The Interesting Case of Highlands REIT-Part II in a Series on InvenTrust Properties Corporation

February 11, 2019 | James Sprow | Blue Vault

Quick Re-Cap

Quick Re-Cap

Highlands REIT, Inc. was created in 2016 to own and manage substantially all of the “non-core” assets previously owned and managed by InvenTrust Properties Corp. InvenTrust is a nontraded REIT that was originally incorporated as Inland American Real Estate Trust, Inc. and raised over $8.3 billion in its public offerings which closed in 2009, making it the largest nontraded REIT in history in AUM. Near its peak in 2010, the REIT reported net property investment of $9.3 billion in 881 properties, excluding its lodging and development properties, located in 35 states.

In 2012, Inland American began implementing a strategy of focusing its diverse portfolio of real estate into three asset classes – retail, lodging, and student housing. The goal was to position the company to explore various strategic transactions and liquidity for its shareholders. In 2014 the REIT became self-managed and became independent of its previous sponsor, The Inland Group, Inc.

Related: The Interesting Case of Highlands REIT-Part I in a series of InvenTrust Properties Corporation

In April 2015 Inland American Real Estate Trust, Inc. changed its name to InvenTrust Properties Corp. The REIT has not announced any plans for a future liquidity event. In fact, the REIT continued to reshape its portfolio in 2018 and January 2019 by acquiring five shopping center properties and selling 12 shopping center properties.

On April 14, 2016, Highlands REIT, Inc. was spun off from InvenTrust Properties Corp. through a pro rata distribution of 100% of Highlands REIT common stock to the InvenTrust shareholders of record on April 25, 2016. Each holder of one share of InvenTrust common stock received one share of Highlands REIT common stock. The Spin-Off agreement also released InvenTrust from any liabilities as well as losses that could arise from third party claims relating to the separation.

Highlands REIT, Inc. began its life as a portfolio of those assets that InvenTrust considered “non-core” and included assets that are special-use, single-tenant or build-to-suit, face unresolved legal issues, are in undesirable locations or in weak markets or submarkets, are aging or functionally obsolete, and have suboptimal leasing metrics.

To quote the Highlands REIT 2016 10-K:

“Assets with such characteristics are relatively illiquid compared to other types of real estate assets and may require additional investments to improve our disposition options. In addition, certain of these assets are in hyper-amortization under their loan agreements (resulting in rental payments less certain expenses being used to pay down the principal amount of the loan); have rental payments, less certain expenses, being “swept” and held by the lender pursuant to the loan agreement; and are in or likely to enter foreclosure proceedings. These factors may also limit our disposition options with respect to these properties and has had, and is expected to continue to have, an adverse impact on the cash flow generated by such assets. For example, three of our assets, contributing $47.93 million (or 54.1%) in annualized base rent for the year ended December 31, 2015, prior to the Distribution, are now either in foreclosure or are likely to enter into foreclosure proceedings in 2017.”

In other words, Highlands REIT started life as a collection of, shall we say, junk.

Update on Highlands REIT

In 2018, Highlands REIT sold a total of four properties for a combined sale price of $80.4 million. On December 28, 2018, Highlands REIT, Inc. completed the sale of Bridgeside Pointe property, a 153,110 square-foot office property located in Pittsburgh, Pennsylvania, for a gross sale price of $38.5 million. The property was originally purchased by InvenTrust (Inland American) in 2005 for $30.1 million.

