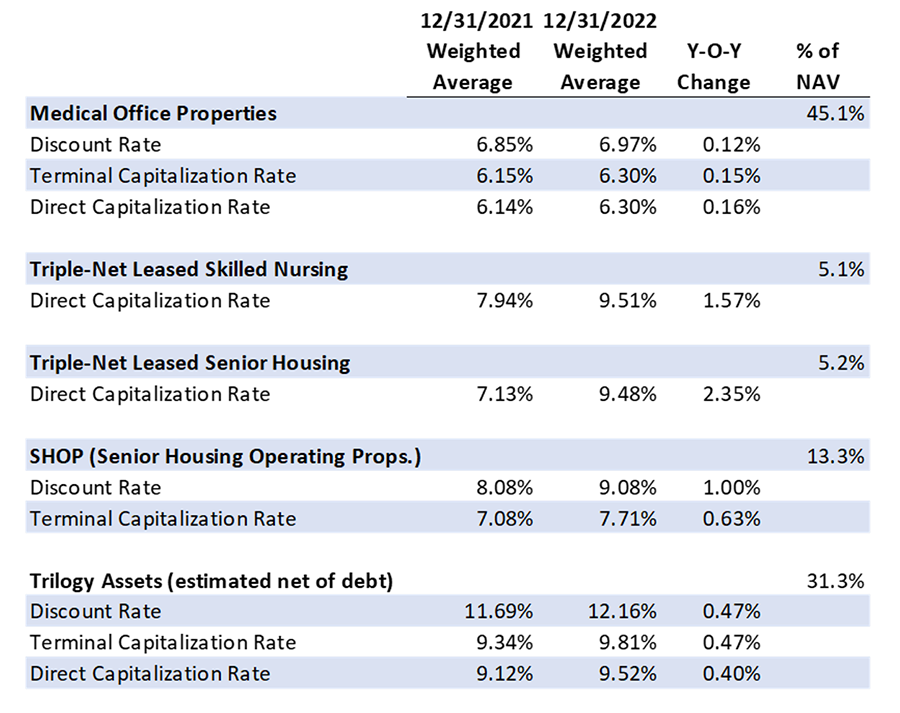

In an 8-K filing on March 15, 2023, the Company reports the key assumptions used in the discounted cash flow analyses to arrive at the value of the appraised properties as of December 31, 2022. In the table below we compare the weighted average discount rates and capitalization rates used in the most recent report to those used in the December 31, 2021, valuations.

The increases in discount rates and terminal capitalization rates are responsible for a significant amount of the decrease in the REIT’s NAV per share. Stanger also used a discount rate in valuing the REIT’s debt investment of 10.75%. This rate was 3.25% higher in the 2022 NAV calculation compared to 2021, resulting in a lower value for the investment, largely due to the increase in market interest rates.

Suspension of DRIP Program

In order to preserve the Company’s liquidity, better align distributions with available cash flows and position the Company to achieve its long-term strategic goals, on March 15, 2023, the Board authorized a reduced quarterly distribution from $0.40 per share to $0.25 per share to the Company’s Class T and Class I common stockholders of record as of the close of business on April 4, 2023 for the quarter commencing January 1, 2023 to March 31, 2023. The quarterly distribution will be paid on or about April 18, 2023 and represents an annualized distribution rate of $1.00 per share. As the Company previously reported in its Current Report on Form 8-K filed with the SEC on November 16, 2022, the Board approved the suspension of the Company’s distribution reinvestment plan beginning with distributions declared for the quarter ending December 31, 2022. As a result of the suspension, the first quarter 2023 distribution will be paid in cash, only from legally available funds.

Source: SEC