James Sprow | Blue Vault |

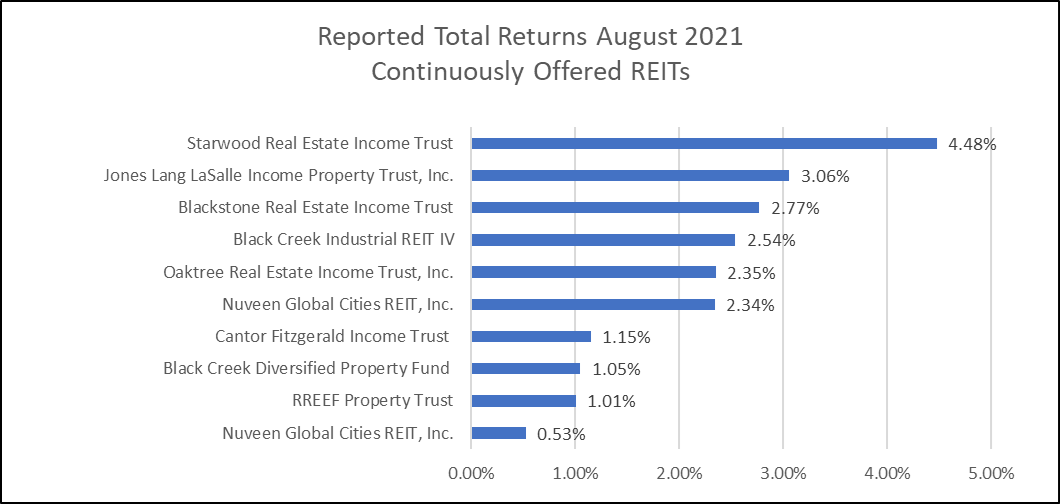

Ten continuously offered nontraded REIT products reported total returns for August, with a median return of 2.35%, which represents the increase in monthly NAVs and monthly distributions. The highest August return was reported by Starwood Real Estate Income Trust at 4.48%. Jones Lang LaSalle Income Property Trust was next with a total return in August of 3.06%. For year-to-date returns through August 31, Blackstone REIT led all ten NTRs with a YTD return of 18.32%, followed by Nuveen Global Cities Trust at 15.05% and Starwood REIT at 13.77%.

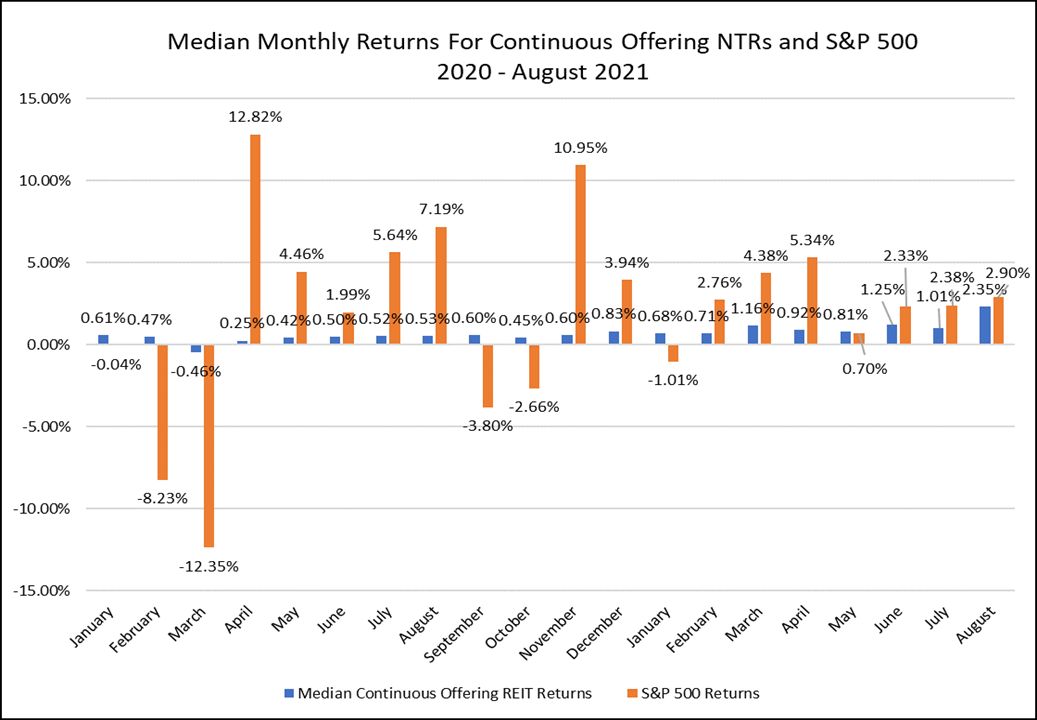

For August, the total return on the S&P 500 was 2.90%. The 12-month total return on the S&P 500 through August 31 was 21.58%. Seven nontraded REITs reported 12-month trailing total returns with a median of 11.40%. When it comes to volatility, the monthly total returns on the S&P 500 index was 3.90% compared to the standard deviation of the median returns on the continuously offered nontraded REITs was just 0.50%.

Chart I illustrates the August 2021 total returns for the 10 continuously offered nontraded REITs.

Chart I

Chart II clearly illustrates the difference in volatility for the monthly total returns of the nontraded REITs and the S&P 500. The S&P 500 had negative total returns in five of the 20 months from January 2020 through August 2021. The continuously offered nontraded REITs reported a median total return that turned negative in only one of the 20 months, that of March 2020 when the COVID pandemic caused the S&P 500 to record a total negative return of 12.35%.

Chart II

* Returns are calculated for Class I common shares for all REITs except Cantor Fitzgerald Income Trust’s Class IX and Jones Lang LaSalle Income Property Trust’s Class A shares.

Sources: Individual NTR websites and Yahoo!Finance.com