Which REIT Sector is Most Undervalued?

July 18, 2017 | By Brad Case | Reit.com

I’ve noted in other recent market commentaries that exchange-traded REITs seem to be undervalued, in the sense that multiple valuation metrics that have historically been reliable predictors of future total returns are in distinctly bullish ranges. For example, if the historical relationship between the average equity REIT dividend yield spread to 10-year Treasury securities and future Equity REIT total returns continues to hold, then the spread at the end of June (+1.66%) suggests that Equity REIT total returns may average something like 14% per year over the next four years and outperform the broad stock market by something like 5 percentage points per year over the next three years; the same analysis applied to Mortgage REITs suggests that they may provide total returns averaging something like 10% per year over the next two years. (I report results for the forward-looking period over which each valuation metric has historically shown the most predictive power.) The empirical approach suggests similar conclusions when we apply it to measures of yields on other income-producing assets such as high-yield corporate bonds and high-quality corporate bonds, and also when we use estimates of the spread between REIT stock prices and net asset values (P-NAV).

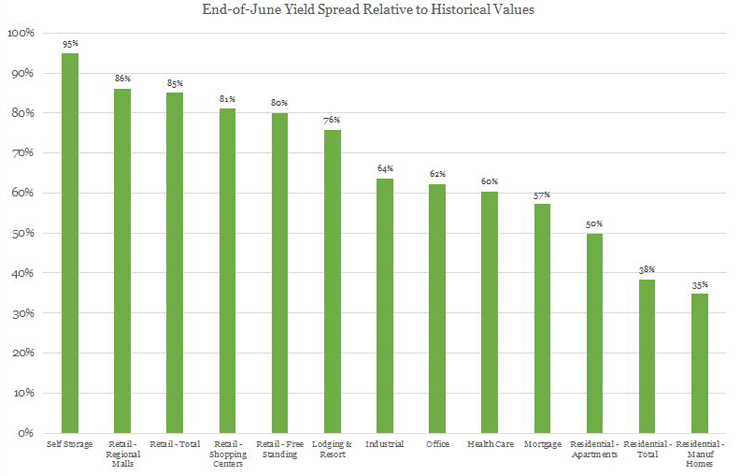

It’s possible to use a similar analysis to get some idea of relative sector valuation, too: specifically, which segments of the REIT industry seem to be even more undervalued than others. It’s important not to demand too much from this sort of exercise: it’s no substitute for looking carefully at operating fundamentals (occupancy rates, rent growth, construction activity, etc.) in each segment, nor does it substitute for forming a judgment about the management skills of each REIT’s executive leadership. Think of this as a rough cut, a first step to understanding the individual companies and making informed investment decisions.

At the end of June the average dividend yield of self-storage REITs was 4.05%. Historically speaking, that is basically normal for self-storage REITs: in fact, the median month-end value since the beginning of 1994 has been 4.03%. By itself, though, dividend yield does not have very much predictive power: what has done a pretty good job historically of predicting future total returns (with an R-squared of 60%) is the dividend yield spread to 10-year Treasuries. With the Treasury yield at just 2.19%, the yield spread for self-storage REITs at the end of June was 1.86%—which is extraordinarily large by historical standards. In fact, for self-storage REITs the yield spread to Treasuries has exceeded 1.86% during only 5% of months (just 14 of them, to be exact) since the end of 1994…

![]()

See our recent blog posts on REIT Sectors.

What’s in Store for Self-Storage?