SS&C Technologies Releases Q4 and Full Year 2021 Earnings Results

February 10, 2022 | SS&C Technologies

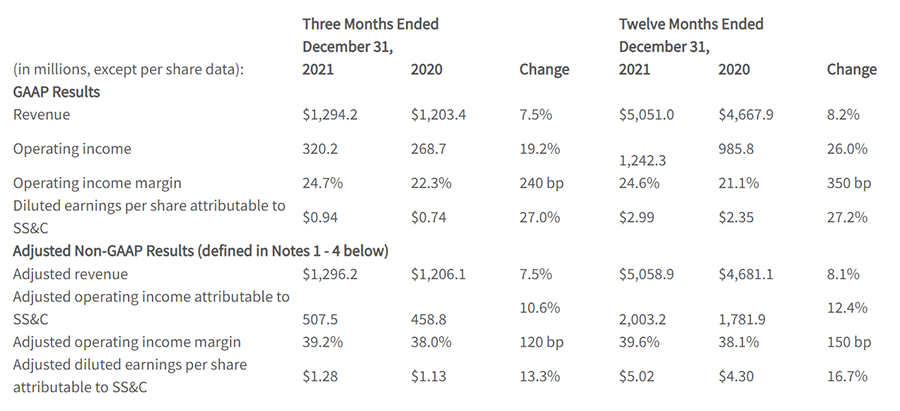

Q4 2021 GAAP revenue $1,294.2 million, up 7.5%, Fully Diluted GAAP Earnings Per Share $0.94, up 27.0%

Adjusted revenue $1,296.2 million, up 7.5%, Adjusted Diluted Earnings Per Share $1.28, up 13.3%

SS&C Technologies Holdings, Inc. (NASDAQ: SSNC), a global provider of investment, financial and healthcare software-enabled services and software, today announced its financial results for the fourth quarter and full year ended December 31, 2021.

Fourth Quarter and Full Year 2021 Highlights:

• SS&C generated net cash from operating activities of $1,429.0 million for the twelve months ended December 31, 2021.

• We paid down $519.9 million in debt in 2021 to bring our consolidated net leverage ratio and net secured leverage ratio to 2.69x and 1.72x consolidated EBITDA attributable to SS&C, respectively.

• Adjusted organic revenue growth for Q4 2021 was 6.9%.

• SS&C reported adjusted consolidated EBITDA attributable to SS&C of $522.9 million for the quarter, $2,064.8 million for the full year 2021.

• Adjusted consolidated EBITDA margin increased to 40.3%, up 90 bps from Q4 2020.

• In November, SS&C’s Board of Directors approved a quarterly dividend payout of $0.20 per share, up 25.0% from $0.16 per share.

“SS&C’s 2021 financial results reflect the cumulative progress our salesforce, product specialists, and management teams have made. We released several new products, sold to flagship clients, secured key renewals, and formed a healthcare joint venture with two industry leaders. I would like to thank our talented team and our customers as we remain focused on delivering top quality service,” says Bill Stone, Chairman and Chief Executive Officer. “The pandemic and its impacts on the labor force have put pressure on our costs and we expect this is to continue. We have spent tremendous amounts of research and development dollars on automating our workflows and we expect these productivity gains to begin showing up in margin improvements. Our pending acquisitions of Hubwise and Blue Prism will also improve our workflows.”

Operating Cash Flow

SS&C generated net cash from operating activities of $1,429.0 million for the twelve months ended December 31, 2021, compared to $1,184.7 million for the same period in 2020, a 20.6% increase. SS&C ended the fourth quarter with $564.0 million in cash and cash equivalents and $5,982.4 million in gross debt. SS&C’s net debt balance as defined in our credit agreement, which excludes cash and cash equivalents of $139.5 million held at DomaniRx, LLC was $5,557.9 million as of December 31, 2021. SS&C’s consolidated net leverage ratio as defined in our credit agreement stood at 2.69 times consolidated EBITDA attributable to SS&C as of December 31, 2021. SS&C’s net secured leverage ratio stood at 1.72 times consolidated EBITDA attributable to SS&C as of December 31, 2021.

