February NTR Sales Up, Nontraded BDC Sales Down from January

March 13, 2019 | James Sprow | Blue Vault

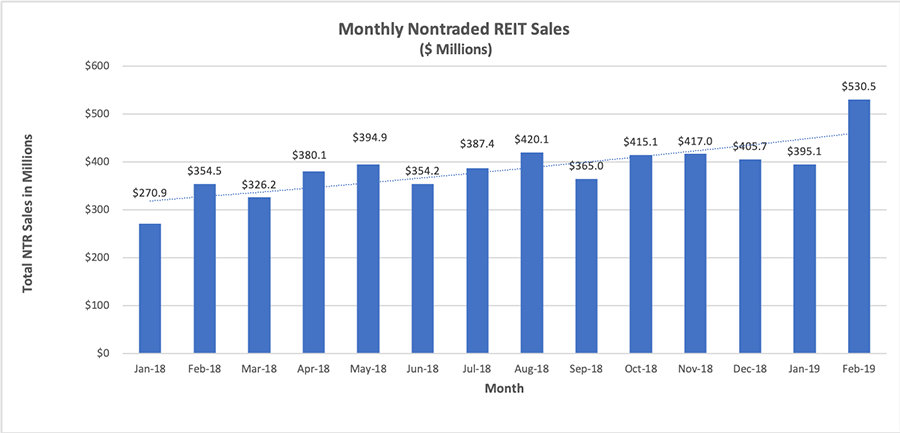

Reporting nontraded REITs1 booked capital raise of $530.5 million in February, up 34% from the $395.1 million total for January and up 28.6% from the $412.6 million monthly average in Q4 2018. Blackstone REIT saw capital raise rise in February by 35%, and other nontraded REIT offerings reported a combined capital raise increase of 33%, from $158.4 million to $211.4 million, adding proportionately to the very impressive month-to-month rise for the industry.

With the Blackstone REIT February sales of $319.1 million, up 35% from sales in January of $236.7 million, the 33.5% increase in capital raise month-to-month among reporting NTRs was due to several other REIT programs significantly increasing their capital raise. After Blackstone REIT with 60% of the month’s sales, the leading REIT program in capital raise in February was Griffin-American Healthcare REIT IV, Inc. with sales of $52.7 million, up 47% from January’s $35.8 million. Jones Lang LaSalle’s Income Property Trust raised $33.1 million in February, up 125% from $14.7 million in January. Black Creek Industrial REIT IV was next with sales of $27.2 million, down 7% from January. The Hines Global Income Trust total for February was $24.0 million, up from $19.3 million in January. Strategic Storage Trust IV raised $16.6 million in February, up over 110% from $7.6 million January.

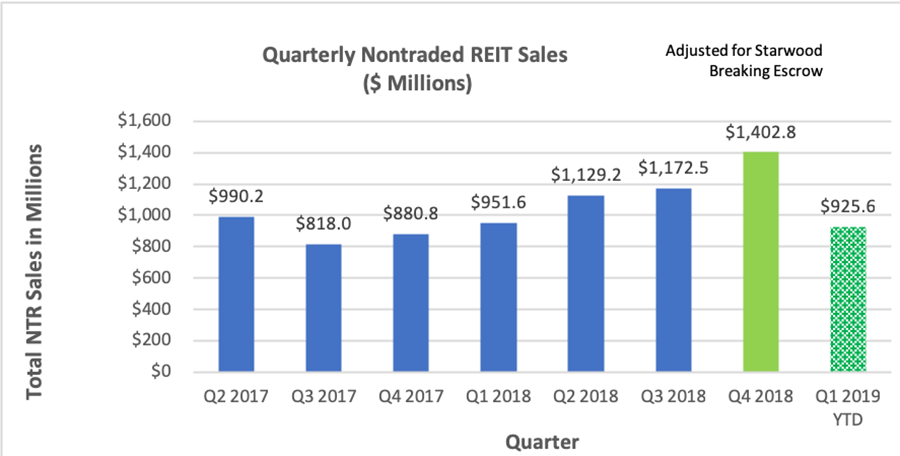

A significant addition to nontraded REIT sales in Q4 2018 that was reported as of December 21, 2018 is the breaking of escrow by Starwood Real Estate Income Trust, Inc. The REIT satisfied the minimum offering requirement of subscriptions aggregating at least $150 million on that date, and the escrow agent released gross proceeds of approximately $165 million to the company. As of January 31, 2019, the REIT had issued and sold 8.2 million shares of its Class S, T, D and I shares for estimated total gross proceeds in excess of $168 million. The $165 million raised as of December 21, 2018, when added to the NTR industry’s total for Q4 2018, brings the quarter’s capital raise to over $1.4 billion, up over 19% from Q3 2018. (Third-party reports estimate Starwood’s NTR sales in January and February totaled $85.6 million.)

