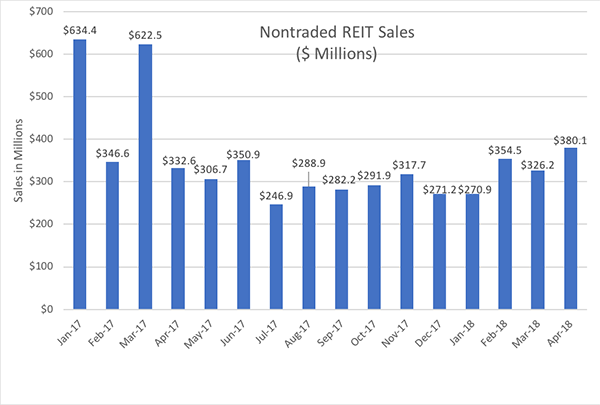

First Quarter 2018 NTR Sales and April Sales Trends

June 5, 2018 | James Sprow | Blue Vault

Looking back at Q1 2018 shows that nontraded REIT capital raise increased over 8% compared to the Q4 2017 total. Twenty-one nontraded REIT programs reported sales in Q1 2018 of $951.6 million after Q4 2017 sales by twenty-one nontraded REIT programs of $880.8 million.

April 2018 NTR capital raise continued the upward trend as 21 programs raised $380.1 million compared to the March total of $326.2, an increase of 16.5%.

After Blackstone REIT’s Q1 2018 capital raise (including DRIP proceeds) of $632.8 million (of which almost all was raised via wirehouse BDs), the capital raise leaders in the NTR space were Griffin-American Healthcare REIT IV, Inc. with $56.4 million, Carter Validus Mission Critical REIT II, Inc. with $34.1 million and Cole Real Estate Income Strategy (Daily NAV), Inc. with $32.7 million.

The sponsor with the largest increase in capital raise from Q4 2017 to Q1 2018 was Black Creek Group, with capital raise increasing from a total of $31.8 million to $61.6 million. SmartStop Asset Management, LLC increased total nontraded REIT sales by 21% from $14.7 million to $17.7 million.

Although ranking second among all nontraded REIT sponsors in capital raise in both Q4 2017 and Q1 2018, Griffin Capital Company’s NTR capital raise decreased slightly from $65.5 million in Q4 2017 to $62.3 million in Q1 2018, a 5% drop.

A new entrant to the nontraded REIT space, Cantor Fitzgerald raised $11.5 million in Q1 2018 compared to $12.9 million in Q4 2017.

Several smaller REIT sponsors had significant increases in capital raise, albeit from small Q4 2017 totals. Moody National Companies increased capital raise from $4.4 million in Q4 2017 to $6.9 million in Q1 2018. Hi-REIT (formerly Hartman Income REIT Management, Inc.) raised $3.8 million in Q1 2018 compared to $2.9 million in Q4 2017.

April 2018 capital raise by nontraded REITs was up 17% over March 2018, at $380.1 million compared to $326.2 million. Blackstone increased capital raise 11% in April compared to March. Cantor Fitzgerald increased capital raise from $3.7 million in March to $7.8 million in April. Griffin Capital increased capital raise 17% from $19.9 million to $23.3 million month-to-month. Black Creek Group increased capital raise by 21% from $21.3 million to $25.7 million. Jones Lang Lasalle had sales increase 166% from $5.9 million in March to $15.8 million in April. Among smaller nontraded REIT sponsors, Moody increased capital raise in April by 72% over March and RREEF America increased capital raise 55% month-to-month.