James Sprow | Blue Vault |

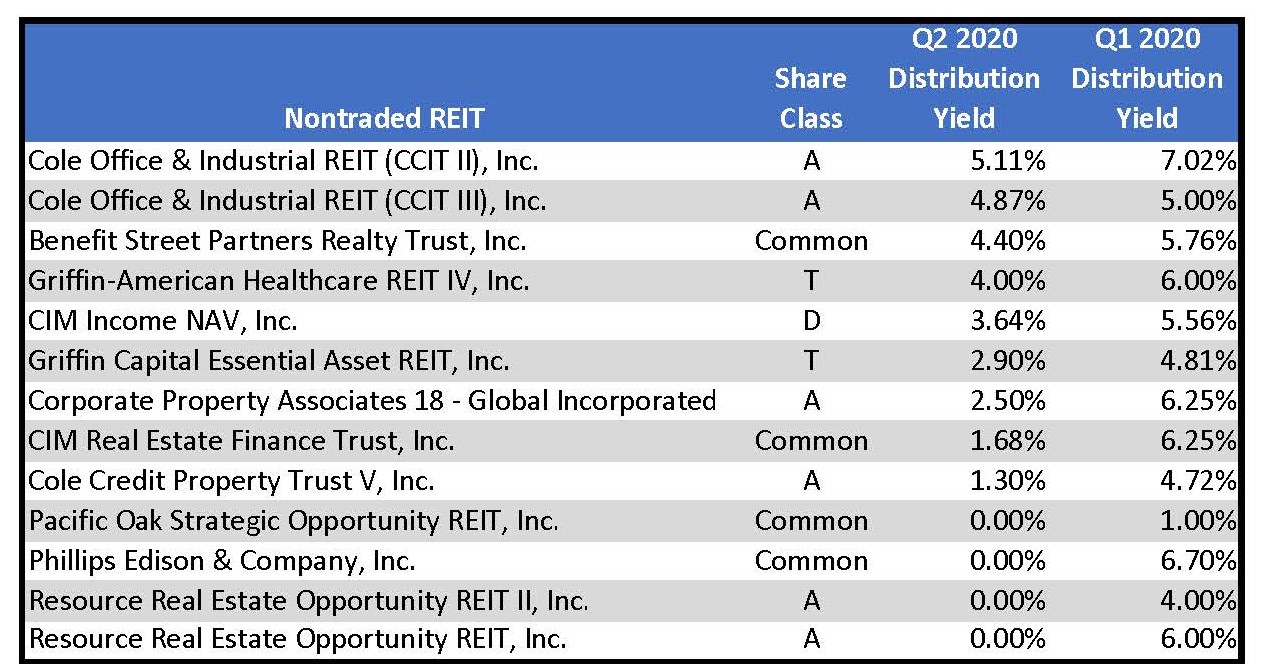

Between the first quarter of 2020 and the second quarter, there were 13 nontraded REITs that have lowered or eliminated their distributions and 15 nontraded REITs that have lowered their net asset values per share. The following table lists the nontraded REITs that lowered or eliminated their quarterly distributions rates:

