James Sprow | Blue Vault |

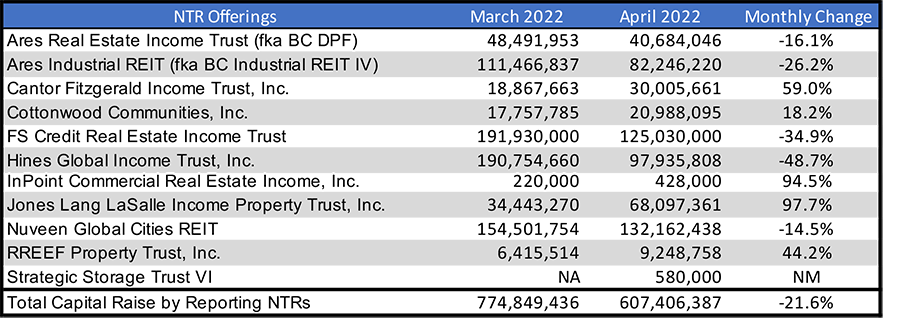

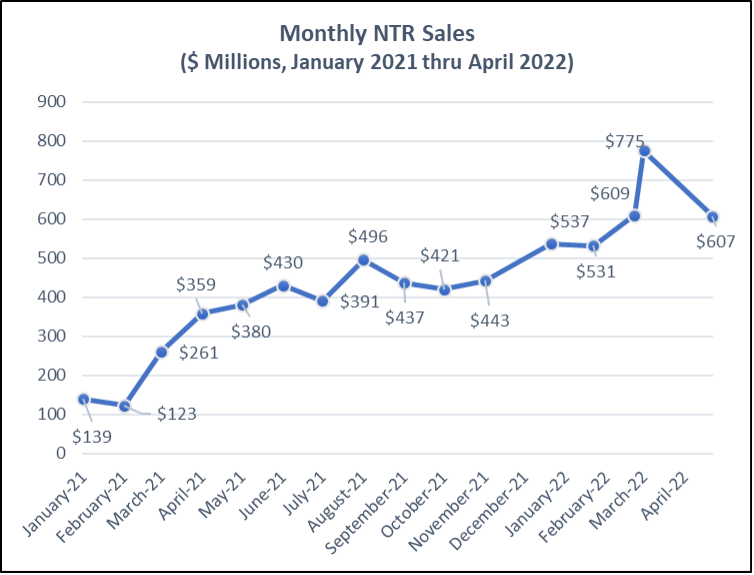

Blue Vault received April 2022 sales totals for eleven nontraded REIT program offerings as of May 10, 2022. Sales reported by those eleven NTRs totaled $607.4 million, down 21.6% from $774.8 million in March, and up 69% Y-O-Y from the $358.6 million in sales in April 2021. Among reporting nontraded REITs, Nuveen Global Cities REIT led the group with $132.2 million in sales, down 14.5% from the sales by the REIT in March. FS Credit REIT reported April sales of $125.0 million, down 34.9% from $191.3 million in March. Hines Global Income Trust reported $97.9 million in sales, down 48.7% from $190.8 million in March. Ares Industrial Real Estate Income Trust was next with $82.2 million, down 26.2% from $111.5 million in March. Jones Lang LaSalle Income Property Trust had sales of $68.1 million, up 97.7% from $34.4 million in March. Ares Real Estate Income Trust had sales of $40.7 million, down 16.1% from $49.5 million in March. New to the list was Strategic Storage Trust IV, which became a nontraded REIT after terminating their private offering on March 17, 2022.

All capital raise figures for these nontraded REITs include DRIP proceeds.

Sales in the chart do not include capital raised by Blackstone REIT, Starwood REIT, Brookfield REIT and Invesco REIT. Those four REITs raised $11.22 billion in Q4 2021 and raised capital with equity sales in April 2022 but did not report to Blue Vault. Blackstone REIT raised $9.03 billion (including DRIP) in Q4 2021, followed by Starwood REIT with $2.09 billion, Brookfield REIT with $57.7 million and Invesco REIT with $36.5 million during the 4th Quarter 2021.

