Unraveling the Mystery of Peakstone Realty Trust

May 17, 2023 | James Sprow | Blue Vault

How did a nontraded REIT with a net asset value per share of $7.42 June 2022 and $9.03 in 2021, do a 1-for-9 reverse stock split and subsequently see its newly-listed shares open for trading at $8.00 per share on April 13 (the equivalent of $0.89 per share before the 1-for-9 reverse stock split)? How do we explain the subsequent rise in the share price which reached over $42 per share on April 19, followed by a precipitous fall to less than $16.00 by May 4, and which was recently trading at $21.75 on May 16? Quite frankly, we have no rational explanation!

A Brief History

Griffin Capital Essential Asset REIT II began life with an IPO in 2014. The nontraded REIT was externally managed by Griffin Capital. In April 2019, the REIT merged with Griffin Capital Essential Asset REIT, and as of December 31, 2019, the nontraded REIT’s real estate portfolio consisted of 99 properties with 118 lessees consisting substantially of office, warehouse and manufacturing facilities.

In 2021 the REIT merged with Cole Office & Industrial REIT for approximately $1.2 billion in a stock-for-stock transaction, which grew the REIT’s portfolio to 123 properties. As the original name implied, the strategy of the REIT was to invest in properties that are essential to the tenants’ business operations, with lessees that are creditworthy, providing default protection. The properties are generally new or recent Class A construction quality and condition and subject to long-term leases with defined rental increases, offering a consistent and predictable income stream across market cycles, or short-term leases with a high probability of renewal and potential for increasing rent.

In August 2022, the REIT sold a 41-property office portfolio to a joint venture in which it holds a 49% interest, along with an additional five-property office portfolio sale in December 2022 to the same JV.

In June 2021, the REIT was re-named Griffin Realty Trust. In January 2023 it was renamed Peakstone Realty Trust. (“Peakstone”)

The REIT’s Strategy

Peakstone’s CEO Michael Escalante has been with Griffin Capital since 2006, serving as CIO until 2018. Together with the management team, the strategy for Peakstone was to separate out the suburban office assets from the industrial assets, with the industrial assets of 19 properties designated as “Core” and the 38 suburban office properties considered “Non-Core.” Another portfolio segment of 21 properties consists of vacant and non-core assets. Long-term, management wanted to dispose of the REIT’s office assets and focus investments on industrial properties. The REIT reduced the dividend rate in 2023 to a level that could be sustained by the industrial portion of the portfolio.

The REIT’s listing on April 13 came without an IPO. A common strategy is to utilize an investment banking firm to support a public listing with additional shares being sold via an IPO, and having the investment bankers supporting the pricing of the listed shares. This did not happen with the Peakstone listing in April, as the management anticipated selling off the office assets in the portfolio and re-allocating the proceeds to investments in industrial properties. Peakstone’s management team did not see the need for additional equity capital to accomplish their goal of re-allocating the REIT’s portfolio toward industrial assets.

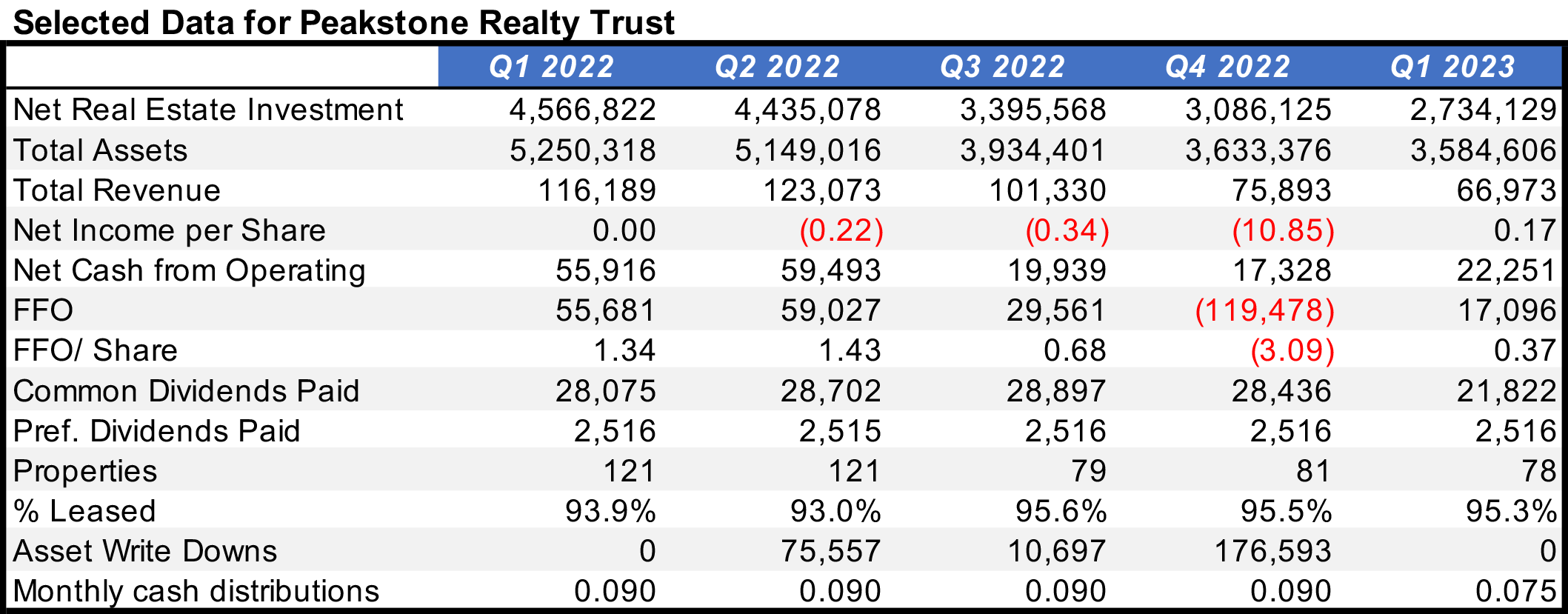

Some Key Financial Data

In the above data, from Q1 2022 thru Q1 2023, we see the results of the REIT’s selling off its real estate assets prior to the public listing. We also see the asset write downs that occurred in 2022, and the recovery of net income and funds from operations (FFO) in Q1 2023. Over the quarters shown, the portfolio’s percentage leased has held up well. Going forward, the lowering of the distribution rate will make it more sustainable if funds from operations continue to recover. In Q1 2023 the distributions were once again covered by cash provided by operations.

In the Investor Presentation made prior to the April 13 listing, Peakstone’s management lays out their case for the REIT’s potential moving forward. Given the REIT’s portfolio of suburban office properties that made up 58% of the REIT’s in-place ABR and the public market’s discounting of office REITs by over 40% of NAVs, it is somewhat understandable that Peakstone’s stock has been tarred with the same brush. Looking at the suburban locations of the REIT’s office investments and the quality of the tenants, it doesn’t make sense to lump their office properties with those of other REITs that may have more central business district assets in large cities. The industrial portion of the current portfolio is 100% leased with 59% investment graded tenants. None of this explains the stock’s erratic performance and how its share value has fallen to the equivalent of $2.40 pre-split.

Conclusion

Peakstone’s management has a long way to go to build investor confidence in both its strategy and the value of its assets. We will watch with interest as this former nontraded REIT deals with the challenges ahead.

Sources: SEC, Yahoo!Finance, Peakstone