Which Nontraded REITs May Be Most Vulnerable to Rising Interest Rates? (Part 2 of 2)

August 2, 2018 | James Sprow | Blue Vault

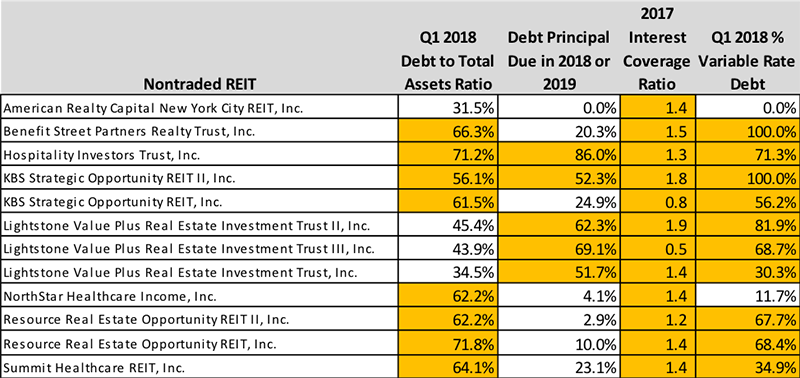

In a recent article (Part 1), we looked at those nontraded REITs that could be vulnerable to rising interest rates. We used the criteria of debt to total assets ratio, debt principal due in 2018 or 2019, their 2017 interest coverage ratio, and the percent of the REIT’s debt that was at unhedged variable rates.

Recognizing that newer REIT programs with open offerings typically use more short-term, variable rate debt and then refinance with longer-term, fixed rate debt as their portfolios are stabilized, we will eliminate those REITs that belong in Blue Vault’s Emerging, Growth or Stabilizing LifeStages. For those REITs that are in the Maturing LifeStage, meaning they have closed their offerings and have relatively stable investment portfolios, we can screen on their 2017 interest coverage ratios to find those with ratios less than 2.0X. Next, we identify those with a debt ratio greater than 50%, more than 40% of their debt principal due in 2018 or 2019, and over 20% of their debt at unhedged variable rates. The result of this screening is shown below. The highlighted cells show the REITs with metrics that meet our screening criteria. While the criteria are somewhat subjective, they are helpful in identifying potential vulnerability to rising interest rates that could be challenging for REITs that need to refinance their existing debt.

Only two REITs meet all four criteria: Hospitality Investors Trust, Inc., and KBS Strategic Opportunity REIT II, Inc. Several others with very high proportions of variable rate debt that must be refinanced within two years are: Lightstone Value Plus Real Estate REITs II and III. Some nontraded REITs that invest in CRE-related debt have the ability to hedge their variable rate borrowings by investing in variable rate mortgages or other loans. The effects of rising interest rates for the borrowings of those REITs are offset on the asset side of the balance sheet by rising rates on their investments.

There may be sound reasons for a particular REIT to utilize more debt, due to the type of investments it makes (multifamily REITs, for example, typically utilize more leverage than other REITs), and variable rate debt has been less expensive in the recent historically low interest rate environment. However, as rates rise, the effects on some REITs will be more challenging than for others.