Prospect Capital Reports First Year Capital Raise for Preferred Stock Offering

December 13, 2021 | James Sprow | Blue Vault

![]()

Preferred Capital Securities, an independent managing broker-dealer, has reported that the non-traded convertible preferred stock offering of Prospect Capital Corporation (NASDAQ: PSEC), a publicly traded business development company, has raised more than $257 million since its launch in late 2020. Preferred Capital Securities serves as the dealer manager for the offering.

Founded in 2004, Prospect Capital Corporation has approximately $6.5 billion in assets under management and provides private debt and private equity to middle-market companies in the United States. Its preferred stock offering is comprised of up to 40 million Series A1, M1, and M2 shares with a $1 billion aggregate liquidation preference.

Preferred Capital Securities focuses on back-office services and the wholesale distribution of alternative investments to independent broker-dealers and registered investment advisors across the United States and Puerto Rico.

The firm currently serves as managing broker-dealer of the preferred stock offerings for Preferred Apartment Communities (NYSE: APTS) and Prospect Capital Management (NASDAQ: PSEC), and as managing broker-dealer of the Priority Income Fund, a non-traded closed-end fund.

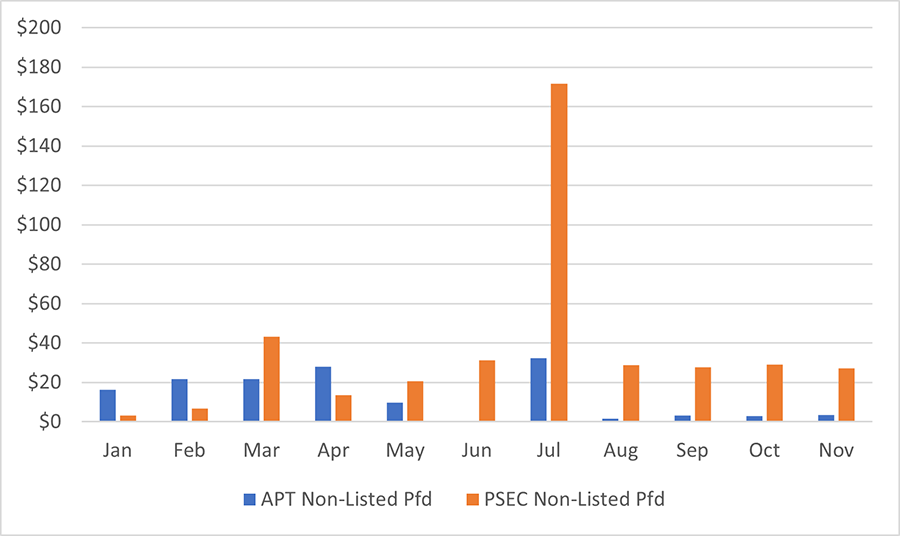

The following chart shows the monthly sales of non-listed preferred stock for both PSEC and APTS reported to Blue Vault during 2021.

Source: Blue Vault

Source: Blue Vault

Preferred Capital Securities has raised more than $2.9 billion in retail capital across eight offerings which have issued approximately $1 billion in liquidity for its investors since its inception in 2011.

Sources: Prospect Capital, Blue Vault