James Sprow | Blue Vault

Blue Vault’s Interval Fund Research

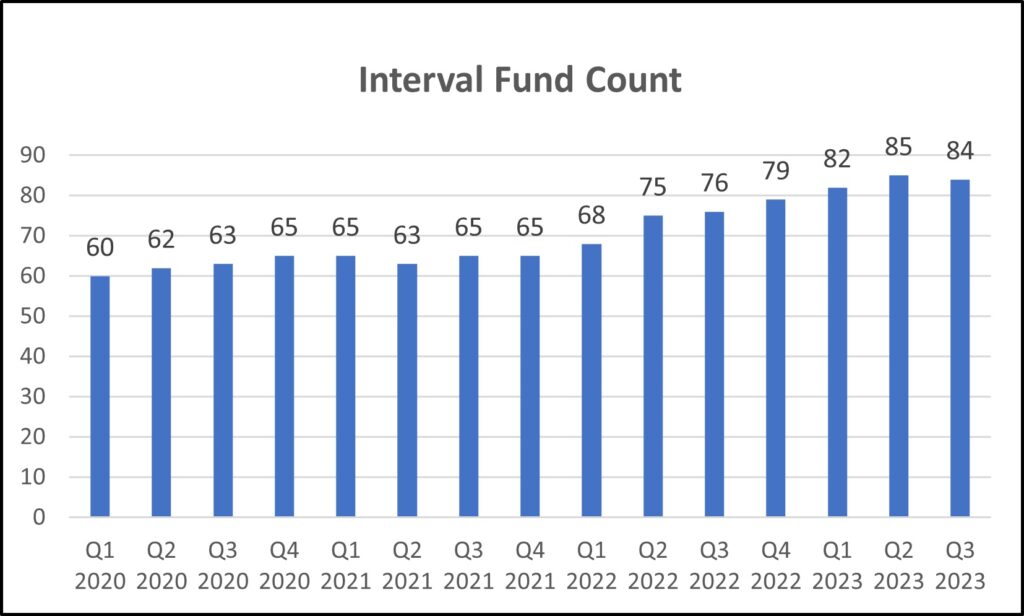

Blue Vault currently provides research reports on all interval funds of significant portfolio size, usually a fund with more than $50 million in total assets and at least one year of operations. The number of interval funds has increased substantially since Q1 2020, from 60 to 84 funds, or an average of over six new funds per year.

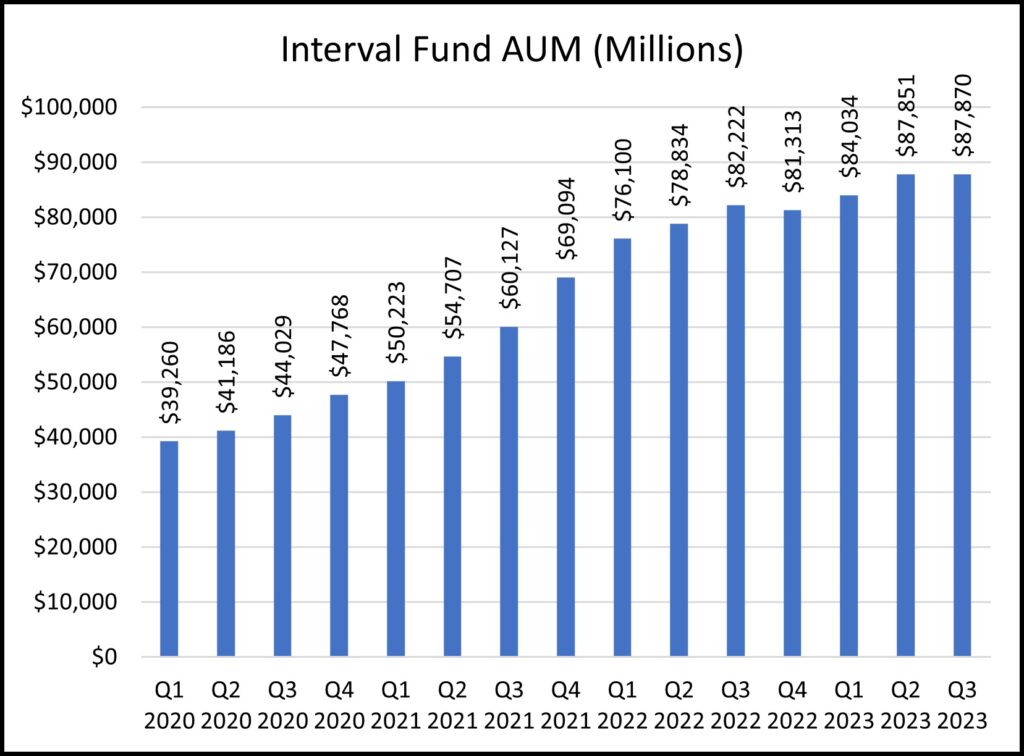

Along with the increase in the number of funds, the AUM of the interval fund industry has increased 128% since Q1 2020, an average quarterly rate of increase of 6.0%

Two Complicating Factors in Interval Fund Reporting

Several factors make Blue Vault’s research on interval funds more complicated. First, interval funds only report their financials to the SEC semi-annually. This reporting frequency contrasts with the quarterly filings of nontraded REITs and nontraded BDCs. Second, interval funds have differing fiscal years (at least seven different month ends during a calendar year). This means that the data relating to performance cannot be compared across the industry of interval funds on an “apples-to-apples” basis. For example, a fund with a June 30 fiscal year-end cannot be compared to a fund with a March 31 fiscal year-end, as the periods over which their respective performance metrics are measured and reported are not the same.