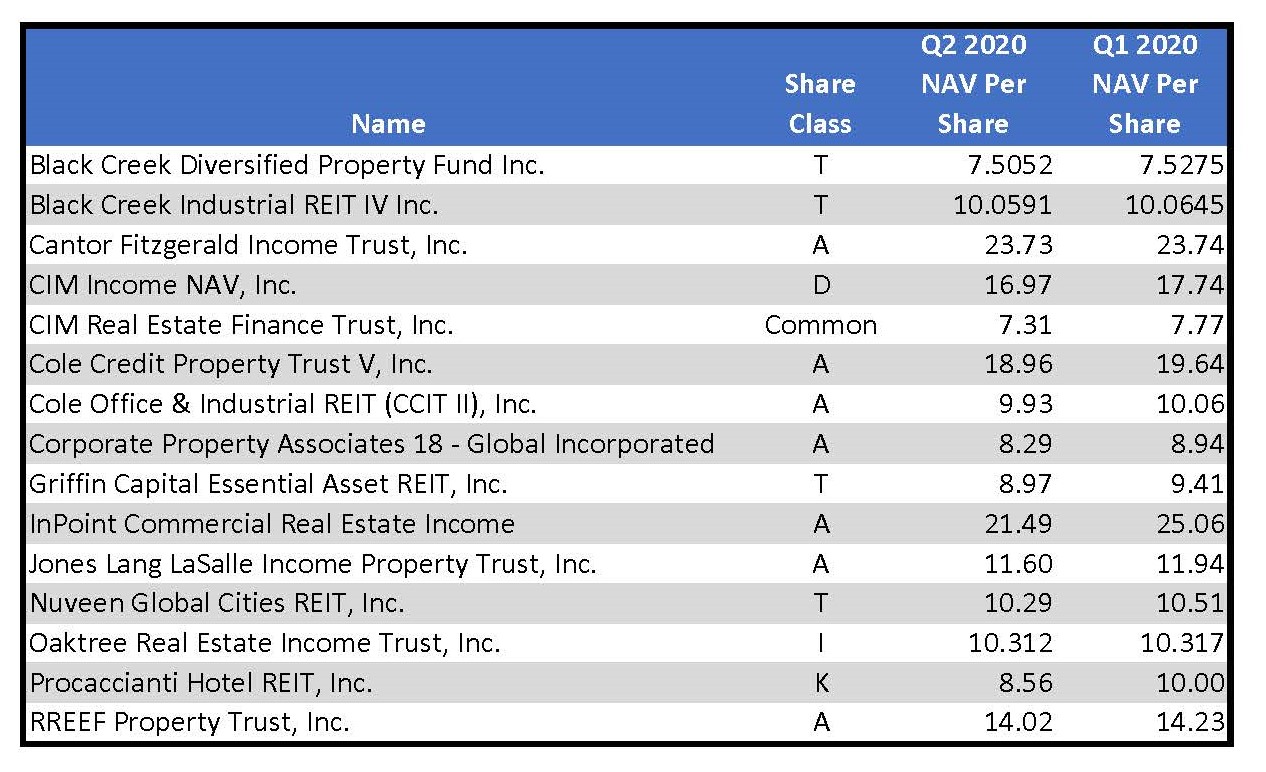

There were 15 nontraded REITs that had lower NAV’s per share in Q2 2020 than in Q1 2020. The following table lists those REITs:

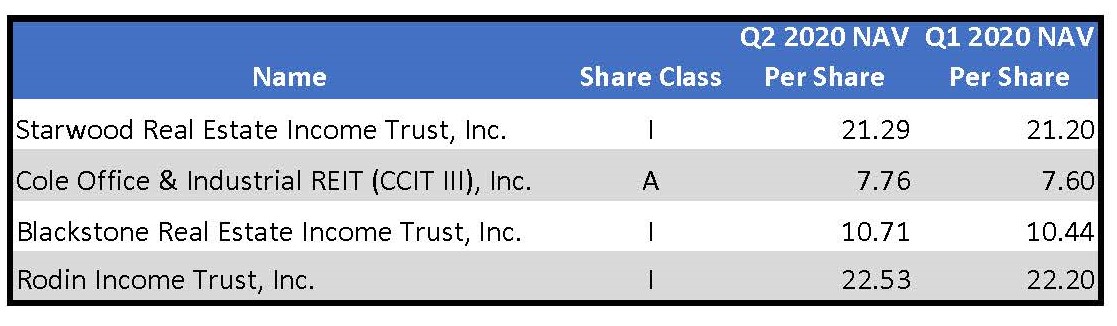

There were four nontraded REITs that had higher NAVs per share in Q2 2020 than in Q1 2020:

Source: Blue Vault