What’s Happening with Hospitality Nontraded REITs?

December 13, 2021 | James Sprow | Blue Vault

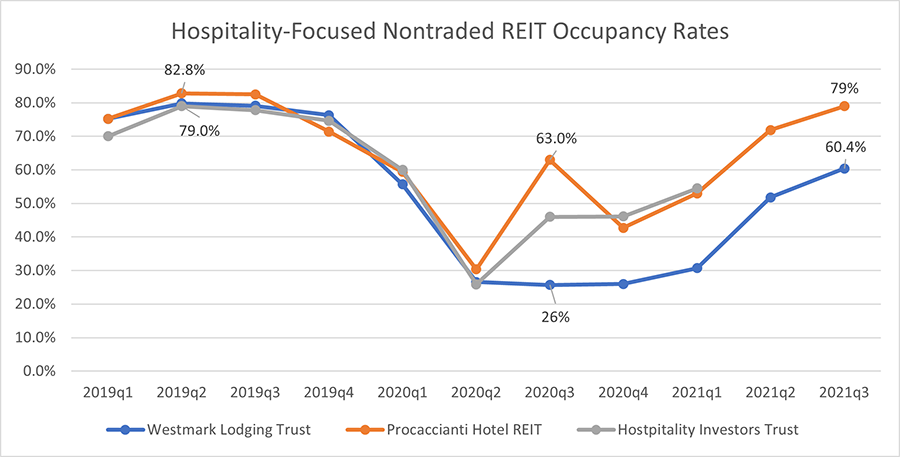

In the first quarter of 2020, the COVID-19 pandemic impacted the hospitality sector with devastating results, dropping occupancies to the lowest points ever by the third quarter of 2020. Three nontraded REITs with assets exclusively concentrated in hotel properties were severely affected by government measures to fight the pandemic. The following chart shows the occupancies reported by these three nontraded REITs from the first quarter of 2019 to the third quarter of 2021. Hospitality Investors Trust, Inc. filed for bankruptcy in May 2021 and stopped filing quarterly reports with occupancy rates.

Source: Blue Vault

Occupancy rates reached their lowest point for Hospitality Investors Trust in Q2 2020 at 26%. Watermark Lodging Trust reached its lowest occupancy level in Q3 2020, just as the other two REITs in this chart were recovering. The sharp recovery by Procaccianti Hotel REIT in Q3 2020 reversed in Q4 2020 before resuming its upward trend. In Q3 2021 the two remaining nontraded REIT with hotel portfolios were approaching their pre-pandemic occupancy rates, with Procaccianti Hotel REIT reaching 79%, nearly back to its rate in Q3 2019 at 82.5%. Watermark Investors Trust is taking longer to get back to its pre-pandemic occupancy levels, at 60.4% compared to its pre-pandemic rate of 77.8%.

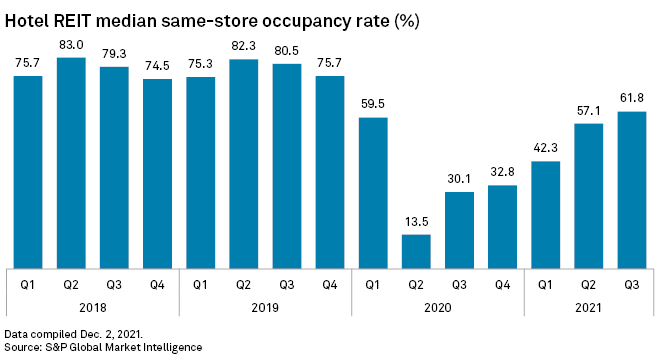

The performance of the nontraded REITs as measured by average quarterly occupancy largely mirrors the listed REITs as shown in the chart below. For Q3 2021, same-store occupancy reached a median 61.8%, its highest level since 2019. There are 18 listed hospitality REITs whose data is compiled for the chart.

Sources: Blue Vault, S&P Global Market Intelligence