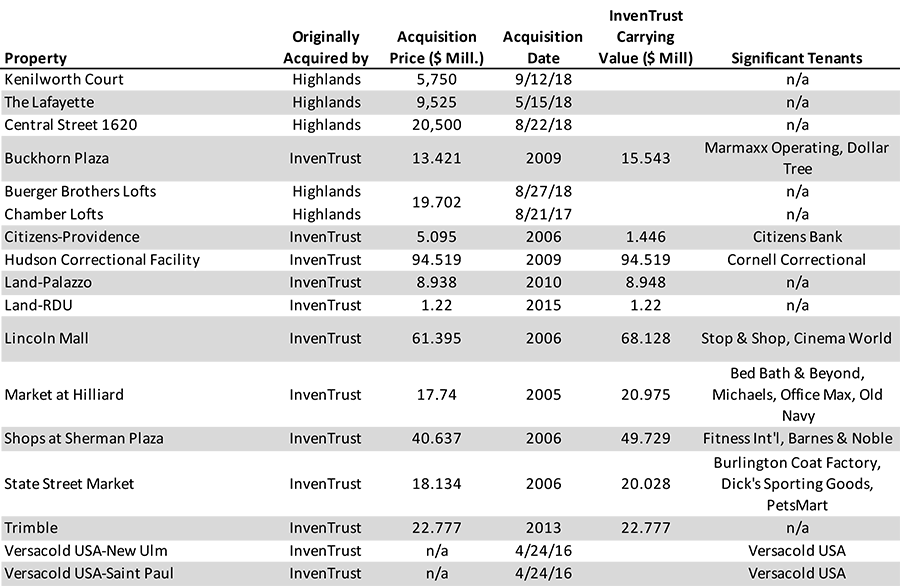

As of December 31, 2018, the Company owned 15 assets and two parcels of unimproved land. During 2018 the Company acquired three multi-tenant residential assets for a gross acquisition price of $35.8 million. Two of the multifamily properties are in Denver, and one in Evanston, Illinois, comprising together a total of 118 apartment units.

Highlands REIT Properties as of 1/31/2019

Table I

Table II

On January 4, 2017, the Board of Directors of Highlands REIT, Inc. met and approved an estimated value of common stock equal to $0.35 per share on a fully diluted basis. On January 4, 2018, the Board approved an estimated value of common stock equal to $0.33 per share on a fully diluted basis. On January 10, 2019, they approved an estimated value of common stock equal to $0.35 per share on a fully diluted basis.

Related: Highlands REIT Sells Longview, Washington Property for $38.3 Million

In May 2017 MacKenzie Capital Management made a third-party tender offer for up to 45,000,000 shares of Highlands REIT for $0.17 per share. The offer closed In June 2017 after receiving approximately 6,600,000 shares, after which MacKenzie would own approximately 9,537,000 shares or approximately 1.1% of the total outstanding shares. Again, in October 2018 MacKenzie Realty Capital made a tender offer for the REIT’s common shares at $0.15 per share. As of September 30, 2018, MacKenzie Realty Capital, Inc., a non-traded BDC, reported ownership of 14,738,698 shares of Highlands REIT, Inc., with a cost basis of $2,908,658 or $0.197 per share. This represents approximately 1.7% of the outstanding common shares as of September 30, 2018. It is possible that MacKenzie Realty Capital is acquiring some shares via third-party auction sites. (see below)

Highlands REIT has not paid distributions to its shareholders since it was spun off from InvenTrust. Its cash on hand at September 30, 2018, was $0.048 per common share.

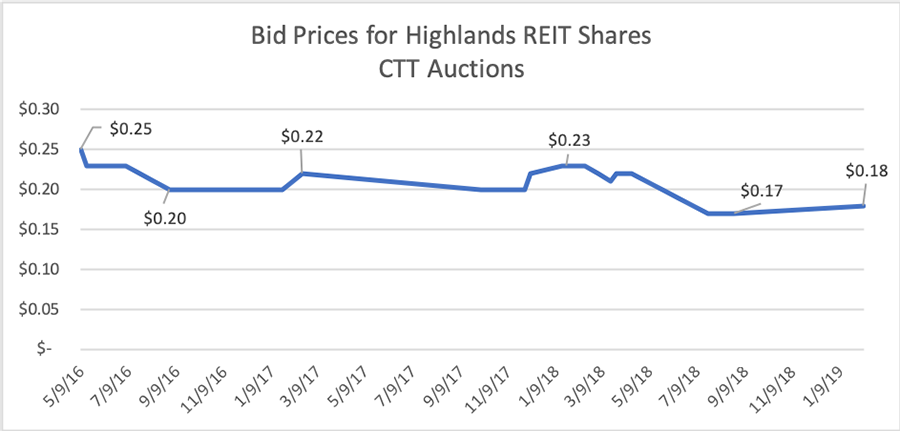

In the latest auction of three different lots of common shares in Highlands REIT, the CTT Auctions site reported bids to purchase Highlands REIT shares at $0.17 per share, down from the $0.22 per share bids reported in March 2018 and $0.25 per share in May 2016.

CTT Auction History for Highlands REIT Common Shares (May 2016 thru February 8, 2019)