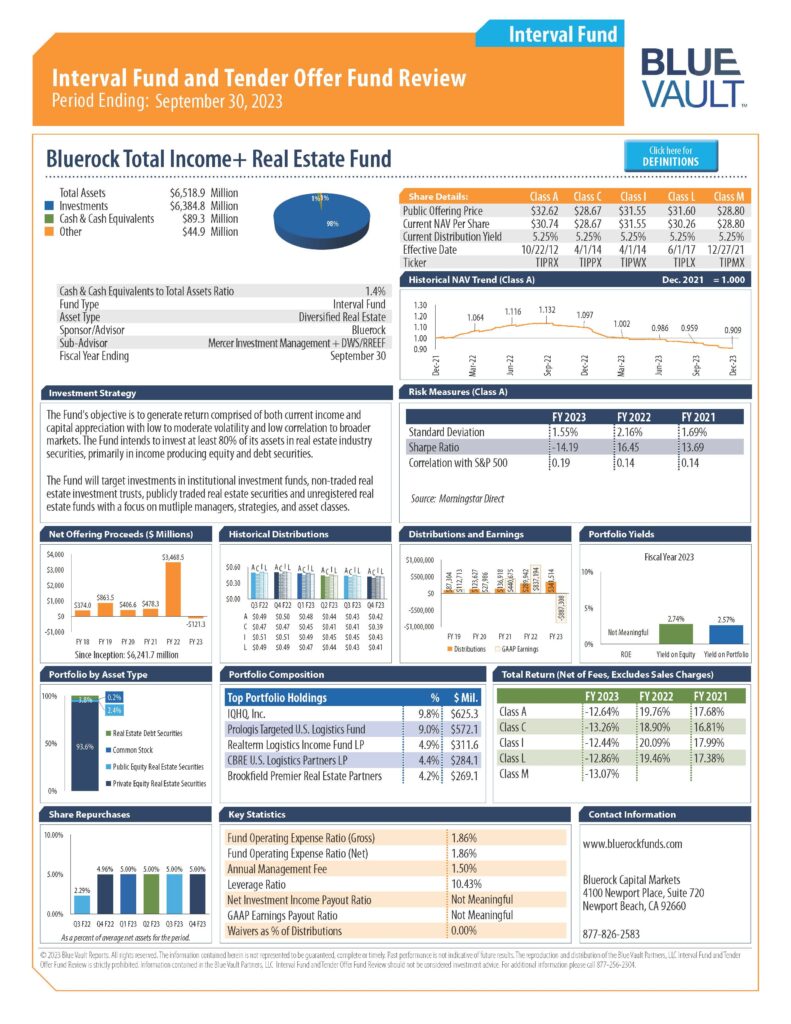

Still, recognizing the complications that semi-annual reporting cycles and differing fiscal years present, Blue Vault prepares research over interval funds as they file their financials with the SEC. A sample interval fund report is shown below.

This report gives a comprehensive view of the interval fund’s performance, including trends for the net asset values, offering prices, distributions, offering proceeds and share redemptions. Unique perspectives in these reports include risk measures, such as a Sharpe Ratio which measures the average return minus the risk-free return divided by the standard deviation of the return on an investment. One of the benefits of interval fund investments is their low correlations with listed stocks, measured in these reports as correlations with the returns of the S&P 500 index.

Blue Vault also reports Fund Operating Expense Ratios (both gross and net) as well as the Annual Asset Management Fee as percentages of the fund’s total assets.

