James Sprow | Blue Vault |

While much of the good news across commercial real estate sectors during the pandemic has come from industrial, multifamily, and self-storage investments, it may be time to look through the laggards to find the next wave of above-average returns. With lockdowns lifted or lifting, it may be time to adjust our thinking and look for opportunities in undervalued properties and portfolios. While the office sector, in particular, has been slow to recover, retail has come back well, with strong occupancy numbers and foot traffic returning to or exceeding pre-pandemic levels.

In an April 25 video by John Chang, Senior VP and National Director Research & Advisory Services at Marcus & Millichap, he illustrated how vacancy rates for multi-tenant retail properties have risen just 40 bps above their pre-pandemic level. Rents have increased 5.5% above their pre-pandemic levels. Multi-tenant retail also offers strong yields, with cap rates for muti-tenant retail averaging 6.7% thru Q1 2022, compared to cap rates for apartment investments averaging 4.8%. Cap rate compression hasn’t been as great in the multi-tenant retail space when compared to multifamily.

Nareit’s March 31, 2022, Fact Sheet reports that listed Industrial REITs have given shareholders an average total return YTD thru March 31, 2022, of negative 6.11%. Apartment REITs have an average total return over that period of negative 2.47%. Even listed Self-Storage REITs had negative total returns so far in 2022 of minus 2.01%. Perhaps surprisingly, the 18 shopping center REITs in Nareit’s report had an average return of negative 0.84%, less negative than the sectors that had such strong performance in 2021. With large nontraded REITs like Blackstone REIT and Starwood REIT focusing their acquisitions in 2021 on industrial and multifamily properties, would it be unreasonable to expect some sector rotation to take place, with more investments in sectors that were hard hit by the pandemic, like Hospitality (Lodging/Resorts 14 listed REITs had total returns averaging +6.89% in Q1 2022) and Retail?

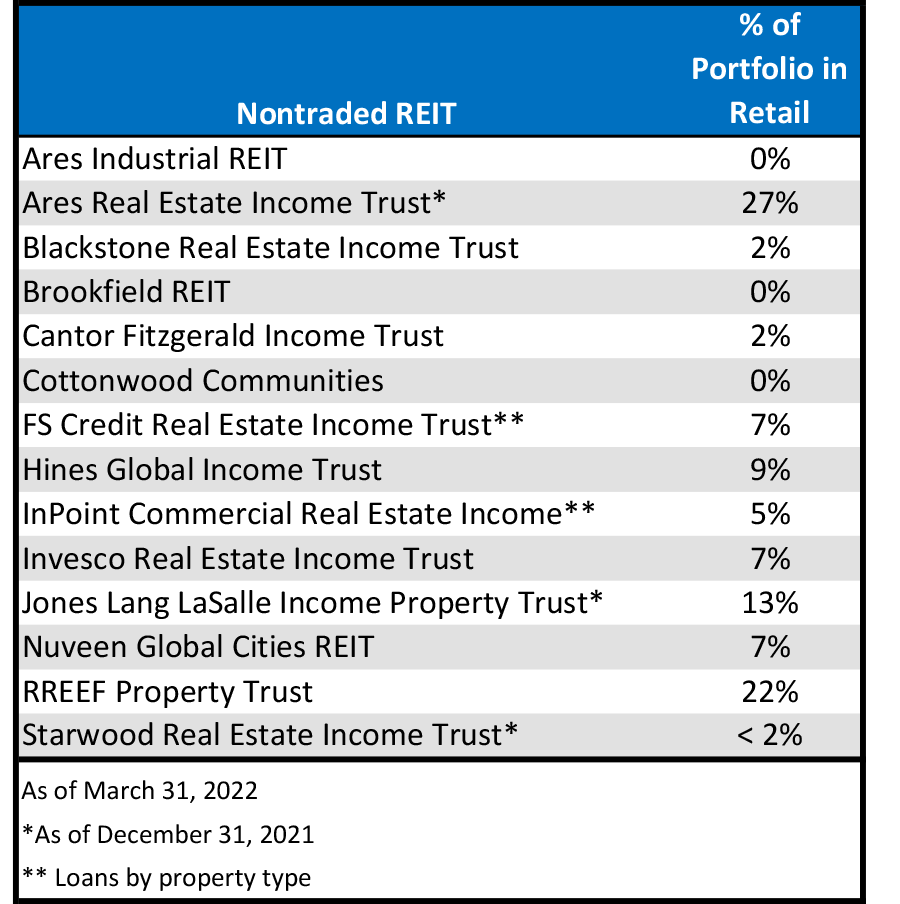

Among the nontraded REITs that are currently raising capital on a continuous basis, only three of the 14 REITs have concentrations in retail exceeding 10% of their respective portfolios. The two largest in terms of assets, Blackstone REIT and Starwood REIT, have 2% or less of their current portfolios in retail properties.

It will be interesting to watch the investment strategies of the large nontraded REITs going forward. Will they begin to rotate their portfolio choices to asset types that were so out of favor during the last two years, largely due to lockdowns and travel restrictions that accompanied the pandemic? This is not to suggest that the strong trends in industrial and multifamily sectors will not continue, but rather, that relative value might be found in the recovery of retail.

Sources: Marcus & Millichap Why Retail is Surprising to the Upside, www.REIT.com,

Individual REIT websites