Store Closings Have Industrial-Sized Silver Lining

Retail downsizing and bankruptcy filings have led to the highest number of store closures in the U.S. so far this year since 2010 — and that was before Macy’s said it would shutter 12 percent of its base last week.

While that’s bad news for the impacted workers and local economies in the closing locations, it’s a necessary step for retailers as they refashion themselves to cater to an accelerating consumer shift toward online shopping.

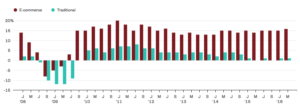

Online and Upward

Year-over-year growth in U.S. e-commerce is outstripping sales at brick-and-mortar retail stores

Other players are also poised to benefit.

For one, there are industrial real estate investment trusts — the companies that own the warehouses and distribution centers retailers need to facilitate all those web sales. Retail chains may be closing stores because they no longer need as much selling space to accommodate shrinking shopper traffic, but they require more space to house all the doodads they sell online.