Triton Pacific Securities

Investors may often hear that “cash is king,” but holding on to too much cash and staying out of both private and public investments may have serious repercussions on an investor’s portfolio.

Cash has its place in any financial plan. It may offer valuable liquidity, which is important for emergency funds or the purchase of everyday goods.

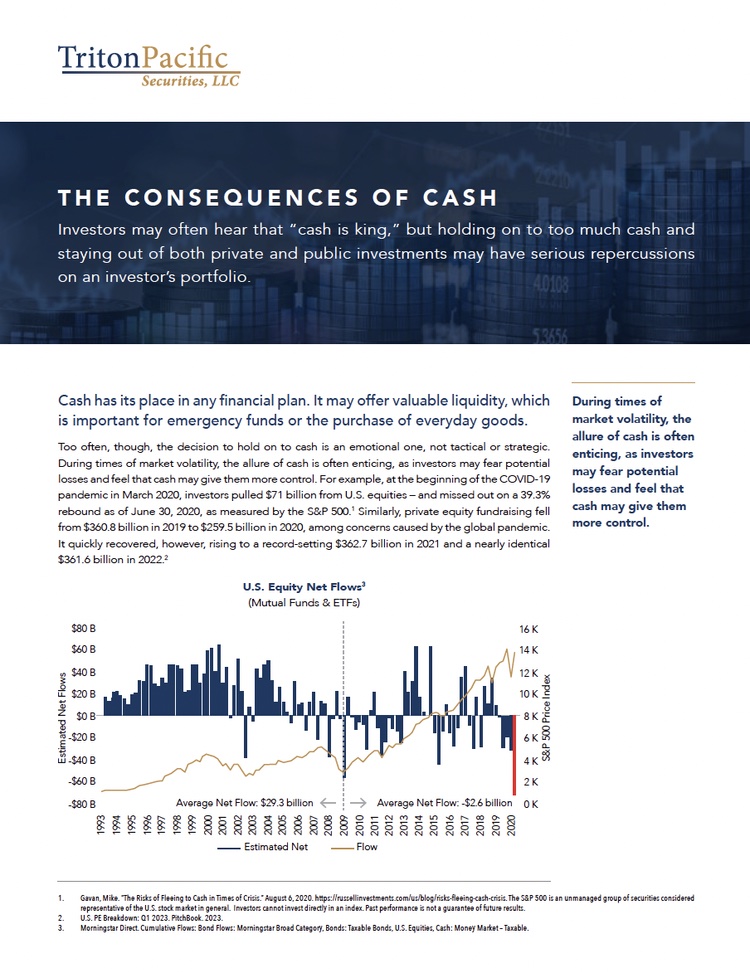

Too often, though, the decision to hold on to cash is an emotional one, not tactical or strategic. During times of market volatility, the allure of cash is often enticing, as investors may fear potential losses and feel that cash may give them more control. For example, at the beginning of the COVID-19 pandemic in March 2020, investors pulled $71 billion from U.S. equities – and missed out on a 39.3% rebound as of June 30, 2020, as measured by the S&P 500.¹ Similarly, private equity fundraising fell from $360.8 billion in 2019 to $259.5 billion in 2020, among concerns caused by the global pandemic. It quickly recovered, however, rising to a record-setting $362.7 billion in 2021 and a nearly identical $361.6 billion in 2022.²

Read the Full White Paper Below