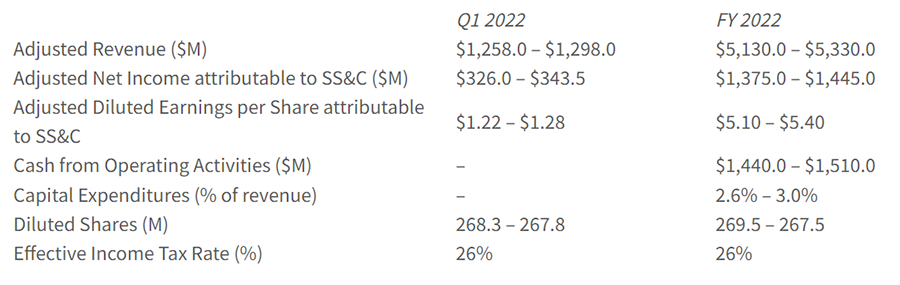

Guidance

SS&C does not provide reconciliations of guidance for Adjusted Revenues and Adjusted Net Income to comparable GAAP measures, in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. SS&C is unable, without unreasonable efforts, to forecast certain items required to develop meaningful comparable GAAP financial measures. These items include acquisition transactions and integration, foreign exchange rate changes, as well as other non-cash and other adjustments as defined under the Company’s Credit agreement, that are difficult to predict in advance in order to include in a GAAP estimate. The unavailable information could have a significant impact on Q1 2022 and FY 2022 GAAP financial results.

Non-GAAP Financial Measures

Adjusted revenue, adjusted operating income, adjusted consolidated EBITDA, adjusted net income and adjusted diluted earnings per share are non-GAAP measures. See the accompanying notes for the reconciliations and definitions for each of these non-GAAP measures and the reasons our management believes these measures provide useful information to investors regarding our financial condition and results of operations.

Earnings Call and Press Release

SS&C’s Q4 2021 earnings call will take place at 5:00 p.m. Eastern time today, February 10, 2022. The call will discuss Q4 2021 results and business outlook. Interested parties may dial +1 888-210-4650 (US and Canada) or +1 646-960-0327 (International), and request the “SS&C Technologies Fourth Quarter and Full Year 2021 Earnings Conference Call”; conference ID #4673675. In connection with the earnings call, a presentation will be available on SS&C’s website at http://investor.ssctech.com/results.cfm. A replay will be available after 8:00 p.m. Eastern time on February 10, 2022, until midnight on February 21, 2022. The replay dial-in number is +1 800-770-2030 (US and Canada) or +1 647-362-9199 (International); access code #4673675. The call will also be available for replay on SS&C’s website after February 10, 2022; access: http://investor.ssctech.com/results.cfm.

Certain information contained in this press release relating to, among other things, the Company’s financial guidance for the first quarter and full year of 2022 constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance, underlying assumptions, and other statements that are other than statements of historical facts. Without limiting the foregoing, the words “believes”, “anticipates”, “plans”, “expects”, “estimates”, “projects”, “forecasts”, “may”, “assume”, “intend”, “will”, “continue”, “opportunity”, “predict”, “potential”, “future”, “guarantee”, “likely”, “target”, “indicate”, “would”, “could” and “should” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements are accompanied by such words. Such statements reflect management’s best judgment based on factors currently known but are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such risks and uncertainties include, but are not limited to, the state of the economy and the financial services industry and other industries in which the Company’s clients operate, the Company’s ability to realize anticipated benefits from its acquisitions, including DST Systems, Inc., the effect of customer consolidation on demand for the Company’s products and services, the increasing focus of the Company’s business on the hedge fund industry, the variability of revenue as a result of activity in the securities markets, the ability to retain and attract clients, fluctuations in customer demand for the Company’s products and services, the intensity of competition with respect to the Company’s products and services, the exposure to litigation and other claims, terrorist activities and other catastrophic events, disruptions, attacks or failures affecting the Company’s software-enabled services, risks associated with the Company’s foreign operations, privacy concerns relating to the collection and storage of personal information, evolving regulations and increased scrutiny from regulators, the Company’s ability to protect intellectual property assets and litigation regarding intellectual property rights, delays in product development, investment decisions concerning cash balances, regulatory and tax risks, risks associated with the Company’s joint ventures, changes in accounting standards, risks related to the Company’s substantial indebtedness, the market price of the Company’s stock prevailing from time to time, and the risks discussed in the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, which are on file with the Securities and Exchange Commission and can also be accessed on our website. Forward-looking statements speak only as of the date on which they are made and, except to the extent required by applicable securities laws, we undertake no obligation to update or revise any forward-looking statements.

About SS&C Technologies

SS&C is a global provider of services and software for the financial services and healthcare industries. Founded in 1986, SS&C is headquartered in Windsor, Connecticut, and has offices around the world. Some 18,000 financial services and healthcare organizations, from the world’s largest companies to small and mid-market firms, rely on SS&C for expertise, scale, and technology.

Click here to view the financial earnings statement in PDF format.

Media Contact:

Patrick Pedonti

Chief Financial Officer

Tel: +1 860-298-4738

Justine Stone

Investor Relations

Tel: +1 212-367-4705

E-mail: InvestorRelations@sscinc.com