Starwood Enters Nontraded REIT Space, Following Blackstone’s Lead

October 19, 2017 | James Sprow | Blue Vault

With the filing of an S-11 for Starwood Real Estate Income Trust, Inc. on October 17, Starwood Capital enters the Nontraded REIT space in a big way, offering up to $4 billion in four classes of common stock (T, S, D and I) and registering its distribution reinvestment program for up to $1 billion. Looking at the registration documents for Starwood Real Estate Income Trust and Blackstone Real Estate Income Trust, which was filed in August 2016, the similarities are striking. Both will be continuous offerings with pricing based upon the prior month’s NAV per share. The maximum offering amounts and the four common stock classes are identical, the upfront selling commissions and dealer manager fees for all four classes are identical as a percentage of the offering prices for each class, and according to the respective filings, the Investment Objectives are identical, literally word for word. In the Investment Strategy descriptions there are only slight differences:

Starwood’s NTR’s Investment Strategy:

Our investment strategy is primarily to acquire stabilized, income-oriented commercial real estate and debt secured by commercial real estate. Our real estate portfolio may include multifamily, office, hotel, industrial and retail assets, as well as other property types, including, without limitation, medical office, student housing, senior living, data centers, manufactured housing and storage properties.

Blackstone’s NTR’s Investment Strategy:

Our investments in primarily stabilized income-oriented commercial real estate in the United States will focus on a range of asset types. These may include office, hotel, industrial, multifamily and retail assets, as well as others, including, without limitation, healthcare, student housing, senior living, data centers, manufactured housing and storage properties.

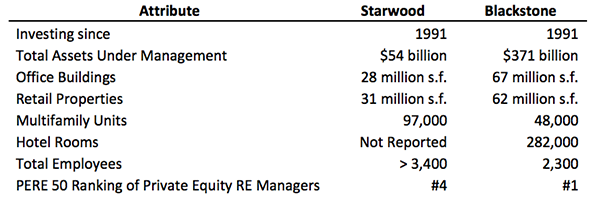

Let’s look at the two sponsors and see how they compare in some key areas:

Starwood Capital

Starwood Capital operates investment programs that invest primarily in real property and programs that invest primarily in real estate-related debt. During the ten-year period ended December 31, 2016, Starwood Capital sponsored 14 real estate programs that were in their investment or operational phases, consisting of (1) 11 private programs that, depending on the program, invest primarily in a mix of real property assets and real estate-related debt, (2) Starwood Property Trust, a NYSE-listed REIT, (3) Starwood Waypoint Homes (f/k/a Colony Starwood Homes), a NYSE-listed REIT focused on single-family homes, following its spin-off from Starwood Property Trust in 2014; and (4) Starwood European Real Estate Finance Limited, a London Stock Exchange-listed company. The Company refers to these 14 real estate programs as “the prior programs.” In the aggregate, during this period Starwood Capital raised more than $20 billion from approximately 1,000 investors from its 11 private prior programs. Additionally, during this period Starwood Property Trust and Starwood European Real Estate Finance Limited raised more than $5.8 billion and £0.4 billion from investors, respectively.

Blackstone

Blackstone has programs that invest primarily in real property and programs that invest primarily in real estate-related debt.

During the ten-year period ended December 31, 2015, Blackstone sponsored 20 real estate programs, consisting of: (1) 12 private programs that invest primarily in real property and (2) eight programs that invest primarily in real estate-related debt, consisting of six private programs, one New York Stock Exchange (“NYSE”) listed public REIT and a registered investment company master-feeder complex. Blackstone also raised capital for numerous separately managed accounts and co-investment accounts during this period. In the aggregate, during this period Blackstone raised more than $82 billion from over 700 investors from its prior private programs. Additionally, during this period Blackstone raised more than $3 billion from its two public programs.

Status of the Blackstone REIT Offering

As of September 20, 2017 the Blackstone Real Estate Income Trust offering had sold 125,506,250 shares of common stock. As of July 31, the REIT showed a combined net asset value of $1.05 billion and an average NAV per share of $10.315.

It remains to be seen if Starwood Capital can raise equity capital in its new offering at anything resembling the pace set by Blackstone. Blackstone’s NTR raised 48% of all equity raised by nontraded REITs in the month of September, almost three times the amount raised by the NTR ranking second, and more than the next four NTRs in sales, combined. If Starwood’s offering raises even one third of the equity proceeds raised by Blackstone’s REIT, it will energize an industry that needs some good news.

![]()

Learn more about Blackstone Group LP on the Blue Vault Sponsor Focus page.

Blackstone making bets on permanent investment funds

Blackstone to Buy Exhibit Space Provider

Blackstone agrees to buy Singapore-listed REIT for $650 mln