Sales of T Shares May be Bright Spot in Nontraded REIT Market

Share Classes Blog Series – Part Four

July 27, 2016 | By Beth Glavosek | Blue Vault

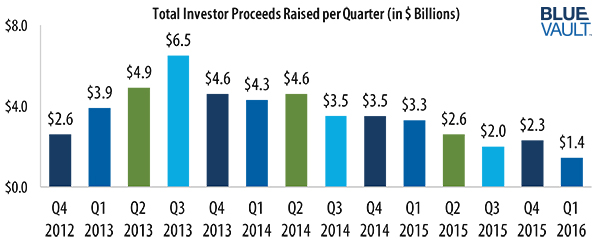

It’s no secret that nontraded REIT sales have slowly tapered off since hitting a high of $6.5 billion in the third quarter of 2013. In the first quarter of this year, $1.4 billion in investor proceeds was raised – a 39% decrease from the last quarter of 2015 in which $2.3 billion was raised.

While June’s sales at approximately $340 million were better than May’s at nearly $300 million[1], the industry will need to explore new avenues for reaching investors in today’s highly charged regulatory environment.

As we’ve discussed previously, the T share will play a significant role in how nontraded products are sold to new investors. T shares reduce the upfront load traditionally paid on nontraded REIT A shares and instead pay a trailing commission over time. One advantage to the T share commission structure is that more of the investor’s funds are available to the REIT to put “in the ground” in the form of real estate investments, and the trailing portion of commissions may be funded by the REIT’s operating cash flows.

According to Blue Vault research, this idea is gaining traction. In September 2015, for example, sales of nontraded REIT A shares were approximately $466 million, while T shares were only $26 million. In the nine months since, T shares have taken on a greater proportion of total sales. In April, A share sales were around $255 million, while T shares were $136 million. By June, A share sales had declined to $133 million, but T shares held relatively steady at $125 million.

The T share is just one example of how the industry continues to evolve and adapt to changing regulatory and investor needs.

[1] Source: Blue Vault Partners Research