Prospect Capital Corporation (NASDAQ: PSEC) (“Prospect”, “our”, or “we”) today announced financial results for our fiscal quarter ended September 30, 2023.

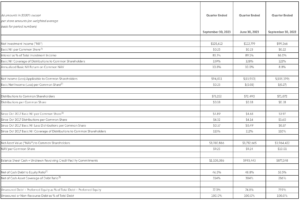

FINANCIAL RESULTS

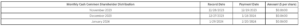

CASH COMMON SHAREHOLDER DISTRIBUTION DECLARATION

Prospect is declaring distributions to common shareholders as follows:

These monthly cash distributions are the 75th, 76th, and 77th consecutive $0.06 per share distributions to common shareholders. Prospect’s objective is to maintain or increase such distributions per common share over time.

Prospect expects to declare February 2024, March 2024, and April 2024 distributions to common shareholders in February 2024.

Based on the declarations above, Prospect’s closing stock price of $5.35 at November 7, 2023 delivers to our common shareholders an annualized distribution yield of 13.5% and an annualized basic NII yield of 18.7%, representing 139% basic NII coverage of common distributions.

Taking into account past distributions and our current share count for declared distributions, since inception through our January 2024 declared distribution, Prospect will have distributed $20.58 per share to original common shareholders, representing 2.2 times September 2023 common NAV per share, aggregating approximately $4.10 billion in cumulative distributions to all common shareholders.

Since inception in 2004, Prospect has invested $20.4 billion across 419 investments, exiting 283 of these investments.

Since October 2017, our NII per common share has aggregated $4.89 while our common shareholder and preferred shareholder distributions per common share have aggregated $4.32, with our NII exceeding common and preferred distributions during this period by $0.57 per common share and representing 113% coverage.

Drivers focused on enhancing accretive NII per share growth include (1) our $2.05 billion targeted 6.50% perpetual preferred stock offerings, (2) greater utilization of our cost efficient revolving floating rate credit facility, (3) increase of short-term SOFR rates based on Fed tightening to boost asset yields, (4) optimization of portfolio company performance, and (5) increased primary and secondary originations of senior secured debt and selected equity investments targeting attractive risk-adjusted yields and total returns as we deploy dry powder from our underleveraged balance sheet.

Our senior management team and employees own over 27% of all common shares outstanding, over $1.0 billion of our common equity as measured at NAV.