Johnathan Rickman | Blue Vault

After reporting two consecutive quarters of promising growth, the nontraded REIT industry saw fundraising slow in the second quarter of 2025, with redemptions exceeding its inflows. The industry also continued to shed assets amid rising interest in private credit and continuing challenges in real estate markets.

Meanwhile, the median distribution rate for all nontraded REITS in the second quarter of the year was a competitive 5%1. That metric compares to a very strong average distribution yield of 8.95% for nontraded business development companies (BDCs) in Q2 20252.

Yet, REIT sponsors continue to draw on other income sources to cover their payouts to shareholders. That wasn’t true for every sponsor and some offerings performed considerably well in the second quarter. Let’s take a closer look at the data for perspective.

Capital Raise

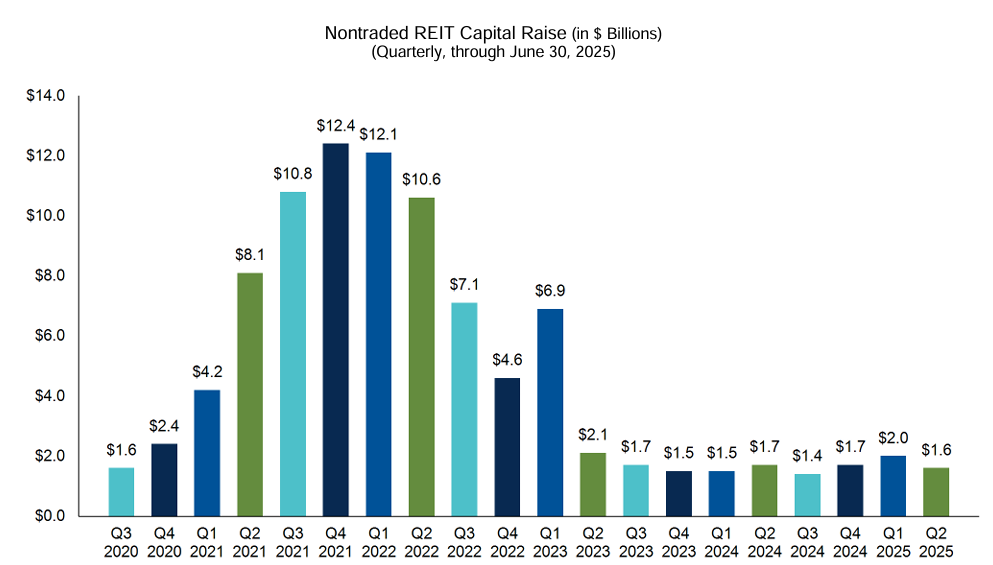

The industry raised approximately $1.63 billion in the second quarter of 2025, down from the $2.1 billion raised in Q1 2025 and from the $1.7 billion raised in Q2 2024.

Blackstone Real Estate Income Trust has dominated the sector since it was introduced in 2016. Blackstone led the sector with $871.6 million in capital raise in Q2 2025 for a 53.6% market share, having raised an estimated total of $82.5 billion since inception.

Other top capital raisers, since inception and as of June 30, 2025, include runner-up Hines Global Income Trust ($136.2 million), FS Credit REIT ($123.6 million), J.P. Morgan REIT ($112.1 million), and Apollo Realty Income Solutions ($107.6 million).

With overall industry fundraising struggling to get going again, redemption levels have simultaneously begun to exceed inflows, with the second quarter of 2025 no exception:

|

Reporting Period |

Capital Raise ($M) |

Redemptions ($M) |

|

Q3 2024 |

$1,377.6 |

$2,294.3 |

|

Q4 2024 |

$1,703.5 |

$1,849.7 |

|

Q1 2025 |

$1,981.3 |

$2,730.3 |

|

Q2 2025 |

$1,625.8 |

$2,015.5 |

Asset Levels

As of June 30, 2025, the nontraded REIT industry had $178.0 billion in assets under management, down from $184.3 billion in the previous quarter. Unsurprisingly, Blackstone REIT also leads the sector in this metric, managing $109.0 billion as of June 30, 2025, making up 61.2% of the industry’s total of $178.0 billion.

Starwood REIT came in second again, reporting total assets of $19.4 billion for 10.9% of the industry total. FS Credit REIT was the third-largest REIT with assets totaling $10.8 billion.

Meanwhile, nontraded BDCs are surpassing REITs in the amount of assets they manage:

|

Reporting Period |

Nontraded REIT AUM ($B) |

Nontraded BDC AUM ($B) |

|

Q4 2024 |

$188.4 |

$178.4 |

|

Q1 2025 |

$184.4 |

$193.9 |

|

Q2 2025 |

$178.0 |

$212.2 |

Distributions

One bright spot for the industry has been median distribution yields (Class A or Class T), which have held steady in the 5% range for the last 3 quarters:

|

Reporting Period |

Median Distribution Yield |

|

Q4 2024 |

4.94% |

|

Q1 2025 |

5.06% |

|

Q2 2025 |

5.00% |

However, maintaining these yields has come at a cost, namely leverage. Median payout ratios for funds from operations (FFO), an accrual measure of profitability, rose slightly for open REITs in the second quarter, to 127% from 123% in Q1 2025. Still, these results are an improvement over Q3 and Q4 2024 results, which hovered around 150% or more for both open and closed offerings. When this metric rises above 100%, it typically indicates the REIT’s income isn’t enough to cover distributions.

Only four public nontraded REIT offerings fully covered their distributions in Q2 2025: Cohen & Steers Income Opportunities REIT (60%), Apollo Realty Income Solutions (85%), J.P. Morgan Real Estate Income Trust (87%), and EQT Exeter Real Estate Income Trust (88%). Those four REITs also happen to be the newest REITs that Blue Vault tracks.

ExchangeRight Essential Income REIT, a privately offered REIT, fully covered its 6.4% distribution rate from cash flow.

The median debt ratio for all open nontraded REITs is 41%, down from 47% in the previous quarter and down from 48% in both the last two quarters of 2024.

Industry Outlook

REITs continue to buy and sell assets despite ongoing market challenges, providing opportunities for committed, long-term investors. According to NAREIT, the U.S.-based trade group for REITs and publicly traded real estate companies, U.S. public REITs owned some 570,000 properties and 14.6 million acres of U.S. timberland at the end of 20243.

With industry performance in flux, some see this moment as an opportune time for a reset.

“We see multiple markers to suggest it’s a good entry point for private real estate,” said Chase Bolding, President and Lead Portfolio Manager, Invesco Real Estate Income Trust (INREIT). “That doesn’t mean an immediate sharp upward movement but rather a return to normalcy whereby income and income growth is driving total return,” he added. “We’re starting to see both institutional and individual investors agree with fresh commitments.”

The big question is when, or even if, capital raise will return to their historical norms. When asked about this, Blue Vault CEO Stacy Chitty said that in his mind it’s not a matter of if. “There’s no doubt that capital raise will rise again. Real estate is a formidable asset class, and nontraded REITs deliver substantial investor value. But when? Nobody knows, but I don’t think we’re too far away. It will at least begin the process of normalizing in early 2026.”

Learn about Blue Vault membership and how our performance data can help build your advisory practice. Are you an asset manager, broker-dealer, or other entity? Contact us today to see how we can help you.

References

1 Blue Vault Nontraded REIT Industry Review: Second Quarter 2025

2 Blue Vault BDC Industry Review: Second Quarter 2025

3 REITs Own 570,000 Properties in the U.S. | Nareit, 08/27/2025