Interval Fund Investments

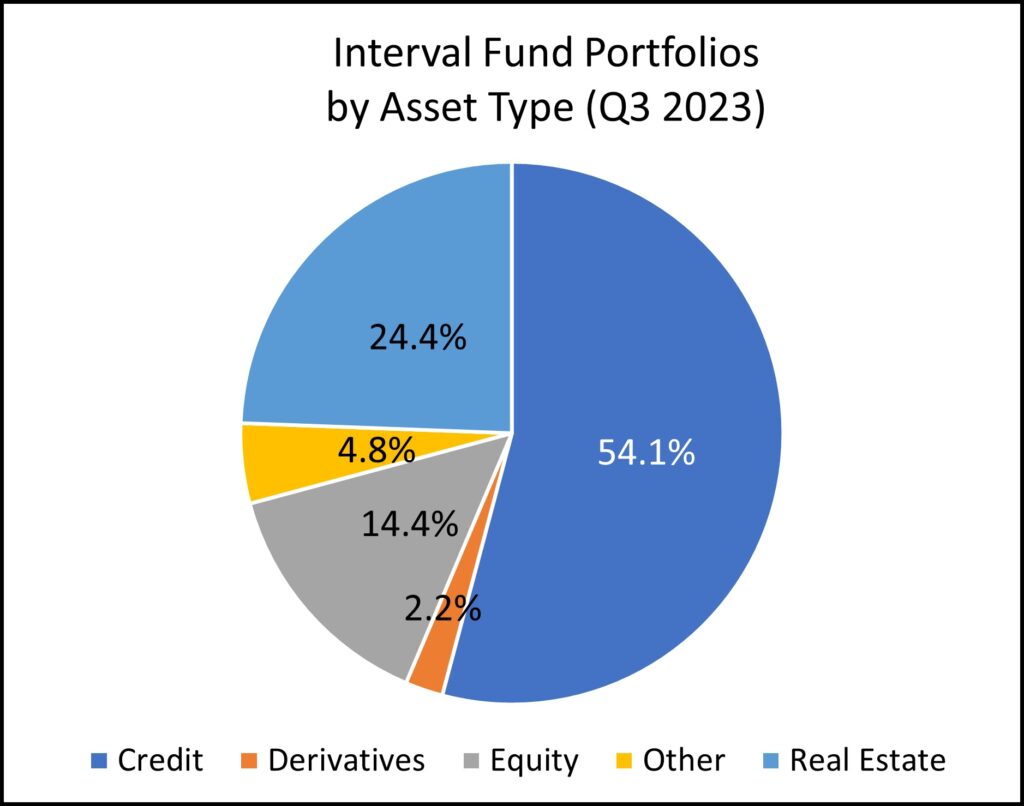

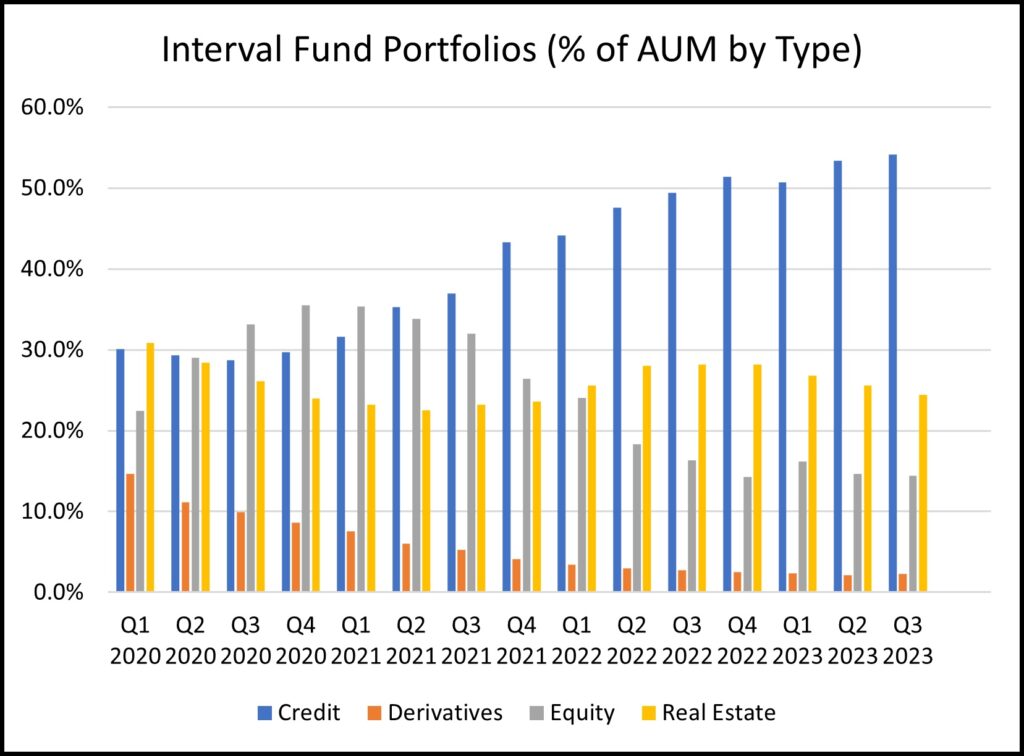

Interval funds can invest in a variety of different assets classes. These investments can include Credit, Derivatives, Equity, Real Estate and Other, as shown below.

Over time the investment mix of interval funds has changed, with much more significant growth in the Credit category, steady investments in the Real Estate category, and relative declines in the share of funds invested in Derivatives and Equity.

Blue Vault members have access to interval fund reports as well as summary data for the interval fund industry.

If you would like to dive deeper into the history of Interval Funds, read more in this piece by Charles Schwab and Michael Iachini—“Interval funds – the facts and the risks”

Sources: Blue Vault; Charles Schwab, Michael Iachini, “Interval funds – the facts and the risks.”