NexPoint Advisors Announces Management Proposal to the Board of Directors of the Business Development Corporation of America (BDVC)

News provided by NexPoint Advisors, L.P.

DALLAS, Aug. 30, 2016 /PRNewswire/ — NexPoint Advisors, L.P. (“NexPoint“) announced today that it has submitted a compelling management proposal to the Board of Directors (the “Board“) of the Business Development Corporation of America (the “Company“) (BDVC), a closed-end investment company that is regulated as a business development company. The Company previously announced on July 26, 2016 that BDCA Adviser, LLC (the “Adviser“) had entered into a membership interest purchase agreement with BSP Acquisition I, LLC (together with its affiliates, “BSP“) to sell 100% of the issued and outstanding membership interests in the Adviser (the “BSP Proposal“).

NexPoint’s proposal includes the following superior terms that are absent from the BSP proposal:

- a permanent 50% reduction of both of the Company’s management and incentive fee arrangements; and

- implementation of NexPoint’s unique stockholder loyalty program, under which NexPoint provides a 2% match to stockholders that invest through the program and retain their shares for at least one year.

In addition, our proposal includes the direct investment of at least $50 million in the Company’s shares. BSP has refused to disclose the amount of any investment it would make in the Company.

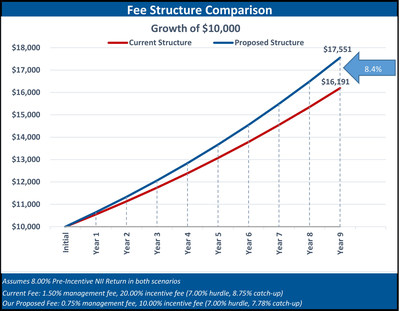

All of these terms directly benefit the Company’s stockholders, which currently suffer from marginal performance and a 16.7% discount to NAV based on the last known secondary market purchase of $7.36on August 15, 20161 (versus the NAV of $8.84 on June 30, 2016). Originally issued at $10.00 per share, the Company paid an 8% dividend, and experienced declines which reduced the NAV to $8.84 per share. Through enhanced performance, materially reduced fees and additional liquidity provided by direct investment, NexPoint believes the Company’s NAV will increase and trade at less of a discount to NAV than under the BSP proposal. Based on the Company’s NAV as of June 30, 2016, NexPoint’s proposed fee discounts would provide over $175 million of aggregate fee savings over the next ten years, assuming an 8% annual return.

The Fee Structure Comparison Chart below presents a comparison between the Company’s current fee structure and NexPoint’s proposed structure on an initial investment in the Company of $10,000.

NexPoint has requested to meet and discuss its proposal with the Board and has also invited the Board to propose other terms that the Board believes are appropriate. To date, the Board has not responded to any of NexPoint’s requests to meet either in-person or telephonically to discuss our proposal or any other terms attractive to the Board. We believe the Board is not giving due consideration to our proposal because the Board’s interests are aligned with management, but not with the interests of the stockholders. We believe BSP has agreed to pay management a $150 million windfall upon approval of its proposal. Public filings state that BSP has no intention of lowering any management or incentive fees paid by stockholders. $150 million equates to almost 10% of the Company’s net assets, which in our view should be directed for the benefit of the Company’s stockholders.

If NexPoint is retained by the Company as its investment adviser, the Company will have access to all of Highland’s capabilities and expertise. We have submitted extensive due diligence directly to the independent directors of the Special Committee of the Board, including Edward Rendell, Randolph Readand Leslie Michelson. These submissions include our letter of intent and four supplemental responses comprising over 200 pages of diligence demonstrating our superior experience, performance and capabilities.

If appointed as investment adviser to the Company, NexPoint will work diligently with the Board and the Company’s current management to implement a smooth transition for the Company and its stockholders.

About NexPoint Advisors, L.P.

NexPoint, together with its affiliates, currently manages approximately $17 billion in net assets and believes that its core competences are squarely within the Company’s investment strategy. NexPoint is affiliated, through common ownership, with Highland Capital Management, L.P. (“Highland”), and shares personnel and other resources with Highland. Highland (together with its affiliates) is one of the world’s most experienced alternative credit managers, tested by numerous credit cycles, specializing in credit strategies, such as a broad range of leveraged loans, high yield bonds, direct lending, public and private equities, and CLOs. Highland also offers alternative investment-oriented strategies, including asset allocation, long/short equities, real estate, and natural resources.

Media Contact

Prosek Partners

Megan Ingersoll

212-279-3115 x223

mingersoll@prosek.com

1 Source: Central Trade & Transfer, CTTauctions.com

Photo – http://photos.prnewswire.com/prnh/20160830/402909-INFO

Logo – http://photos.prnewswire.com/prnh/20150828/261987LOGO

SOURCE NexPoint Advisors, L.P.

Sponsor Focus: Highland Capital Management & AR Global

Recent News: Nontraded BDCs Post High Returns So Far in 2016, and Top BDC Performer