James Sprow | Blue Vault |

As we’ve mentioned in other articles recently, nontraded REIT managers are contemplating or have already taken action to delay or discontinue distributions. Some asset types are being hit much more severely than others. The hospitality sector in particular has had severe reductions in revenues.

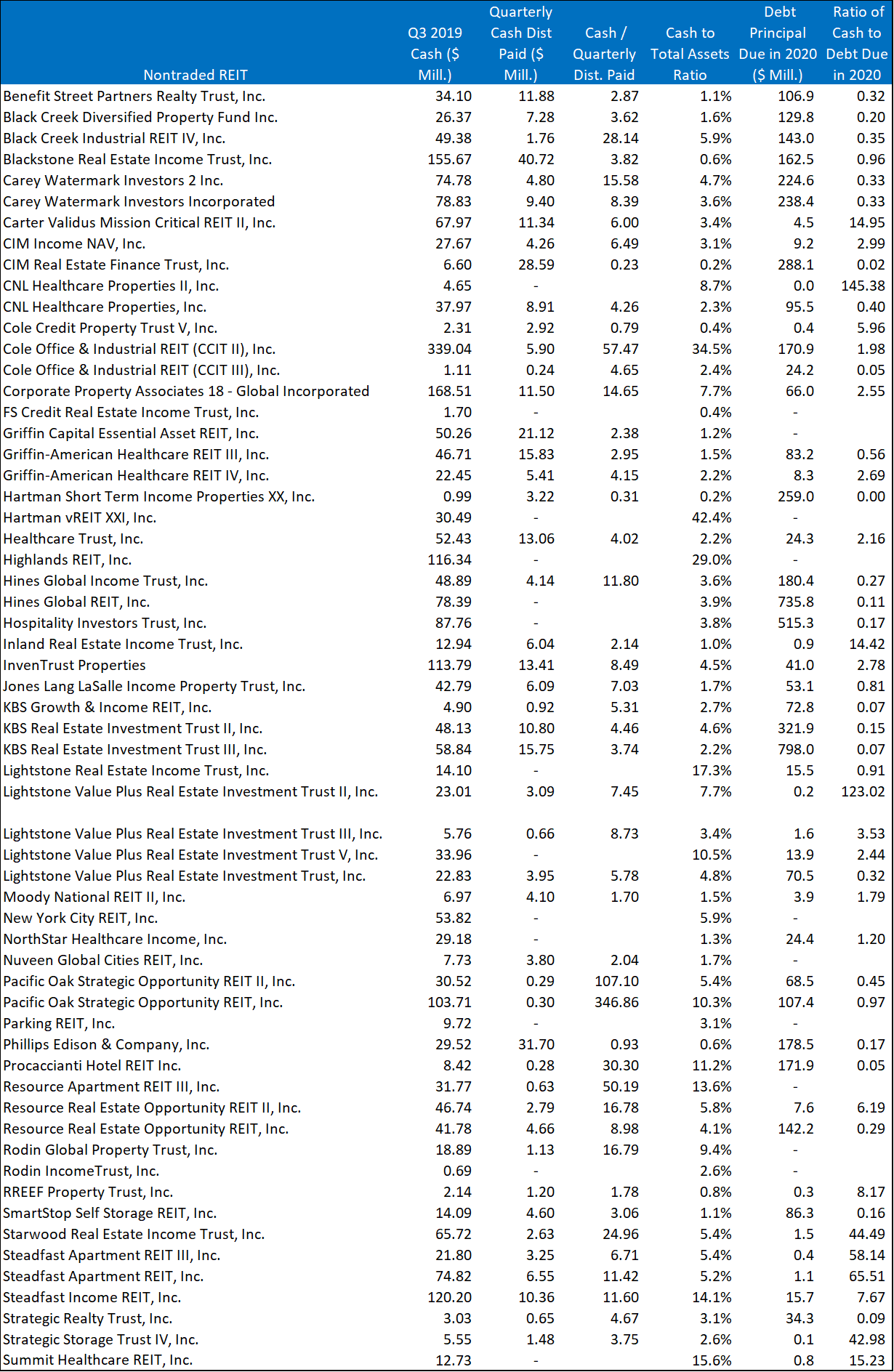

Three financial measures of relative liquidity and the short-term ability of a nontraded REIT to meet its cash flow needs are:

• Cash as a percentage of total assets

• The ratio of cash on hand to cash distributions

• The ratio of cash on hand to near-term debt principal due

Many factors will determine the ability of a nontraded REIT to remain solvent and meet financial obligations without resorting to suspending or reducing distributions and share redemptions. For REITs that are currently raising capital through public offerings, the rate of capital raise and the decisions to invest new funds in real estate assets will certainly affect their financial liquidity. Blue Vault’s monthly reports on nontraded REIT capital raise will reveal how the pandemic has affected sales of REIT shares and how lower sales figures might impact REIT behavior in terms of new acquisitions and distributions.

As not all nontraded REITs have filed their 10-Ks for 2019, we look at Q3 2019 data to see where nontraded REITs stood with regard to the three measures of liquidity. All figures in the following table are as of September 30, 2019.

There are many reasons why a particular REIT may have relatively low or high cash balances at the end of any particular quarter. REITs that are raising capital and have yet to deploy that capital into new investments may have high cash balance relative to distributions being paid. REITs that are utilizing revolving lines of credit with relatively shorter maturities (Blue Vault assumes no extensions of revolving line maturities in our reporting of principal due) may have a low ratio of cash on hand relative to near-term principal payments due. REITs in the liquidation stage may have relatively high cash to assets ratios as liquidating distributions have yet to be paid out as special distributions to shareholders.

Another important consideration is how REITs provide liquidity through the use of marketable security investments. For example, Blackstone REIT, with over $26 billion in total assets, held only $155.7 million in cash as of September 30, 2019. However, the REIT had over $3.8 billion in securities, many of which could be readily converted into cash to meet the REIT’s liquidity requirements.

Of course, nontraded REITs that are not making cash distributions to their shareholders will tend to have more cash on hand to meet upcoming principal due, other things equal. Those REITs that have continuous perpetual offerings with more generous share redemption programs may maintain higher levels of cash relative to assets to meet their redemption requests each quarter. CFOs at nontraded REITs will manage their cash balances to meet the upcoming liquidity needs while investing cash in earning assets, and will do so over the longer run, which means quarter-ending balances may not be representative of longer-run considerations.

Source: Blue Vault