James Sprow | Blue Vault

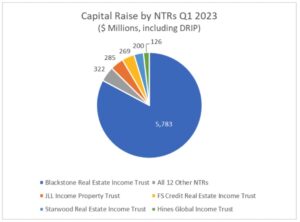

The contrast between capital raised by nontraded REITs in the first quarter of 2023 and the second quarter of the year is marked significantly by the injection of capital by the University of California Board of Regents. In January 2023, the UC Regents invested $4.0 billion in Blackstone REIT whose share made up 69% of the capital raised in Q1 2023. Without that infusion of cash, Blackstone REIT would have raised about 25% of the industry total. With the UC investment, the REIT raised 81.6% of the industry total.

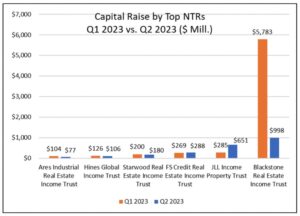

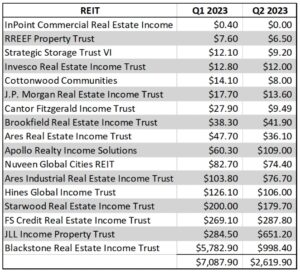

Blackstone REIT’s capital raise dropped precipitously from $5,783 million to just $998 million in Q2. This was the lowest total capital raise for the REIT since Q1 2019. The REIT was averaging $6.3 billion in sales over the previous eight quarters. Blackstone REIT has also been dealing with a large number of redemption requests since the fall of 2022. In Q3 2023, the REIT redeemed an estimated $224.8 million in common shares, reaching the limit of 5% of aggregate NAV and fulfilling only 17% of requests in June 2023. Over the past four quarters through June 2023, the REIT has paid out an estimated $874 million in common share redemptions.

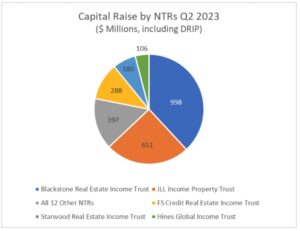

The top five nontraded REITs raising capital in Q1 2023 raised $6,663 million, 94.0% of the $7,088 million raised by the industry. In Q2 2023, with the large drop-off in capital raise by Blackstone REIT, the top five NTRs raised $2,223 million, 84.9% of the industry total.

The top NTRs in terms of capital raise have been Blackstone REIT, Starwood REIT, JLL Income Property Trust, FS Credit Real Estate Income Trust, and Hines Global Income Trust.

The 81.6% share of Q1 2023 capital raised by Blackstone REIT is dramatic.

Blackstone REIT’s share of capital raised by NTRs in Q2 2023 dropped to 38.1%, reflecting the impact that the $5 billion first quarter investment by UC Regents had on the REIT and the industry total.

Sources: SEC, Blue Vault