Disappointments at Colony NorthStar Inc. and Colony NorthStar Credit Real Estate

March 28, 2018 | James Sprow | Blue Vault

When Colony NorthStar Inc. (NYSE: CLNS) announced its financial results for the fourth quarter and the full year ended December 31, 2017, President and CEO Richard Saltzman tried to put a positive spin on what was a tough year for the listed REIT.

He said,

2017 was, on balance, a disappointing year for Colony NorthStar. Our financial results were not as robust as anticipated based upon continuing negative headwinds in healthcare, retail broker-dealer distribution, and less than expected returns in our residual real estate private equity secondaries and CDO portfolios. However, we achieved more than expected on the strategic front in terms of asset and platform sales, refinancings, synergies, and general streamlining, all with the goal of simplifying our business and emphasizing a few select areas of growth prospectively. In 2018, we will continue to be a net seller of non-core assets with a conservative bias to protect liquidity for further deleveraging, potential stock repurchases, and select investments in growth areas that are consistent with turbo-charging our investment management business. As announced today, we have reset our dividend to approximate expected taxable income and net cash flow, excluding the contribution of gains, and we expect to be in a position to grow the dividend in the future.

The ”reset” of the dividend was a cut to a first quarter 2018 rate of $0.11 per share, down from $0.27 per share in Q4 2017. That’s a substantial “reset.” It drops the dividend yield from almost 20% to 8% based on a recent $5.50 share price for CLNS.

The Q4 2017 report showed a net loss attributable to common shareholders of $0.69 per share and a full year net loss attributable to common stockholders of $0.64 per share, which included a $375 million write-down of the firm’s retail investment management business. The Company’s Investment Management segment includes the business and operations of managing capital on behalf of third-party investors through closed and open-end private funds, non-traded and traded real estate investment trusts and registered investment companies.

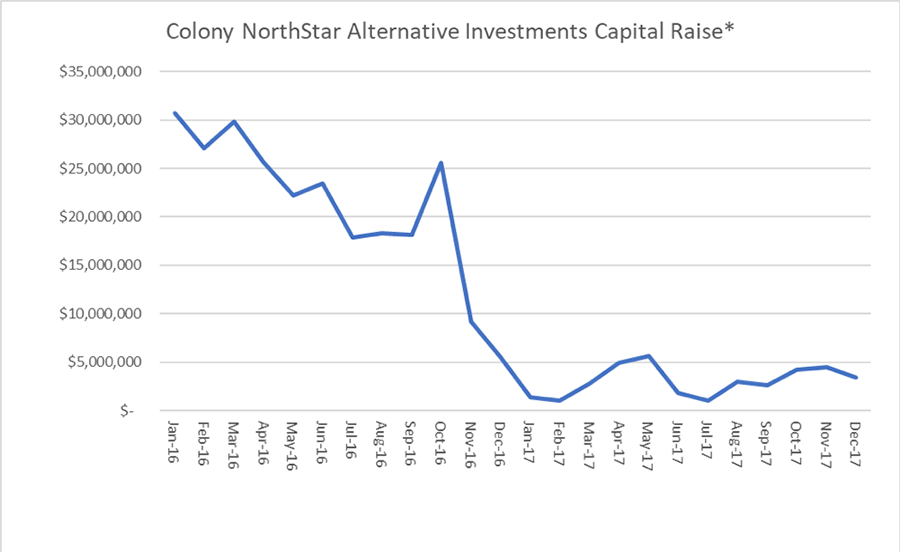

A glance at the capital raise for nontraded REIT programs and interval funds over the past two years reveals the lack of success the Company has had in the Investment Management area:

*Capital Raise by Colony NorthStar programs including NorthStar Healthcare Income, Inc., NorthStar Real Estate Income II, Inc., NorthStar/RXR New York Metro Real Estate, Inc., NorthStar Real Estate Capital Income Fund, and NorthStar Real Estate Income Master Fund, as reported to Blue Vault.

Combination of S2K and NorthStar Securities

Subsequent to the fourth quarter 2017, the Company entered into a definitive agreement with S2K Financial Holdings, LLC to combine the Company’s broker-dealer, NorthStar Securities, LLD, with S2K to create a market leading retail distribution business, which will be rebranded as Colony S2K Holdings, LLC (“Colony S2K”). Colony S2K will distribute both current and future investment products of Colony NorthStar and S2K. S2K is the holding company of S2K Financial, LLC, a registered broker-dealer wholesale distributor of investment vehicles and funds. S2K was founded in 2015 by Steven Kantor and others.

Richard B. Saltzman, CEO and President of Colony NorthStar, said,

We’re very pleased and excited about this new construct with S2K for our broker-dealer and retail distribution platform. For a variety of different reasons, the industry is going through a significant transformation and this strengthens and renews our commitment to the space in a way that maximizes our opportunity to be a ‘best-in-class’ market leader. We’ve known Steve Kantor for more than 25 years and have tremendous confidence in his leadership capabilities and resourcefulness to achieve this objective.

Colony NorthStar Credit Real Estate Launch

As reported in February by Blue Vault, the REIT’s management listed the new REIT Colony NorthStar Credit Real Estate, Inc. (NYSE: CLNC) on February 1, formed by the merger of NorthStar Real Estate Income Trust, NorthStar Real Estate Income II and a portfolio of assets contributed by CLNS. According to the merger agreement, each share of NorthStar I common stock was converted into the right to receive 0.3532 shares of Class A Common Stock of CLNC, plus cash in lieu of fractional shares. Also, each share of NorthStar II common stock was converted into the right to receive 0.3511 shares of Class A Common Stock of CLNC, plus cash in lieu of any fractional shares.

On February 1, CLNC closed at $20.40 per share, making the value of NorthStar I shareholders’ interest $7.20 per share (plus an interest in a note not included in the merger with a value estimated at $0.73 per share) and the value of NorthStar II shareholders’ interest $7.16 per share. Both REITs issued shares in their IPOs for $10.00 and the full-cycle returns for those investors have been either very small or negative, even with the 7.00% distribution yields for both REITs. Since February 1, 2018, the share price of CLNC has fallen to $19.00 per share as of March 26. The current dividend rate for CLNC of $1.74 annualized represents a forward yield of 9.20% based on its stock price. Based on the $10.00 original share price for NorthStar II, and the 0.3511 shares of CLNC received in the merger, the dividend yield is 6.1% annualized for those shareholders.

In Blue Vault’s Q3 2017 NTR Review, the MFFO payout ratios for NorthStar REIT and NorthStar RE Income II were 135% and 127%, respectively, for 2017 year-to-date, and those payout ratios had increased in Q3 2017, meaning the REITs were not covering their total distributions and had not been covering in recent years.

CLNC is managed by a subsidiary of Colony NorthStar, Inc. The base management fee is currently 1.50% of stockholders’ equity per annum., and CLNC can also issue to the Manager stock-based or other equity-based compensation.

CLNC’s Board of Directors has authorized a stock repurchase program, under which the Company may repurchase up to $300 million of its outstanding Class A common stock until March 31, 2019. If the Company repurchases shares in the open market under this program, such repurchases will not begin until after the release of the Company’s financial statements for the year ended December 31, 2017, which were filed with the SEC on March 23.

The repurchase of CLNC shares in the open market may provide a level of support for the REIT’s common stock price. It remains to be seen whether the Board of CLNC will decide to use the $300 million to do so.

Learn more about Colony NorthStar, Inc. on the Blue Vault Sponsor Focus page.

NorthStar REIT and NorthStar REIT II Shareholders Approve Merger

Colony NorthStar Signs Letter of Intent with S2K to Create “Colony S2K”