Key Takeaways:

•Individual wealth is growing and both mass affluent and high-net-worth investors are increasingly interested in alternative strategies and private markets.

•Three investor segments showing signs of significant growth include women, engaged first-time investors, and mass affluent investors.

•Private credit has evolved and grown exponentially over the past decade.

•New registered alternative investment vehicles are giving individual investors what they want: more liquidity and transparency.

•Market uncertainty and radical macroeconomic shifts reinforce the role of alternatives within a diversified portfolio.

1.Growth in Wealth Creates Demand for Sophisticated Advice and Products

High-net-worth and ultra-high-net-worth investors have long been active investors across the alternatives landscape. Alternative investments is a top priority for 49% of North American family offices, while 34% are planning to increase allocations to private credit.1

However, as wealth across segments of individual investors increases, demand for alternatives is also growing more broadly. Mass affluent wealth is expected to grow 40% between 2020 and 2025, according to EY’s report on understanding the future of advice. Forecasts are for this growth to represent the biggest disruption to wealth management in decades as the gap between retail and high-net-worth is filled by an emerging mass affluent segment, many of whom are interested in more sophisticated advice and products, including alternatives. At the same time, a massive transfer of wealth is under way as baby boomer men die and assets transfer to mostly female spouses, who are often younger and have longer lifespans.

By 2030, an estimated $30 trillion in investable assets—a figure close to the annual GDP of the United States—is expected to transfer from baby boomers, according to McKinsey & Company’s review of theU.S. wealth management segment. A sizable proportion of this wealth could end up in private markets as the top choice for new products sought by wealthy individuals.

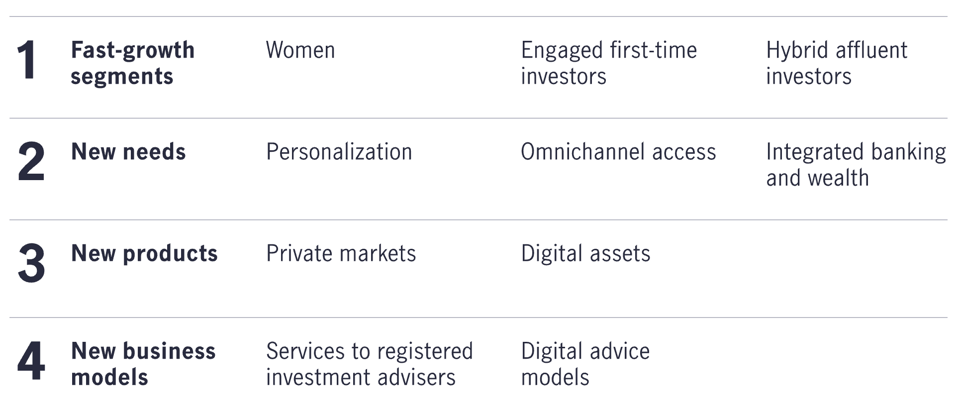

Expected Growth Areas in Wealth Management Over the Next Decade