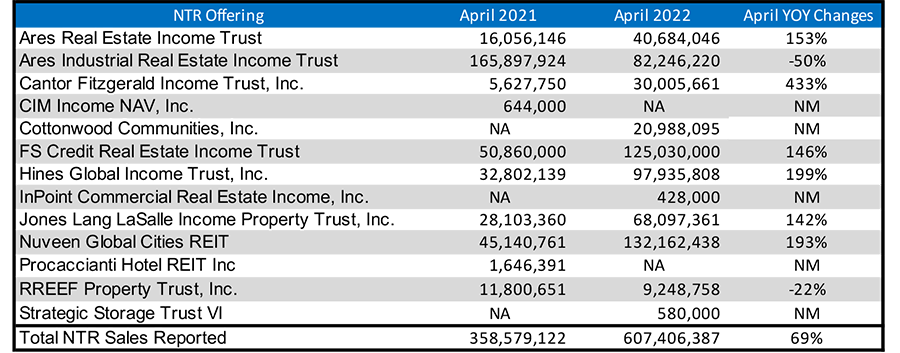

Y-O-Y NTR Capital Raise Comparisons

Year-over-year comparisons show capital raised by reporting nontraded REITs was up 69%.

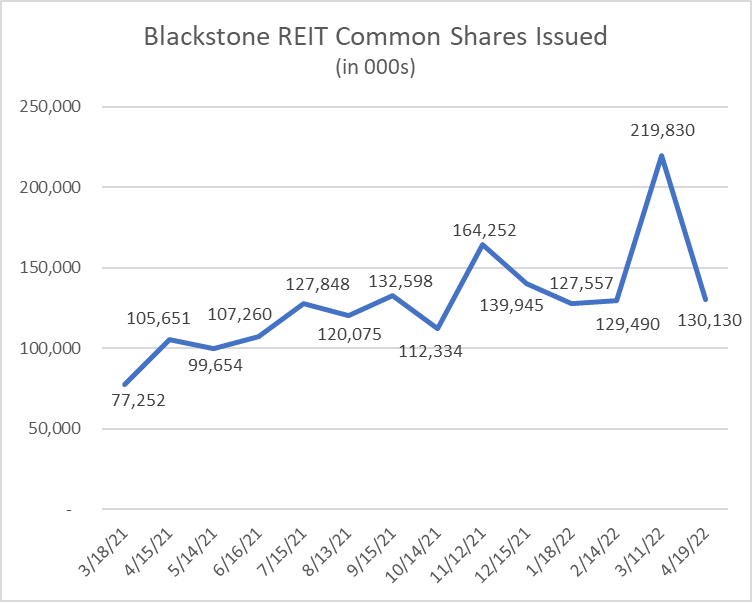

Sales by Blackstone REIT and Starwood REIT Estimated

Although neither Blackstone REIT nor Starwood REIT are reporting monthly sales to Blue Vault, 424b3 SEC filings by these two continuously offered nontraded REITs give data on the status of their public offerings. Using these data, we can estimate their common stock issuances both from the offerings and DRIP reinvestments. By far the largest nontraded REIT is Blackstone, raising a large majority of all capital being raised in the sector. The charts below show the shares issued in their offering. Because the capital raised is reported only in billions, the monthly totals are inexact, but the overall magnitude of their capital raise is evident. For the reports filed 3/11/22 through 4/19/22, Blackstone REIT raised approximately $1.9 billion through the issuance of approximately 130 million shares. For reports dated 3/15/22 through 4/15/22, Starwood REIT issued over 25.6 million shares, raising approximately $717 million.

