WSJ Reports Fed’s Senior Loan Officer Survey Points to Trouble for CRE

May 7, 2019 | James Sprow | Blue Vault

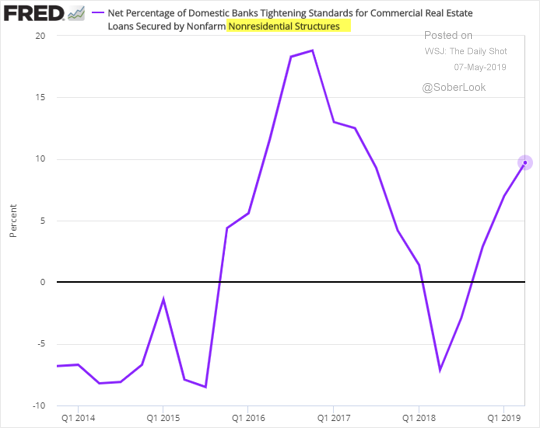

The Wall Street Journal’s “Daily Shot” for Tuesday, May 7, includes data from a survey of domestic banks by the Federal Reserve that shows an increasing number of those respondents tightening standards for commercial real estate loans secured by nonfarm nonresidential structures.

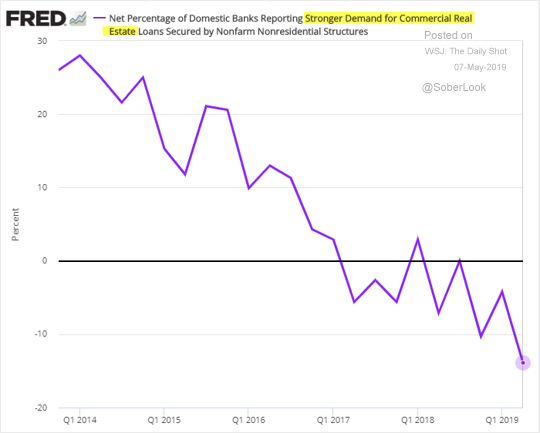

The report also showed the net percentage of domestic banks reporting stronger demand for commercial real estate loans secured by nonfarm nonresidential structures.

Loan demand for CRE loans secured by multifamily residential structures also appears to be weakening in Q1 2019.

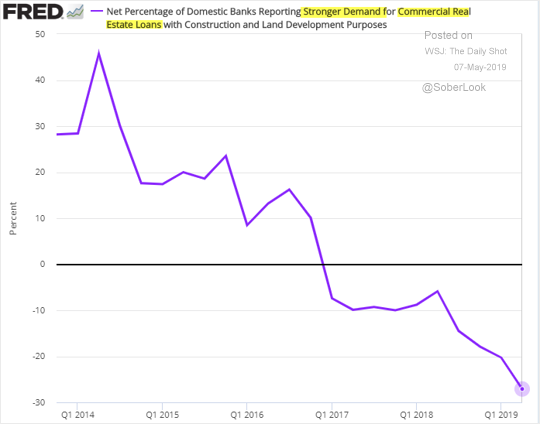

The net percentage of domestic banks reporting stronger demand for commercial real estate loans with construction and land development purposes has been downward trending since Q1 2017 and was down again in Q1 2019.

Do these survey trends indicate a softening in the commercial real estate market, or rather a relative retreat from bank financing of commercial real estate?

Sources: Wall Street Journal, Federal Reserve Bank of St. Louis