Hotel Sector Bounces Back

April 22, 2022 | James Sprow | Blue Vault

There is good news in the hotel asset class. According to STR, overall, US hotel occupancy advanced to 66.4% in the week ending April 9, up 2.3 percentage points from the prior week and 3.3 percentage points off the level attained in the corresponding week of 2019. For the industry, the week’s occupancy was the ninth highest since the beginning of the pandemic, but for the luxury (72.2%) and upper upscale (69.6%) chain categories, it was the highest. Both average daily rate (ADR) and revenue per available room (RevPAR) remained well ahead of the levels seen in the comparable week in 2019. Weekday (Monday -Wednesday) occupancy increased the most during the week, up 2.7 percentage points to 64.2%. Weekday occupancy has been above 60% for the past five weeks.

Investors are also noticing the uptick in hotel revenues and occupancy rates, and are buying hotels at an increased clip. More than $12.5 billion worth of hotels were sold in the first three months of 2022, according to CoStar Group, the highest first-quarter figure since 2016. The prices of hotels for sale are surging and the share of delinquent hotel mortgages recently fell to a new pandemic low.

Hotel values increased 18% in March compared with a year earlier, according to Real Capital Analytics. Property prices rose much faster than hotel profits, signaling that investors are bullish about future demand from travelers.

While hotels face rising labor costs, they are among the property types most able to adjust for inflation because they can reprice room rates every day. This is especially true for limited-service or extended-stay hotels, which have smaller staffs.

Hotels in the Sunbelt catering to vacationers are in high demand. Rising wages and savings have allowed more Americans to splurge on trips. Hotel revenues in Miami, Orlando and Nashville have risen, making investments in those cities attractive to investors.

Business travel has not yet recovered from its pre-pandemic levels. That has hurt hotels in cities like New York and Chicago. Hotel owners in New York also face competition from new construction.

Nontraded REITs with Hotels in Their Portfolios

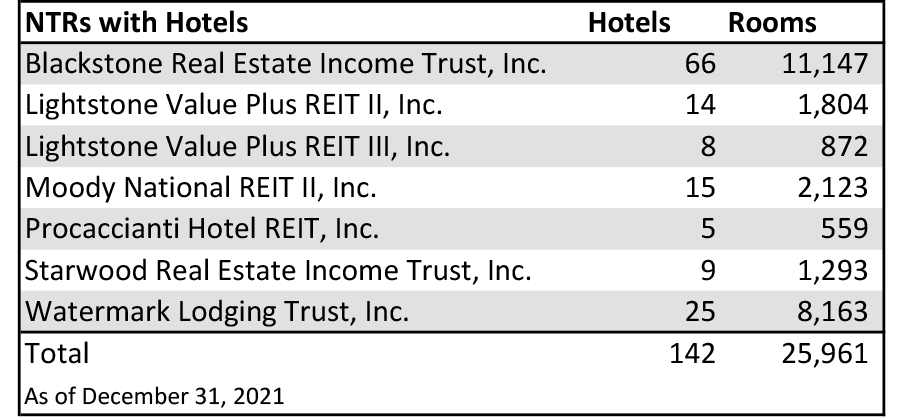

Among nontraded REITs, there are several that have portfolios that are dedicated to hotel properties, and two of the largest REITs that have hotels in their portfolios that make up a small percentage of their total properties. Blackstone REIT had 66 hotels as of December 31, 2021, but that was just 3% of their portfolio property count. Likewise, Starwood REIT owned nine hotels, just 2% of their 389 properties as of December 31, 2021.

Two nontraded REITs have interests in hotel properties currently under development (Lightstone Value Plus REIT IV and Lightstone Value Plus REIT). MacKenzie Realty Capital has a minority interest in one hotel investment.

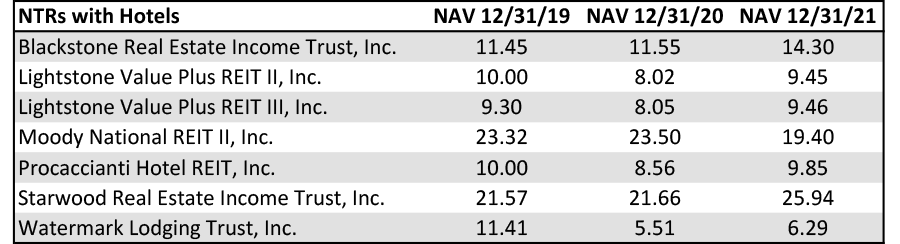

How have the net asset values (“NAVs”) of the NTRs with hotel investments performed since the onset of the pandemic? All but one of the NTRs has an increase in their NAV per share as of December 31, 2021, when compared to the previous year. But those whose investments are exclusively in hotel properties have, in all but one case, not recovered their values since December 31, 2019.

Another factor that can weigh on several REITs going forward is the deferrals of interest and principal payments by lenders. For example, Moody National REIT II states in their December 31, 2021, 10-K that “the lenders for certain of the mortgage loans secured by our properties granted us temporary deferrals of principal and interest payments.” And, “As of the date of this Annual Report, no lenders have accelerated the maturity of any of the loans secured by our properties or initiated foreclosure procedures with respect to any of our properties.”

As the values of hotel properties increase with the recovery of the hospitality sector, it appears that the nontraded REITs that have most of their assets in hotels will rely on increased occupancies and room rates to generate the cash flows necessary to meet their debt obligations. Lenders may well find it more in their interest to allow these trends to play out rather than force the REITs that have weathered the pandemic environment to liquidate assets to meet their debt repayment schedules.

Sources: WSJ, CoStar Group, Real Capital Analytics, STR, SEC, Blue Vault