Professional Services Perspectives

read the latest content from fintech and other service firms

Headlines

As of September 30, 2025, which nontraded REIT tracked by Blue Vault had the most assets under management?

Blue Vault offers unparalleled alts data analysis. Explore how deep our research goes and consider becoming a member today!

Capital Square Completes UPREIT Transaction Near Atlanta with DST Investors

Many DST investors chose to retain this high-performing property and obtain other REIT benefits by participating in the UPREIT transaction.

Tender Offer Fund Assets, Fundraising on the Rise in 2025

The tender offer fund industry had $100.7 billion in assets under management as of October 31, 2025.

CIM Group White Paper: Out of Distress Comes Opportunity: The Return to Office Credit

The U.S. office market is signaling a recovery — and expanded opportunities for investors.

Recent News

Industry Veteran Named as CEO & President of Inland Investments

Inland The Inland Real Estate Group, LLC (“Inland” or “the Company”), one of the nation’s largest commercial real estate investment, finance and operating groups, has...

ExchangeRight Welcomes Betsy Ward as Senior Vice President of National Accounts

ExchangeRight ExchangeRight has announced the appointment of Betsy Ward as senior vice president of national accounts, further strengthening the company’s Distribution team....

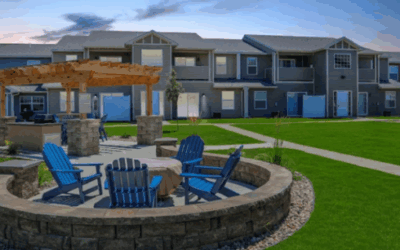

Burlington Capital: Year in Review 2025

Burlington Capital Our team continued to actively execute its multifamily investment strategy in 2025 through strategic dispositions and a new acquisition. We successfully...

Based on the offerings tracked by Blue Vault, what was the nontraded BDC industry’s median total return for the first nine months of 2025?

Answer: Based on the offerings tracked by Blue Vault, the nontraded BDC industry’s median total return for the first nine months of 2025 was 6.38%. Discover...

Nontraded REIT Distribution Coverage Woes Grow in Q3 2025

Johnathan Rickman | Blue Vault Distribution coverage continued to be a challenge for sponsors of nontraded REITs in the third quarter of 2025, compounding the industry’s...

Fine-Tuning Your Plan for 2026

Marketing Intent As alternative investment sponsors begin 2026, now is the right time to pause, reflect, and fine-tune your marketing and sales strategy. Planning for the...

More articles…

Eagle Point Closes $30 Million Financing with Circular Services

The tailored financing reflects Eagle Point’s disciplined underwriting, focus on strong asset coverage and commitment to designing capital solutions that enhance long-term value creation for investors.

$65.9 Million Net-Leased Portfolio 70 DST Fully Subscribed, Strengthening Essential Income REIT Pipeline

The portfolio comprises 15 long-term net-leased properties diversified across 14 markets in 11 states and 198,723 square feet.

Evolution of an Asset Class: The Case for CLO BB Debt Today

The coming of age of CLO BB debt signals not just a change in perception, but a redefinition of risk, return, and opportunity in this corner of the structured credit markets.

Bluerock Private Real Estate Fund Announces a Switch to Monthly Distributions and an Increased Distribution Rate

BPRE is the only listed closed-end fund offering dedicated access to private institutional real estate – an asset class traditionally accessible only to large institutions and ultra-high-net-worth investors.

The Advisor Journey: From Curiosity to Commitment

In the alts space, where opportunity and complexity intersect, influencing an advisor’s decision is both an art and a science.