Among the reporting sponsors of nontraded REIT offerings in February, Blackstone was first in capital raised with $319.1 million, for 60% of the total NTR sales. Griffin Capital was next with $54.3 million in two programs and a 10.2% share. Black Creek Group, with two open programs, raised $40.6 million with a 7.7% share. Jones Lang LaSalle was next with $33.1 million, followed by SmartStop’s two programs with $16.9 million.

Among those REITs with significant increases in capital raised between January and February, the largest percentage increase was achieved by Jones Lang LaSalle Income Property Trust which raised $33.1 million in February after raising $14.7 million in January, a 125% increase. SmartStop’s Strategic Storage Trust IV raised $16.6 million in February, up 118% from the January $7.6 million.

Year-over-year, February 2019 NTR sales were up 49.7% from February 2018. The Q4 2018 total was $1,237.8 million, up 5.6% from the Q3 2018 total of $1,172.5 million, and up 40.5% from the $880.8 million for Q4 2017. Due to the lack of capital raise reports from five effective NTRs, most notably Starwood REIT, it is possible that the industry total is actually significantly greater than $530 million for February. The breaking of escrow by Starwood REIT in December 2018 would alone increase Q4 2018 capital raise by $165 million, and monthly totals accordingly. The first two months of 2019 had total sales of $925.6 million, compared to $625.4 million for the same period in 2018, a 32.4% increase.

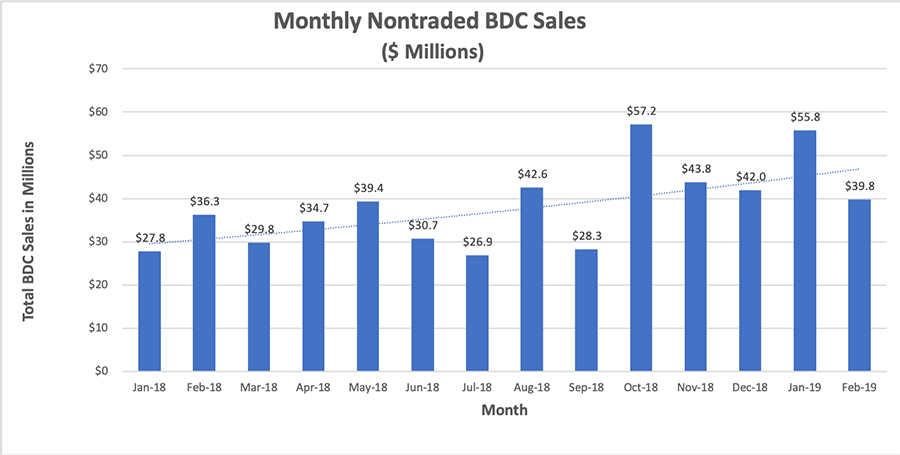

Nontraded BDC Sales Fell 29% in February

Nontraded BDC sales fell 29% from $55.8 million in January to $39.8 million in February, a decrease of 29%, with only two nontraded BDC programs raising funds in February compared to six in April 2018 and seven in February 2018. Owl Rock Capital Advisors again led nontraded BDC sponsors with sales of $37.95 million by its Owl Rock Capital Corporation II program, 95% of all nontraded BDC sales in February, down 29% from its $55.76 million sales in January. MacKenzie Realty Capital was the only other program with $1.84 million in sales for a 4.6% share in February, down significantly from its January sales of $2.58 million.

1The following NTRs would not provide sales data to Blue Vault: FS Credit Real Estate Income Trust and Phillips Edison Grocery Center REIT III. The following NTRs did not provide sales data to Blue Vault: Nuveen Global Cities REIT, Starwood REIT, Oaktree REIT.