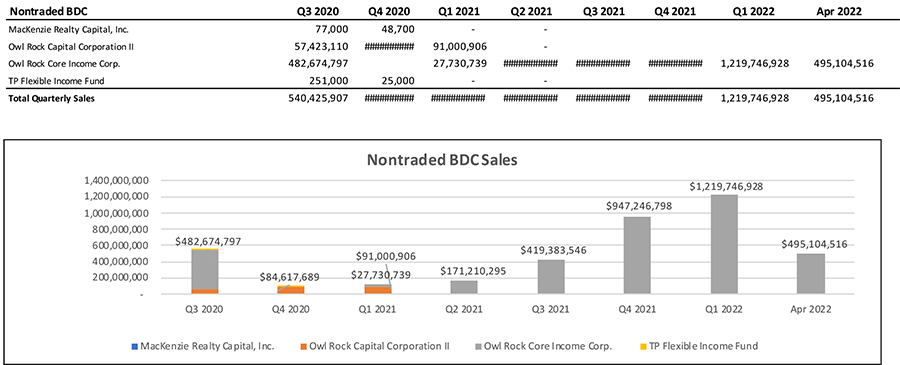

Nontraded BDC Capital Raise thru April 2022

Only one nontraded BDC was raising funds and reported to Blue Vault in April 2022. Blue Owl Capital Inc. (formerly Owl Rock Capital Advisors) had $495.1 million in equity capital raised in April 2022, up 2.6% from the March total of $482.7 million. Blackstone’s nontraded BDC was also raising capital but did not report its sales to Blue Vault. Quarterly capital raise for the four reporting nontraded BDCs are shown below along with April 2022.

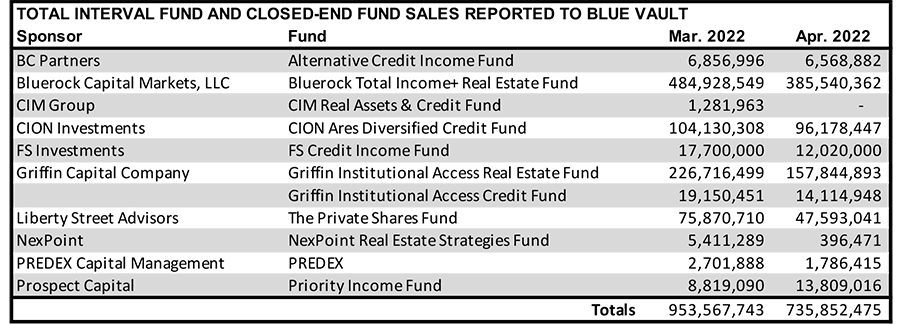

Interval Fund Sales Reported to Blue Vault for April

Ten Interval Funds reported their capital raise for April 2022 to Blue Vault. Bluerock Total Income+ Real Estate Fund raised $385.5 million, down 20.5% from the $484.9 total for March. Griffin Institutional Access Real Estate Fund raised $157.8 million, down 30.4% from the March total of $226.7 million. The ten funds that reported had total capital raise of $735.9 million, down 22.8% from the $953.6 million raised in March 2022.

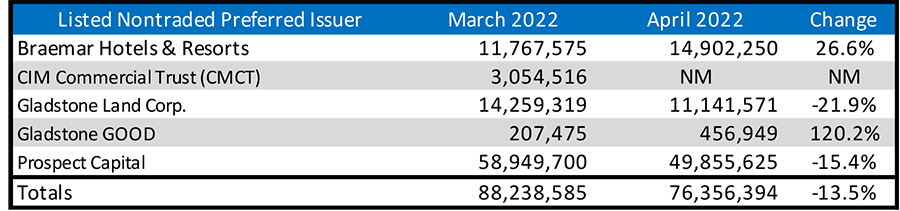

Listed REITs with Nontraded Preferred Stock Issuances

Blue Vault has received sales reports from four listed REITs that issued nontraded preferred stock in April. Leading the group was Prospect Capital with $49.9 million in preferred stock issuances, down 15.4% from the $58.9 million March total. Braemar Hotels & Resorts issued $14.9 million, up 26.6% from $11.8 million in March. Gladstone Land issued $11.1 million in nontraded preferred stock, down 21.9% from the March total. For all four listed REITs that issued nontraded preferred and reported to Blue Vault, the total was $76.4 million, down 13.5% from the March total of $88.2 million reported by five listed REITs.

Sources: SEC, Blue Vault