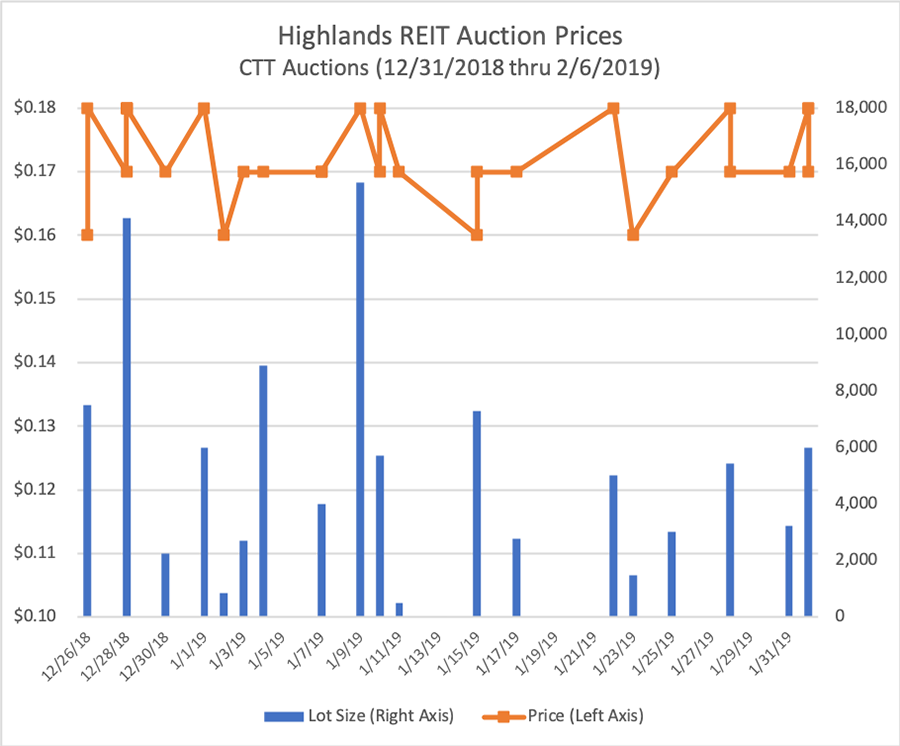

The most recent auctions on the same site show shares selling within the narrow range of $0.16 to $0.18 per share. (In six cases, closing prices differed for two lots sold on the same day.)

Recent CTT Auction History for Highlands REIT Common Shares

The Company repurchased and retired 116,334 of fully vested shares previously awarded to an employee pursuant to a separation agreement during the nine months ended September 30, 2018. The shares were repurchased for $0.33 per share, which was based on the Company’s most recently announced estimated share value.

As of September 30, 2018, the book value of stockholders’ equity was $0.312 per share, up from $0.297 per share as of December 31, 2017. For the nine months ended September 30, 2018, the Company reported net income of $0.01 per share, down from the $0.22 per share reported for the 2017 nine-month period. Operating income fell in the period by 50% and the $12.7 million net income reported was almost entirely due to $12.3 million in gains from the sale of properties. Largely due to a $194.6 million gain on extinguishment of debt, the 2017 income statement showed net income of $0.20 per share, following a $0.07 per share loss in 2016 and $0.02 profit in 2015. Of course, GAAP-based income numbers don’t necessarily reflect market values. Looking at the REIT’s September 30, 2018, Statement of Cash Flows, the REIT had $12.0 million in net cash outflow in the nine months ended September 30, 2018, compared to a $47.8 net cash outflow for the same period in 2017.

The REIT, by paying down debt, has reduced its debt ratio to just 10.9% as of September 30, 2018, compared to 16.8% as of year-end 2017. The paying down of mortgage debt explains all of the negative cash flow through September 30, 2018, and $36.3 million (76%) of the negative cash flow for the same period in 2017.

With the recent multifamily property acquisitions, it doesn’t appear that Highlands REIT is planning a liquidity event any time in the near future. The diverse nature of its property portfolio makes a merger or listing unlikely.

Those who have purchased shares within the recent price range of $0.17 to $0.18 have paid roughly 50% of the REIT’s estimated NAV per share. While the REIT does not pay distributions, the rate of return investors can anticipate, should the REIT liquidate its portfolio of properties and receive 90% of the NAV per share after transaction costs, would be over 50% if it occurred within one year, 25% if within 2 years, and 16% if within three years.

The REIT had an estimated $11.5 million MFFO in 2018 thru September 30, which is approximately $0.013 per share, or an annualized rate of $0.0176 per share. Only in theory, if this MFFO level could be maintained, it would support a 5% cash distribution rate based upon the REIT’s $0.33 estimated NAV per share. Speculative investors in the shares via the auction market, based upon recent pricing, would receive roughly double that rate, should the REIT begin to make cash distributions.

As we stated in our previous article on Highlands REIT:

“Those investors who are willing to wait may come out of their investments in Highlands REIT with substantial rates of return. Sometimes a diverse collection of junk purchased at a discounted price can eventually be very profitable. Time will tell.”

Sources: SEC, S&P Global, Blue Vault, CTT Auctions

Learn more about Inland Real Estate Investment Corporation on the Blue Vault Investment Manager page