Carter Validus Mission Critical REIT Announces Lower NAV

October 1, 2018 | James Sprow | Blue Vault

On September 27, 2018, the REIT’s board approved an estimated per share NAV of common stock of $5.33. The board engaged Robert A. Stanger & Co., Inc., an independent third-party valuation firm, to calculate the estimated per share NAV and provide an appraised value on 42 of the 62 properties in the real estate portfolio as of June 30, 2018.

In calculating the estimated per share NAV, Stanger also considered (i) appraisal reports prepared by a third party, other than Stanger, on 18 properties with valuation dates ranging from February 16, 2018 to February 22, 2018, (ii) the then pending disposition price for two properties pursuant to purchase and sale agreements, net of estimated transaction costs, (iii) Stanger’s estimated value of the REIT’s secured notes payable, (iv) Stanger’s value estimate with respect to the consolidated joint venture and unconsolidated joint venture, (v) Stanger’s estimate of Carter/Validus Advisors, LLC’s (the “Advisor”) subordinated participation in net sales proceeds due upon liquidation of the portfolio, (vi) the Advisor’s adjusted carrying value of other assets and liabilities, and (vii) the carrying value of the unsecured credit facility.

Shareholder account statements for the quarter ended June 30, 2018, reflected, and account statements for the quarter ended September 30, 2018 will reflect, the estimated per share NAV of $6.26. Future quarterly account statements, however, will reflect the estimated per share NAV of $5.33.

Participants in the distribution reinvestment plan (the “DRIP”), under which distributions are reinvested in additional shares of common stock, distributions accrued from September 1, 2018 through September 30, 2018 will be reinvested at $6.26 per share. Beginning with distributions that will accrue in October 2018, distributions will be reinvested at $5.33 per share, the new NAV per share.

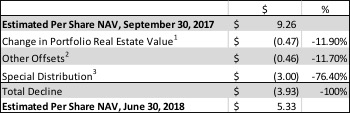

The table below sets forth the calculation of the decline in the Estimated Per Share NAV from September 30, 2017 at $9.26 to June 30, 2018 at $5.33:

1) While the change in Portfolio Real Estate Value above represents the change in the aggregate value of 62 properties owned as of June 30, 2018, the largest declines in individual property values were attributable to Walnut Hill Medical Center and Bay Area Regional Medical Center. Bay Area Regional Medical Center in Webster, Texas, was purchased in 2014 for $118.8 million. Walnut Hill Medical Center in Dallas, Texas, was acquired in 2014 for $101.4 million. It was not occupied as of May 23, 2018.

2) Other Offsets include distributions in excess of earnings.

3) Represents a special distribution paid on March 16, 2018, in connection with the sale of certain real estate properties between December 2017 and January 2018.

According to the REIT, as of June 30, 2018, “early” investors, those who acquired shares of the Company on April 28, 2011, and received all cash distributions, including the $3.00 special distribution, have received cumulative cash distributions of approximately $7.90 per share. The sum of these cumulative distributions and the Estimated Per Share NAV of $5.33 amounts to $13.23 per share. “Later” investors, those who acquired shares of the Company on June 6, 2014, and received all cash distributions, including the $3.00 special distribution, have received cumulative cash distributions of approximately $5.72 per share, and the sum of these cumulative distributions and the estimated value per share of $5.33 amounts to $11.05 per share.

According to Blue Vault, the REIT has paid distributions through Q4 2017 at 7.00% annualized based upon the $10.00 original offering price. After the $3.00 special distribution paid on March 16, 2018, the REIT paid distributions at a 6.00% annualized rate based upon the original $10.00 offering price less the $3.00 distribution.

Sources: SEC, Blue Vault

Learn more about Carter Validus on the Blue Vault Sponsor Focus page

Carter Validus Mission Critical REIT II, Inc. Announces New Officers

Carter Validus Mission Critical REIT II Announced Q2 2018 Financial Results