James Sprow | Blue Vault |

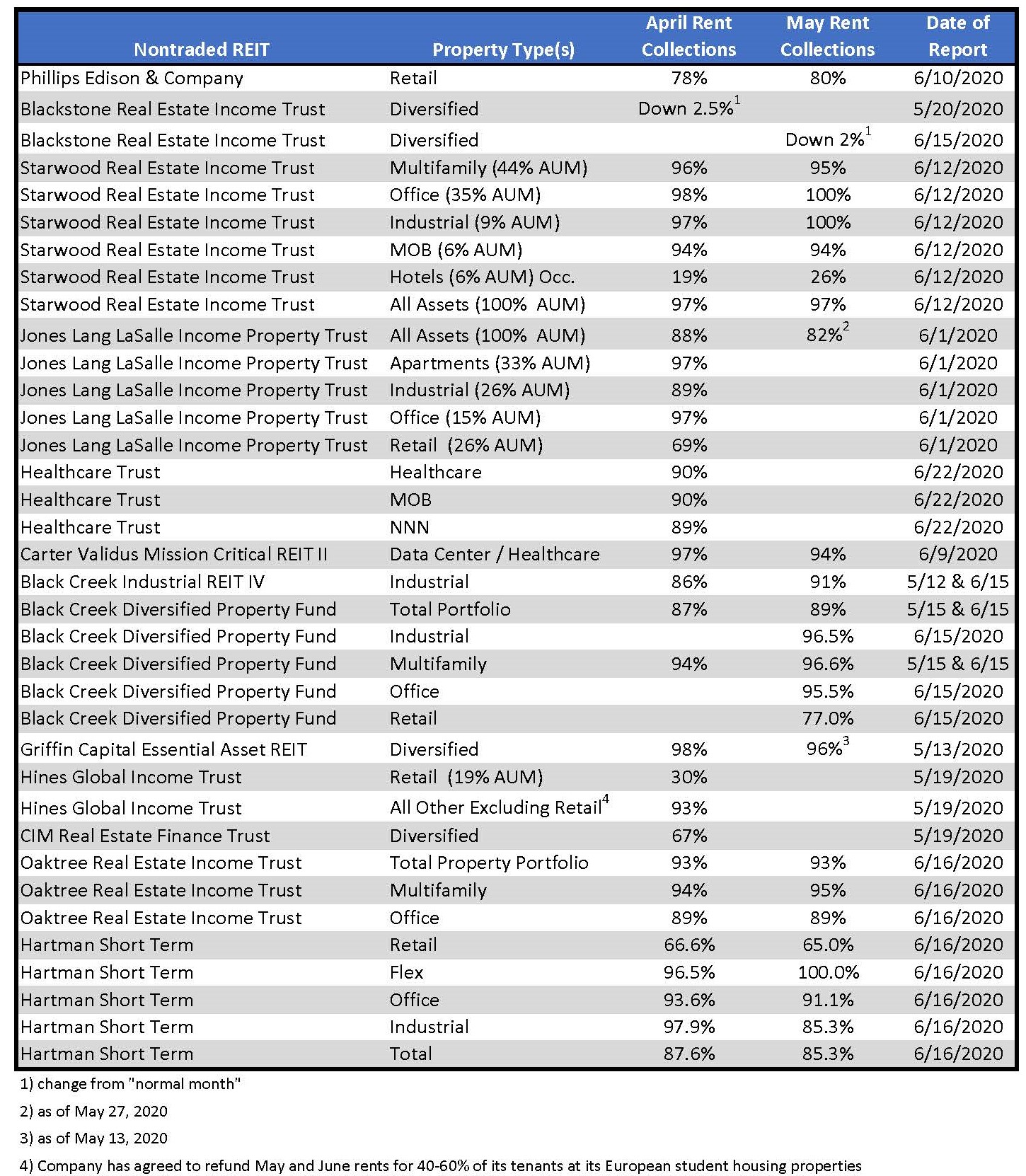

Unlike many reported financial metrics that appear regularly in the quarterly reports of nontraded REITs, the rent collections that NTRs are reporting during the COVID-19 pandemic and the related impacts on commercial real estate are not uniformly and consistently reported. Some REITs have published letters to their shareholders in which they report how the pandemic has affected their rent collections. Others have produced letters to shareholders that only warn of possible impacts upon future distribution rates and net asset values. Blue Vault has combed through SEC filings for some of the larger nontraded REITs to find reports that mention rent collections. For our purposes, we wanted to compare the rent collection rates in April 2020 and May 2020. Not all REITs that reported rent collections for April 2020 have followed up with reports for May 2020.

Unlike many reported financial metrics that appear regularly in the quarterly reports of nontraded REITs, the rent collections that NTRs are reporting during the COVID-19 pandemic and the related impacts on commercial real estate are not uniformly and consistently reported. Some REITs have published letters to their shareholders in which they report how the pandemic has affected their rent collections. Others have produced letters to shareholders that only warn of possible impacts upon future distribution rates and net asset values. Blue Vault has combed through SEC filings for some of the larger nontraded REITs to find reports that mention rent collections. For our purposes, we wanted to compare the rent collection rates in April 2020 and May 2020. Not all REITs that reported rent collections for April 2020 have followed up with reports for May 2020.

Those nontraded REITs that have multiple asset types in their portfolios may report asset types as a percentage of the total portfolio values (AUM). From these reports, we can see that different asset types have performed differently when it comes to rent collections. Generally speaking, Industrial, Multifamily and Office have had relatively better rent collections than Healthcare and Retail. And, as expected, Hospitality assets have been hit the hardest, as shown by occupancy rates.

The tables below show some rent collection and occupancy data for a selection of nontraded REITs. Phillips Edison & Company also report the percentage of the “Neighbor Spaces” that were open for business in April and May in their grocery-anchored shopping center properties. The Hospitality Investors Trust numbers show the sharp contrast between hotel occupancies in April and May 2020 and the prior year’s occupancy rates.

Source: SEC